US-based Fidelity Investments, one of the world’s largest asset management companies (AMC), has now cut the fair value of conversational messaging unicorn Gupshup by 31 percent as of March 31, 2023, in the latest instance of an investor marking down the fair value of an Indian unicorn.

Fidelity Investments holds stakes in Gupshup Inc, the holding company of the Mumbai- and San Francisco-headquartered cloud-based chat development platform, through multiple funds. The latest SEC filings of these funds, such as Variable Insurance Products Fund III and Fidelity Central Investments Portfolio LLC, show that the US-based AMC slashed the fair value of Gupshup by 31.6 percent. This effectively pegs the valuation of the company at $957 million, down from its last valuation of $1.4 billion.

Neuberger Berman, also an investor in Gupshup, has not reduced the company’s fair value.

“Gupshup has continued to maintain its high growth with profitability since its funding round in 2021. Valuation marks of illiquid securities are made by each investor fund based on internal policies, which we have no comment on,” said Beerud Sheth, Co-founder and CEO, Gupshup.

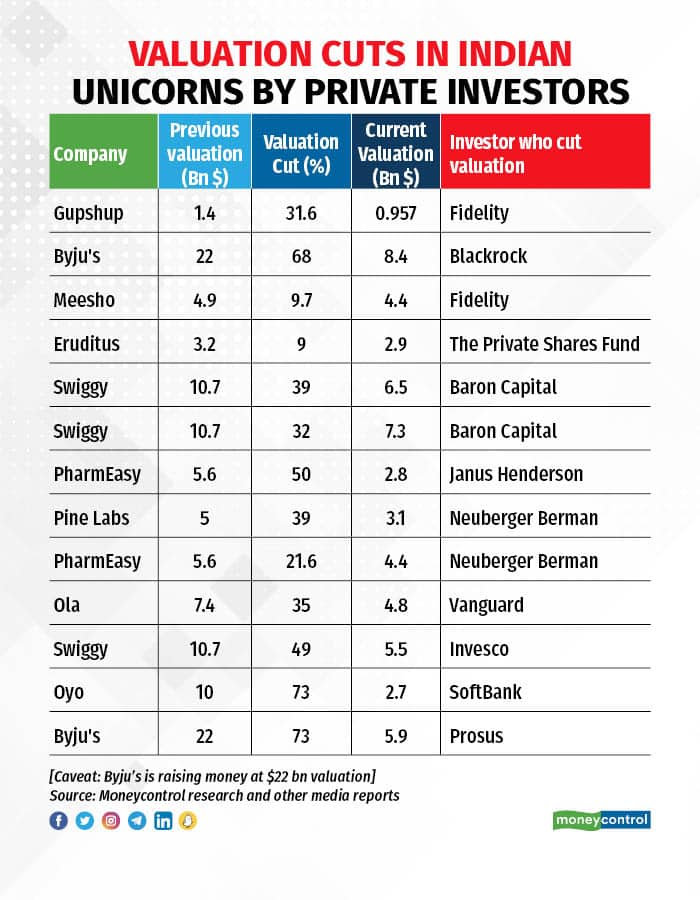

Steep declineThe cloud-based chatbot is the latest Indian unicorn to experience a reduction in its fair value. Other prominent startups such as Meesho, Ola, Swiggy, Eruditus, and Byju's have also seen their fair values reduced by US-based AMCs. While Meesho and Eruditus have seen their fair values getting marked down by 9-10 percent, the rest have seen a steep cut in mark downs, between 30 and 50 percent.

It is important to note that these adjustments to fair values are typically based on AMC's internal assessment of the macro and microenvironment. They do not necessarily indicate a permanent markdown in the startup's overall valuation.

Founded almost a couple of decades back by Beerud Sheth, Gupshup claims to serve over 45,000 businesses across their marketing, sales and customer support automation use cases across a range of verticals including BFSI, e-commerce, retail, travel, edtech and healthcare, with customers spread across India, Latin America, Europe, Southeast Asia, the Middle East, and the United States.

Earlier this year, Gupshup launched a new artificial intelligence-powered tool leveraging OpenAI's GPT-3 technology to build advanced conversational chatbots for enterprises.

The financialsThe company has raised more than $380 million to date from a clutch of investors including Tiger Global, White Oak, Malabar Investments, and Helion Venture Partners among others.

The company’s revenue jumped 1.5 times in FY22 (2021-22) to Rs 1,132 crore, according to a media report. Gupshup has also been one of the rare profitable unicorns in India. However, the company’s profit narrowed to Rs 39.9 crore in FY22 from Rs 52.5 crore a year earlier. Gupshup earns revenue mainly through mobile messaging services and advertisements.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.