India’s three biggest startup investors—Sequoia Capital, Tiger Global Management and SoftBank—have slashed deals by more than 80 percent so far, highlighting the horrors of the funding winter that has pushed startups to take a number of cost-cutting initiatives including thousands of layoffs.

While SoftBank is yet to open its account, the other two have been part of only 11 deals in total so far this calendar year against close to 60 by the three (including SoftBank) in the same period of 2022, data collated by Tracxn Technologies showed. Sequoia Capital, a typically early-stage investor, was the most active among the three this year with 10 deals.

While Tiger Global participated in only one deal, SoftBank has not struck a single deal in India since July last year, the data showed. Sequoia Capital, Tiger Global and SoftBank had participated in 28, 28, and 3 deals, respectively, in the same period of 2022, the data showed.

Sequoia has participated in deals amounting to $111 million in 2023 so far against $1.36 billion a year ago. Tiger Global, meanwhile, participated in just PhonePe’s $100-million deal against deals totalling to $2.47 billion in the year-ago period. SoftBank’s three deals last year amounted to $570 million.

SoftBank declined to comment. Questions sent to Sequoia Capital and Tiger Global remained unanswered.

So far in 2023, India’s startup ecosystem, currently the third-largest in the world, saw just 623 deals overall against 1,501 deals in the year-ago period, the data showed. Startups raised $8.84 billion across these 623 deals against a whopping $24 billion in the same period of 2022.

How important are these investors?Sequoia Capital, Tiger Global Management and SoftBank have been the most prolific startup investors in India over the last 10 years. The three have been instrumental in producing unicorns and soonicorns (soon-to-be-unicorns) in the country. Sequoia Capital has backed more than 30 of India’s 108 unicorns, while Tiger Global has invested in close to 40. SoftBank, on its part, has backed 21 unicorns in the country.

Last year, Sequoia Capital India had raised its largest-ever fund worth $2.85 billion to invest in technology startups in India and Southeast Asia. The company earmarked $2 billion for Indian startups. But the venture capital firm has come under fire as some of its portfolio startups allegedly witnessed corporate governance lapses.

Like Sequoia, Tiger Global has been eyeing a new fund with a focus on Indian technology companies. The hedge fund company has also been extremely bullish on India, with its partners visiting the country at least four times in 2022 to explore potential investments. Between 2014 and 2022, Tiger Global invested more than $6.1 billion across 240 deals.

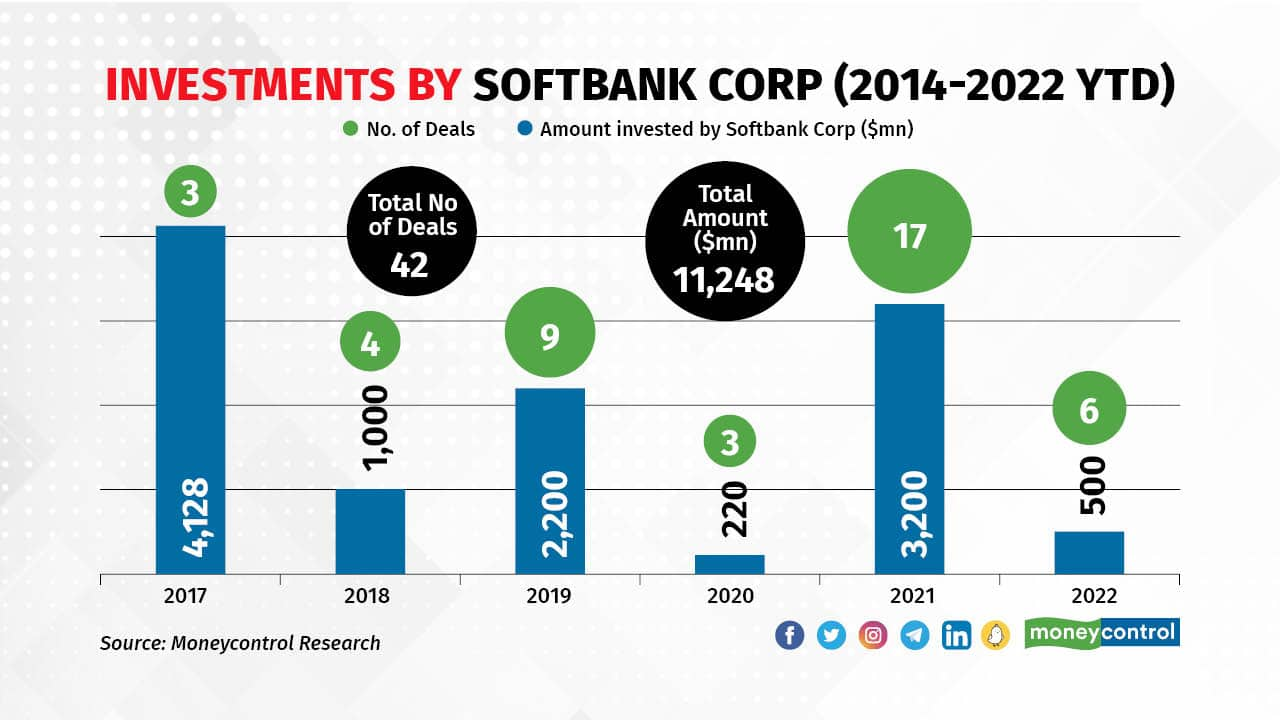

SoftBank, however, has been extremely cautious since May last year and said that it would be slashing its investments by a fourth. The Japanese investment conglomerate has invested more than $11.2 billion between 2014 and 2022 in India across 42 deals.

“Tiger has shown all the optimism, Sequoia has raised a large fund but are they investing?” said a growth-stage investor, requesting anonymity.

“The current market isn’t investable. Many companies across stages, which raised money in 2021 and 2022, have become non-investable because the entry price for a new investor has become very high. These companies have also traded growth for profitability now so you don’t even have ‘growth’ for growth-stage companies. So there will be some caution for all investors at least till the year end,” the investor added.

Worsening funding winterA sharp decline in startup investments amid rising macroeconomic headwinds globally has prompted companies to cut down expenditure in order to extend their runways to survive and weather the challenging situation.

Consequently, startups have fired more than 6,000 employees in 2023 alone, taking the overall layoff count to 25,000 since the start of 2022. Startups have also shuttered non-core verticals and have reduced expenses on advertising and marketing over the last 12 months. However, some investors are of the opinion that there’s still enough excitement about India’s startup ecosystem among local VC firms even as global investors have taken a step back.

“The Covid years and until the first half of last year, you had the biggest investors globally coming in at prices that companies were demanding. We literally saw once-in-a-lifetime investors investing in Indian startups then,” said an early-stage investor, requesting anonymity.

“So in my opinion, the current environment isn’t extremely bad for startups. Yes, there is correction, and it could go bad further at least by the end of 2023, but I feel we are back to where we were before Covid, in fact we are doing slightly better than 2019. Covid was an aberration and a lot of things changed because of that. But there’s still some excitement, especially for the local VCs in the country,” the investor added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.