Signature Global, whose Rs 730 crore initial public offering opened for bidding on September 20, aims to turn profitable before FY26, a company official said.

The real estate developer plans to recognise revenue of Rs 7,000 crore from ongoing projects spanning 17 million square feet by FY26.

The company completed about 6 million square feet of projects from FY21 to FY23, translating into revenue recognition of about Rs 1,500 crore, chief executive officer Rajat Kathuria said in a pre-IPO Interview to Moneycontrol.

Signature Global has about 45 million square feet of completed, ongoing, and planned projects. This includes 17 million square feet in various stages of development and 21 million square feet in the pipeline through land acquisitions or collaborations.

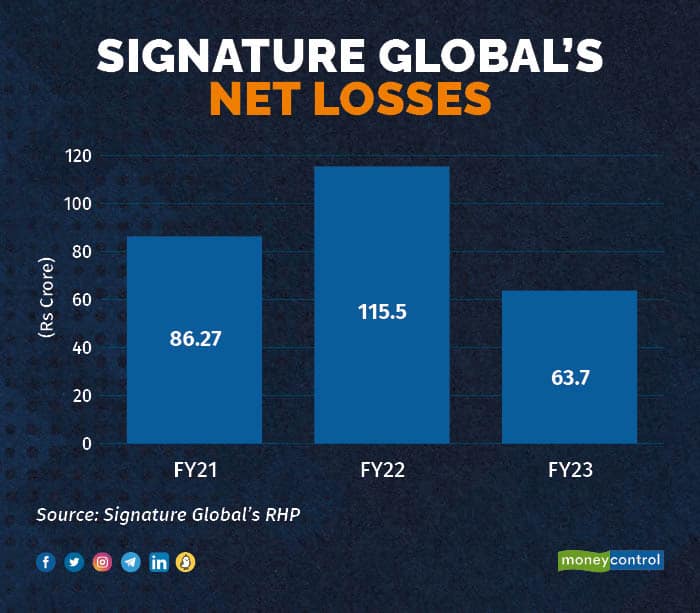

Gurgaon-based Signature Global posted losses for the past three years, according to the IPO documents. The losses were mainly because revenue from real estate projects were recognised only when they met performance obligations, as compared to the previous percentage-of-completion method.

Signature Global IPO

Signature Global IPO

Chairman Pradeep Kumar Aggarwal said the company’s focus will be on the affordable and mid-income housing segments for the next three to five years in its core operational area of the National Capital Region.

Aggarwal said the mid-income segment could derive a margin of almost 30 percent, while in the affordable income segment, it could be 24 percent. Of the 17 million square feet currently being developed, 11 million square feet are in the mid-income category, reflecting the company’s focus on this segment.

Also read: RR Kabel lists at 14% premium: Should you hold, buy, or book some profit?

About the Signature Global IPO:

The Signature Global IPO is open from September 20 to September 22. The offer consists of fresh shares worth up to Rs 603 crore and an offer for sale of shares for Rs 127 crore. The company proposes to use Rs 432 crore for debt reduction and the balance for inorganic growth through land acquisitions.

In FY23, the company’s net debt stood at Rs 1,100 crore and its operating surplus before investment in land stood at Rs 691 crore, translating into a ratio of 1:2.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.