The Reserve Bank of India (RBI) is likely to conduct more variable rate repo (VRR) operations to ease tightening liquidity in the banking system that has led to a surge in interbank call rates, bankers said ahead of the three-day monetary policy meeting scheduled to start on Wednesday.

Liquidity in the banking system is tightening due to heavy outflow of funds for tax payments, increased credit demand and RBI selling dollars to stem the rupee fall, they said.

On September 22, the RBI conducted an overnight VRR operation worth Rs 50,000 crore, which saw bids of Rs 94,267 crore. The cutoff rate was at 5.58 percent. The repo rate, or the rate at which RBI lends to banks, is at present 5.40 percent.

Under VRR operations, banks bid for funds from the RBI at a rate higher than the repo rate, while the call money rate is an overnight rate at which banks lend to each other to meet cash requirements.

“The RBI has made it clear that they want to take out surplus liquidity from the banking system as that will help in controlling inflation. Right now, liquidity conditions have been tightening because of the hefty advance tax and goods and services tax (GST) outflows coupled with the RBI’s regular intervention in the forex market by selling dollars,” said Rajeev Pawar, head of treasury at Ujjivan Small Finance Bank.

As on September 23, the net liquidity absorbed by the RBI stood at Rs 1,642 crore, down from Rs 2.1 lakh crore on September 3.

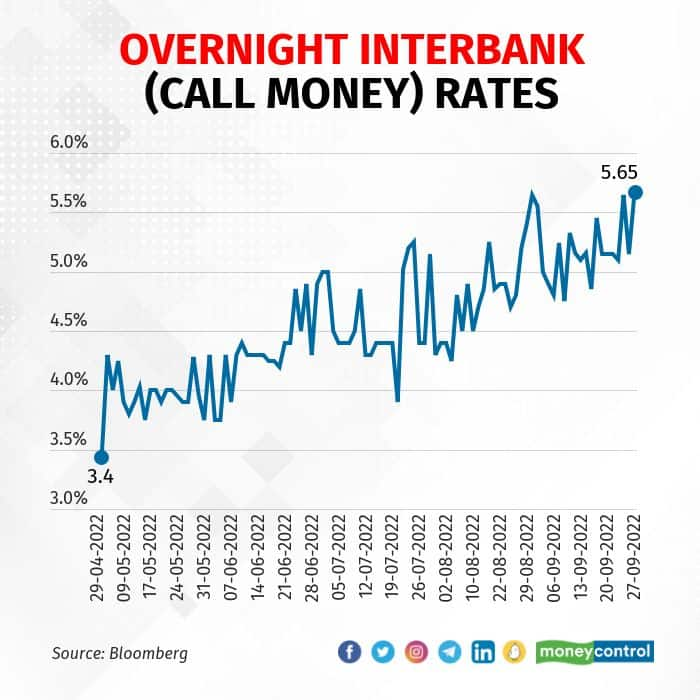

With liquidity shrinking, the weighted average call rate (WACR) spiked to 5.72 percent on September 21, the highest since August 6, 2019, and up 32 basis points (bps) from the repo rate. This is in comparison to when the WACR was 5.38 percent on August 30 and 4.90 percent on August 1. One bps equals one-hundredth of a percentage point.

“A persistently higher WACR over the repo rate would mean tighter liquidity conditions consistently. This might not go down well with the RBI,” said Ritesh Bhusari, deputy general manager – treasury at South Indian Bank.

“The RBI’s repo operations will continue for some time now, and the WACR will align to the repo rate for the foreseeable future,” he said.

Also read: Liquidity and RBI: A face-off!How the call money market worksThe call money rate caters to the day-to-day cash needs of banks, especially to meet cash reserve ratio and statutory liquidity ratio requirements, and to fulfil sudden demands for funds.

The prevalent liquidity condition in the banking system and the monetary policy influence the call money rate.

Simply put, banking system liquidity is calculated on the basis of supply and demand for central bank money. The RBI uses the Liquidity Adjustment Facility (LAF) window to manage liquidity. Using this window, the central bank lends short-term funds to banks at the repo rate, accepting government securities as collateral, and sucks out funds from banks at the reverse repo rate.

Apart from LAF, the RBI has a number of liquidity management tools to control inflation in the economy by increasing and reducing the money supply.

The RBI, through the monetary policy framework, aims to set the repo rate based on an assessment of the current and evolving macroeconomic situation, and modulation of liquidity conditions to align the operating target of the WACR at or around the repo rate.

What is pushing up call rates?Call rates are rising largely due to tightening banking system liquidity, according to money market experts. According to two bankers’ estimates, tax outflows of Rs 2-2.5 lakh crore may have happened from September 15-20. Liquidity could have tightened further if not for a bond redemption worth around Rs 45,000 crore on September 21, added bankers.

Further, there is also a disparity between credit and deposit growth at banks, leading to tight liquidity conditions. Additionally, the RBI’s dollar sales in the forex market to arrest the rupee’s fall has also sucked out banking system liquidity, said, bankers. The rupee has been on a weakening spree of late against the dollar and had dropped to a record low of 81.66 on September 26, as per Bloomberg data. The RBI typically intervenes in the forex market to prevent exchange rate volatility.

Also read: Rupee may fall to 82 to a dollar this year but RBI unlikely to defend aggressively, say currency expertsWhere are call rates headed?Economists expect banking system liquidity to remain tight ahead of the upcoming festival season due to a higher credit off-take and greater currency in circulation. This could keep the call rate aligned closer to the repo rate, they said.

“We expect liquidity to remain tight even in October amidst higher currency leakage. In part this will be offset by increased spending,” said Upasna Bhardwaj, chief economist at Kotak Mahindra Bank. “Overall, this is expected to keep overnight rates closer to the repo rate. We expect term repos to continue more frequently to manage any frictional tightness.”

According to Sakshi Gupta, principal economist at HDFC Bank, the RBI is likely to use liquidity fine-tuning operations, which might include long-term repo operations or even open market operations to tide over any extreme liquidity tightness in the system.

RBI Governor Shaktikanta Das, in the central bank's last monetary policy meeting on August 5, had said that the multi-year process to normalise banking system liquidity will spill over into the next financial year. He had also said that the RBI will conduct two-way fine-tuning liquidity operations depending on evolving financial conditions.

Bankers said the RBI is likely to come out with repo auctions every time liquidity slips in deficit mode and/or banks face a liquidity shortfall.

“We expect the WACR to remain above the repo rate for some time keeping in mind the liquidity situation. That would also help the RBI bring down inflation expectations going forward,” said Pawar of Ujjivan Small Finance Bank.

“Our view is that as long as the RBI intervenes in the forex market to protect the rupee, repo operations will be conducted simultaneously to keep the rupee liquidity balance,” he added.

The RBI’s rate-setting Monetary Policy Committee’s decision is due on September 30. Most economists expect a 50 bps hike in the repo rate. The repo rate has been increased by 140 bps since May to control inflation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.