Private banks have reported higher net profit growth in fiscal year 2024 compared with the bottomline growth reported by public sector banks, according to a Moneycontrol analysis. In Fy24, banks cumulatively posted a net profit of more than Rs 3 lakh crore, first time ever.

Prime Minister Narendra Modi tweeted May 20 and said: "In a remarkable turnaround in the last 10 years, India's banking sector net profit crosses Rs 3 lakh crore for the first time ever."

On a year-on-year basis, private banks’ profit jumped by 41 percent while public sector banks’ net profit rose 35 percent, data showed.

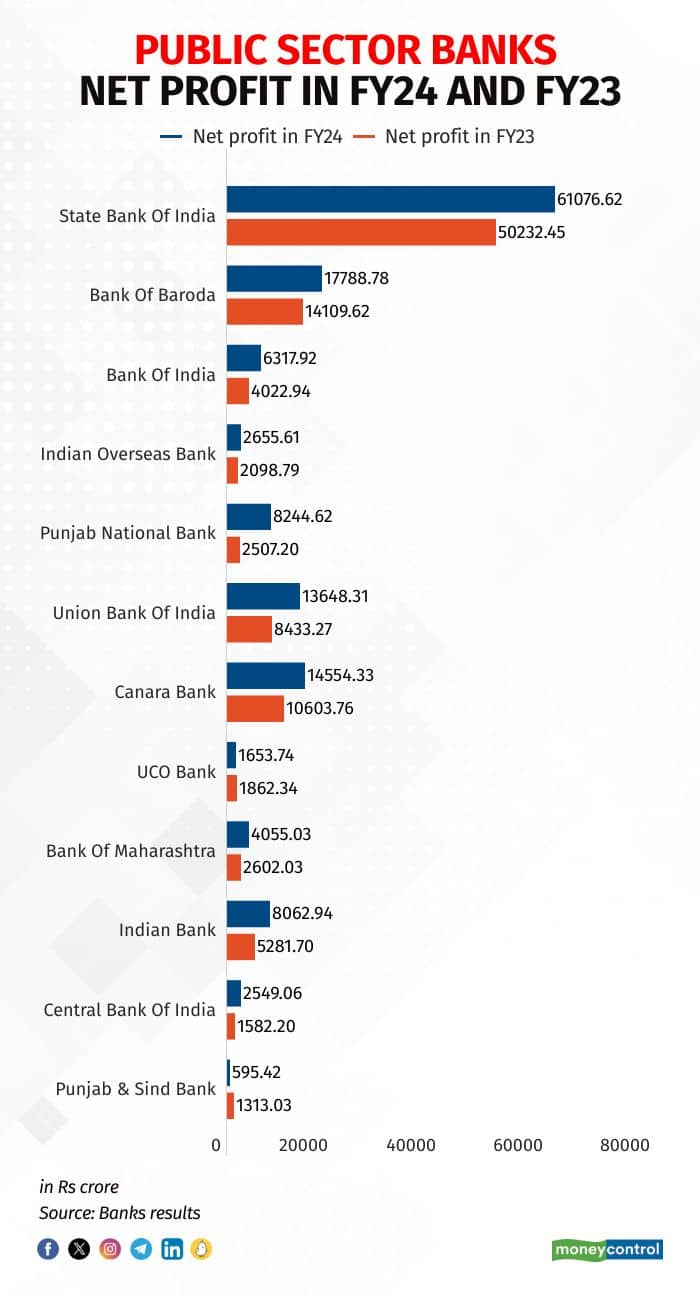

In absolute terms, financial year (FY) 2024 saw India’s private sector banks reporting a bigger net profit than PSBs. In FY24, a total of 26 private sector banks reported a net profit of Rs 1.78 lakh crore versus the 12 PSBs’ net profit of Rs 1.41 lakh crore.

Among private sector banks, HDFC Bank reported the highest profit of Rs 60,812 crore in FY24. And among PSBs, the country’s largest bank, the State Bank of India (SBI), reported a net profit of Rs 61,076 crore.

Also read: Banks report better-than-expected NIM in Q4 but asset quality a concern, say industry expertsAccording to industry experts, the jump in profit is largely due to the banks maintaining high credit growth, resulting in an increase in net interest income. The lenders also kept their asset quality under control, reporting a healthy bad loan book in FY24.

“Banks maintained their healthy performance trajectory with healthy credit growth. It led to an increase in net interest income and consequently, in operating profits,” said Sachin Sachdeva, Vice President, Sector Head, Financial Sector Ratings, ICRA. “Banks also maintained steady asset quality indicators, thereby leading to benign credit costs for the sector. This, coupled with healthy operating profits, resulted in a healthy increase in profits for the banks on a sequential as well as yearly basis.”

YoY numbersIn the previous financial year, private banks’ total profit was at Rs 1.26 lakh crore and PSBs’ total profit was at Rs 1.04 lakh crore. On a year-on-year basis, private banks’ profit jumped by 41 percent and PSBs' net profit jumped by 35 percent.

Barring Uco Bank and Punjab & Sind Bank, all banks reported a jump in their net profit on a YoY basis. Uco Bank’s net profit dipped to Rs 1,653 crore in FY24 from Rs 1,862 crore in FY23, while Punjab & Sind Bank’s net profit plummeted to Rs 595 crore in FY24 from Rs 1,313 crore in FY23

Banks in the last reporting quarter of FY2023-24 reported a better-than-expected NIM but some concerns still remain on the high volume of bad loans for some banks. An analysis of financials of at least 15 banks for the January-March quarter of FY24 showed them reporting robust net profit, deposit and credit growth, NIM and asset quality.

On the asset quality front, among the top PSBs, Union Bank of India reported a gross non-performing asset (GNPA) of 4.76 percent and net NPA (NNPA) of 1.03 percent against 7.53 percent and 1.70 percent, respectively, last year.

Punjab National Bank reported a GNPA of 5.73 percent and an NNPA of 0.73 percent versus 8.74 percent and 2.72 percent last year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.