As the year draws to a close and the new year calls, mounting debt from high-interest loans can dampen festivities. With EMIs draining your wallet and interest compounding, now is a good time for a quick year-end debt audit.

This guide unpacks strategies to prioritise, prepay, and consolidate debts, so that you enter the new year with less burden and more financial agility.

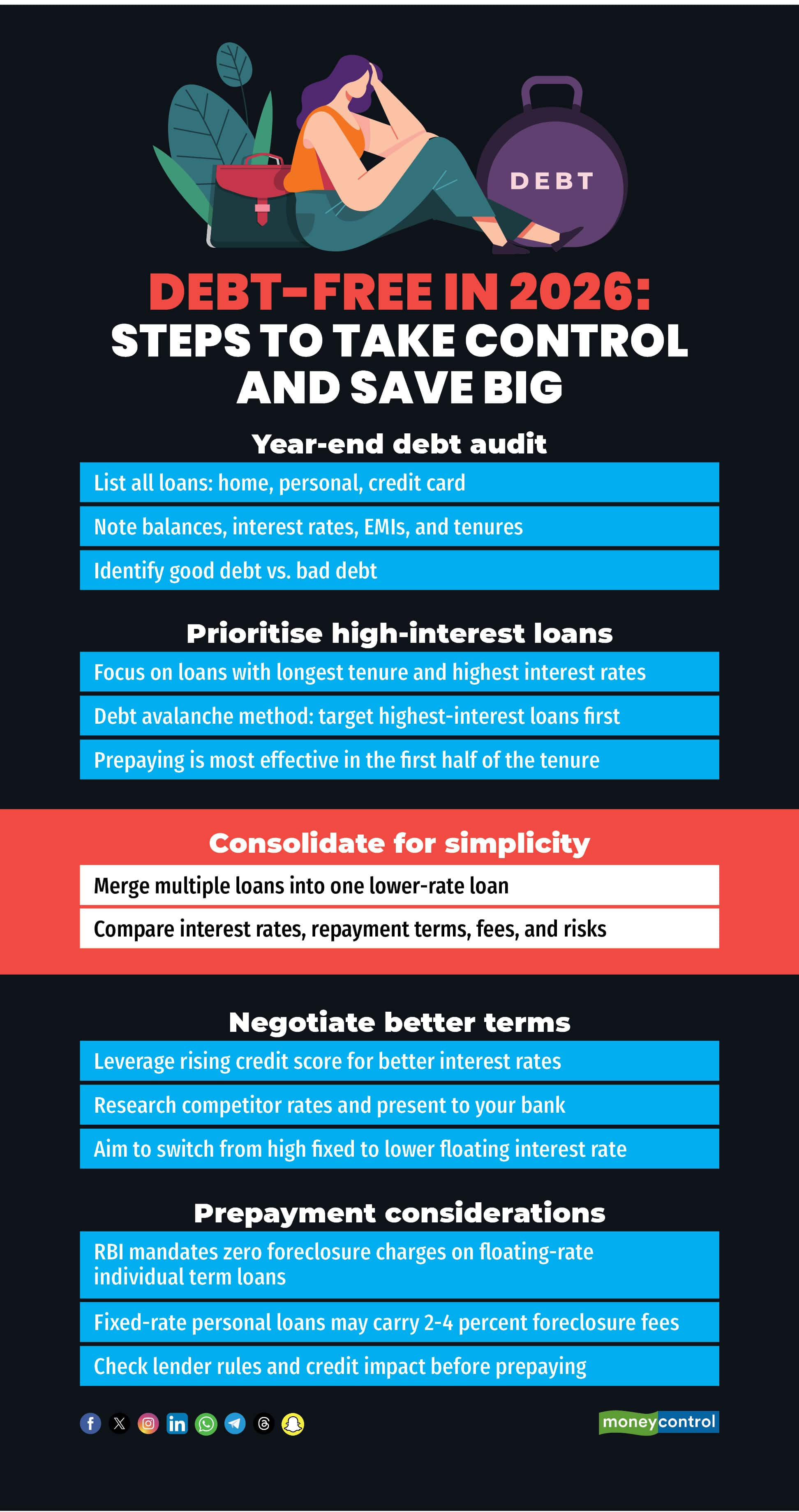

Assess your debt portfolioBegin with a clear inventory. List all loans — home, personal and credit card — detailing balance, interest rates, EMIs and tenures. Tools like loan statements or apps can reveal hidden costs.

The key to managing a debt portfolio is effective financial planning and cash flow budgeting. The strategy to repay debt relies on maintaining healthy financial ratios by understanding your “good” debt (low-rate asset-builders like home loans) versus "bad" ones (high-cost consumer loans).

Anooj Mehta, vice president-partner success at 1 Finance, suggests focusing on loans with the longest tenure and highest interest rates. He advises prioritising repaying high-interest loans that affect expense and liability ratios.

Minimise interest drainTackling debt methodically curbs total outflow. The debt avalanche method — targeting highest-interest loans first — yields maximum savings. Paisabazaar CEO Santosh Agarwal said, "The most effective way to lower your debt burden is to pay off the loan with the highest interest rate using additional funds in hand."

Consider a Rs 50 lakh home loan at 7.5 percent over 15 years. In early years, over 60 percent of EMI services interest. Prepaying is most effective in the first half of the tenure. If you are in the final years of a loan, prepaying saves you little in absolute interest. You might be better off investing that surplus cash instead. “Direct bonuses toward partial prepayments, instructing lenders to shorten tenure for optimal savings. If cash flow is an issue, then the EMI can be reduced, keeping the same tenure but interest saved is less,” Mehta said.

It is wise to select a consolidation plan that matches your financial scenario. Do not forget to compare interest rates, repayment terms, fees and risks associated with all the loan options available before selecting one.

“Consolidate multiple loans into one lower-rate loan to simplify management," said Mehta, recommending refinancing or balance transfer to merge EMIs into a single, manageable payment.

Agarwal said debt consolidation is most effective when the new loan carries a lower interest rate. It simplifies repayment by merging multiple debts into a single EMI and one lender, making it an ideal approach for rolling high-rate credit card debts into personal loans or top-up home loans.

You may also be eligible for pre-approved personal loan offers at lower rates based on your credit score, which can be used to pay off high-interest loans. “Do check offers from the bank where you have an existing relationship, through a salary/savings account or deposits,” Agarwal said.

Negotiate smarter termsA rising credit score showcases your reliability, giving you leverage to negotiate better terms. “The higher the credit score, the lower the interest rate,” Mehta said. Use this, along with your overall banking relationship, to secure concessions and waive fees.

Research rates without hard credit pulls, then present them to your bank. Having an EMIs/ net monthly income (NMI) ratio well within limits, usually less than 55 percent, can boost your chances of a better offer. “A high credit score can empower you to get the best debt consolidation offer,” Agarwal said. Aim switching from a high fixed interest rate to a lower floating interest rate.

Also read | Does the 15×15×15 SIP rule get you to Rs 1 crore for real or is just a myth?

Do check for prepayment penalties, credit impactPrepaying high-rate loans boosts cash flow or trims tenure but caveats apply. RBI mandates zero foreclosure charges on floating-rate individual term loans, a boon for home loans. Yet, fixed-rate personal loans often carry 2 to 4 percent fees — calculate if savings justify them.

"Prepaying high-interest loans reduces tenure or EMIs, boosting credit scores by lowering utilisation, though closing old accounts may temporarily impact history; check lender rules, as some loans have prepayment restrictions," Mehta said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.