Current laws make it difficult for an ordinary citizen to ensure that his assets are inherited by his chosen successors after death. The succession process in India remains a time consuming, tedious, and expensive process, primarily because it involves courts, which are already overburdened with litigation.

Nomination facilities are allowed in several investment avenues. However, with the sole exception of life insurance, nomination just facilitates quicker access to the asset but does not solve the issue of passing title to the nominee. As a result, implementing the citizen’s wish regarding the distribution of his assets on his death remains a difficult task. Let’s understand this through an example.

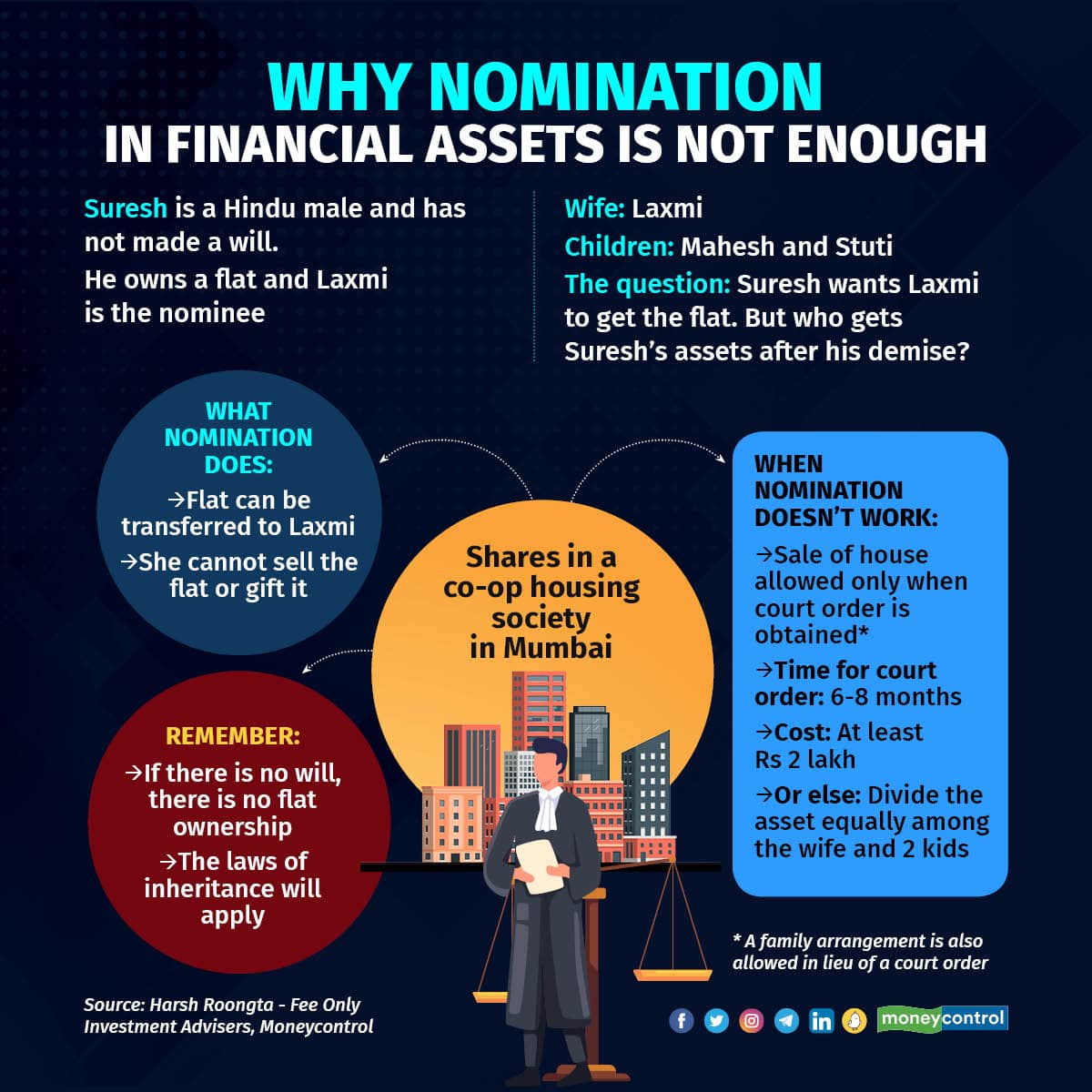

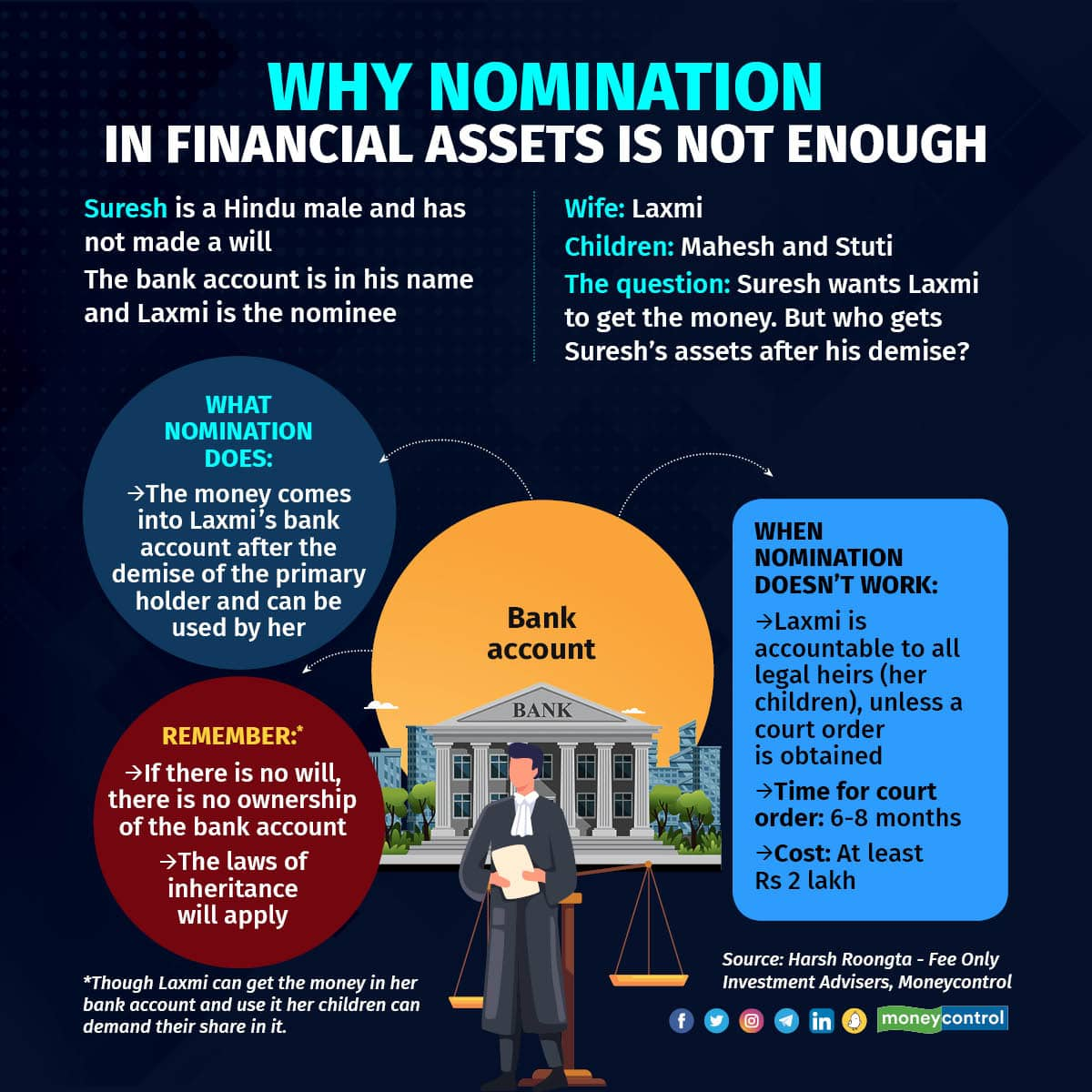

Suresh is a Hindu male, and both his parents are deceased. His family consists of his spouse Laxmi and two adult children, Mahesh and Stuti. Suresh has a flat in a cooperative housing society in Mumbai, a life insurance policy, mutual fund units, some listed shares, and a bank account. Suresh has educated Mahesh and Stuti, who are both well settled and no longer depend on him. Suresh wants to ensure that, on his death, all his assets are inherited by Laxmi so that she can live her life comfortably after his death. To carry out this wish, he has named his spouse Laxmi as the sole nominee in all his investments.

Also read: How to add a nominee in your mutual fund folio in few and easy stepsCurrently the only way Suresh’s wish can be carried out is if he also makes a will naming Laxmi as his sole beneficiary. In case he neglects making this will, then, on his death the assets will be inherited as per the personal law applicable to him (Hindu Succession Act), under which all his assets (except the Life Insurance policy as we will see later) will be divided into three equal shares between Laxmi, Mahesh and Stuti, irrespective of Laxmi being a sole nominee under all these investments.

In the case of immovable property, the Maharashtra Cooperative Societies Act itself prevents Laxmi from selling or otherwise transferring the society shares even though she becomes the owner of the shares.

In the case of immovable property, the Maharashtra Cooperative Societies Act itself prevents Laxmi from selling or otherwise transferring the society shares even though she becomes the owner of the shares.

Although the money will come to the nominee after the primary holder's demise, the nominee is answerable to the legal heirs as laid down in the Will

Mutual funds and demat accounts have been stressing the need for nomination. This is crucial., but a nominee is not the final owner of the assets. The will takes precedence

Nomination in a life insurance policy ensures that the money gets transferred to the nominee

Nomination in a life insurance policy ensures that the money gets transferred to the nomineeAs can be seen above, Laxmi cannot enjoy final access to Suresh’s other assets without going through a long, tedious, and expensive court process with the sole exception of the Life Insurance policy. Mind you, the mutual fund units and shares that get transferred to Laxmi's name can be sold by her. But she will be accountable for the sales proceeds. Laxmi’s children can demand their share. If Laxmi refuses, they can take her to court and ask for their share in the court. The court will then require that she give the rightful share of money to the children.

Given the long judicial delays and expenses involved in litigation, most children will not use that approach. So, in the case of movable assets, given the fact that restrictions cannot be put on their transfer, Laxmi de facto becomes the beneficial owner. However, the chance that her children will take her to court very much remains.

In the case of immovable property, the Maharashtra Cooperative Societies Act itself prevents Laxmi from selling or otherwise transferring the society shares (denoting properrty ownership) even though she becomes the owner of the shares.

Even where such provisions do not exist, a prospective buyer may not wish to purchase the flat from Laxmi if her title has not been perfected through a court order (or a family arrangement that is allowed under the MCS Act).

Suresh’s desire that she be his sole inheritor is thwarted by the Succession law, except in the case of Life Insurance Policy.

A white paper written by the former group general counsel at ICICI Bank and now a senior official at one of the financial sector regulators, Pramod Rao (in his personal capacity) with inputs from ARIA (the Association of Registered Investment Advisors; a community of SEBI-registered investment advisors) proposes changes in the succession law to extend the arrangement pioneered for death claims under life insurance policies, wherein nominees like Laxmi can enjoy unrestricted rights to the amount without having to go through a gruelling legal process.

Some concerns have been raised based on an incorrect understanding of the recommendations, which are summarised below with my responses to them:

1. Citizens will lose the option to have different nominees who will only be caretakers: A citizen will continue to have full rights to provide in his will that the nominees only access the assets as caretakers and that they (nominees) will be accountable to the eventual successors. The citizen may even refuse to name a nominee at all. The provision of the will prevails over nomination in all such cases.

2. Citizens will not be able to donate their assets to charity or philanthropy as some assets do not allow non-individuals to be named as nominees: Again, this is an incorrect understanding. A citizen has full rights to name charitable institutions as a beneficiary in his will and state that the nominees will only access the assets as caretakers and that they the (nominees) will be accountable to the named charitable institution. The citizen may even refuse to name a nominee at all. The provision of the will prevails in all such cases.

3. There should not be a different succession arrangement for different asset types: As already pointed out, life insurance claims already have a different type of succession that is convenient, simple, and inexpensive and the model should be followed in all asset types.

4. This route of succession is not provided for in law: The Life Insurance Act, 1938 was amended after an extensive discussion and based on the comprehensive 190th report of the law commission. Changing the law on the pattern of the Life Insurance Act, 1938, is exactly what is recommended in the white Paper.

In short, the recommendation to use nominations as a simple, easy, and inexpensive option to implement a citizen’s wishes regarding the distribution of his assets after death can substantially improve the ‘Ease of living’ for all Indians.

The option to use a Will or the personal laws applicable to a citizen will continue as before. But millions of Indian citizens will be able to ensure that their chosen successors can easily enjoy the assets representing their lifetime of hard work.

Harsh Roongta is the Founder of FeeOnly Investment Advisers LLP, a SEBI registered investment advisory firm. He is a director and past chairperson of ARIA.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.