With interest rates in the economy headed upwards, debenture public issues are also offering attractive returns to investors.

In its latest public issue, Edelweiss Broking Limited is offering secured, redeemable, non-convertible debentures with a face value of Rs 1,000 to investors, including retail individuals. The company plans to raise up to Rs 300 crore, with subscription open from July 5th to July 26th.

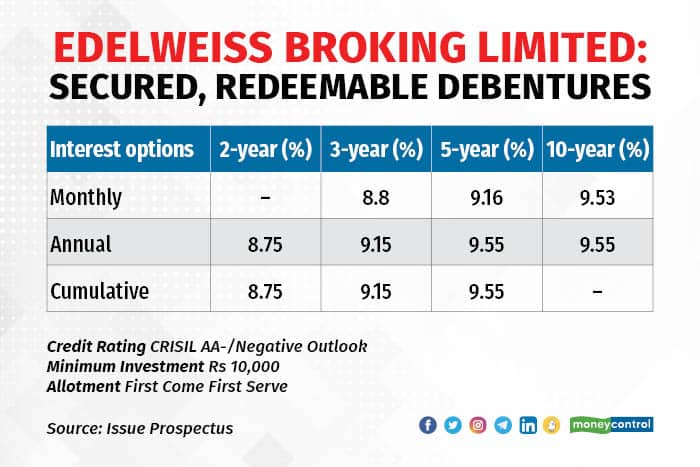

The allotment happens on a ‘first come, first served’ basis. Investors will have the option of choosing from ten series of debentures spread across tenures of 24 months to 120 months. The coupon offered ranges from 8.75% a year to 9.95% a year with monthly, annual and cumulative interest pay-outs.

Edelweiss NCD issue offers options from 2-10 year time periods

Edelweiss NCD issue offers options from 2-10 year time periodsThere is an added offer for existing debenture holders or debenture holders with any of the specified five sister companies. Or, if you are an equity shareholder of Edelweiss Financial Services Limited, the company is offering an incentive of 0.2% a year over and above the debenture coupon. Which means that the effective range of return for this category goes to 8.95% – 10.15% a year.

What’s good Edelweiss Broking Limited is part of the Edelweiss Group. It is a securities broking company operating in the broking and financial products distribution industry. This is one industry that fared well through the pandemic and revenues for Edelweiss Broking have also increased significantly over this period.

The company has a pan-India presence and a good brand to rely on for future growth. Along with securities broking and distribution, the company also undertakes financing of ESOPs and providing margin trading. All these activities in the capital markets have looked up over the last two years, and as a result, Edelweiss Broking Limited has been able to increase revenues by 83% in FY22 over FY21, while keeping costs in check, thereby boosting its profit before tax and operating margin.

For investors looking to add some regular income through debt allocation, this issue offers a good interest rate at a time when bank fixed deposit rates are low. The spread-out maturities mean that you can choose the tenure that suits you. The bonds will be listed, which means you get the option of an early exit if you choose to or need to.

What’s not good The company operates in an industry that is highly regulated and the impact of any new regulation on revenues is beyond its control. Moreover, the growth of the business can be cyclical, in line with the prevalent capital market trends. This, too, can add volatility to business cash flows. While FY22 looks good with a Rs 1,400 crore profit before tax, the company recorded a loss in FY20.

The issue has been rated AA- with a negative outlook by CRISIL. The AA rating reflects the well capitalised Edelweiss Group, and the negative outlook reflects the concerns around its deteriorating asset quality and stressed profitability. While the concerns are mainly around the Group’s lending businesses, any stress to the rating can directly impact the listed price and salability of Edelweiss Broking Ltd’s NCDs, too. Moreover, if there were to be stress on the group’s cash flows, this can affect the broking business as well.

What should you do? With nominal returns potentially going into double digits (for existing bond holders), this is an attractive proposition from a return perspective. There is measured risk, especially for the longer tenure bonds on offer.

“While investing in NCDs, one has to be completely sure about the company’s management, balance sheet and also the credit rating of the issue. In this case, the rating is AA-, which reflects some negative outlook for the future,” says Rushabh Desai, founder, Rupee with Rushabh Investment Services. “For our clients, I find that debt mutual funds tick the right boxes in terms of a risk-return balance. If one wants to invest in an NCD, it’s better to do so only in the highest rated bonds having strong balance sheets, or in sovereign bonds.”

There are no guaranteed pay-outs in NCD issues and you have to take a call based on your assessment of the company’s ability to fulfill its financial obligations. The company has an investment grade credit rating, but there are risks to the future outlook. Moreover, in a rising rate cycle, even the highest grade AAA rated corporate NCDs are quoting at yields slightly above inflation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.