A majority of insurance buyers find it difficult to understand life and health insurance terms and conditions, which remains a key barrier to making their purchases.

Close to 53 percent of prospective policyholders found insurance products and processes difficult to decipher and hence dropped out, a recent study conducted by online insurance broking firm Policybazaar has found.

“This indicates a clear need for education in the category along with simpler, more affordable options. The earlier this education starts, the easier it will be to hit the message home,” the study noted.

Affordability a key hurdle to wider insurance coverageAffordability was another chief barrier, with more than 40 percent of respondents citing high premiums as the key reason for not purchasing life and health insurance policies. The Policybazaar study polled 1,651 respondents for health insurance-related insights and 1,676 respondents for life insurance insights across 27 cities in India.

The hesitancy to go through with their purchase decision is despite greater awareness around life and health insurance, particularly post the Covid-19 pandemic.

Also read: How health and term insurance buying changed completely due to COVID-19

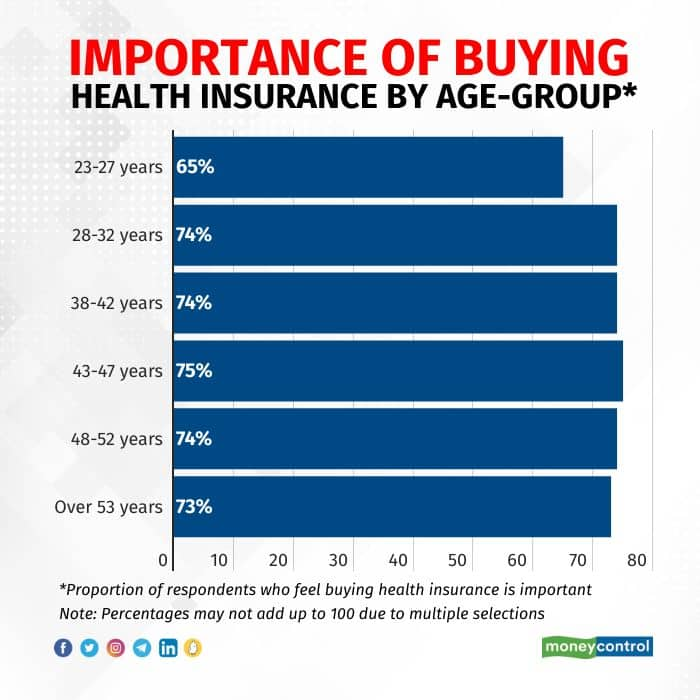

Nearly 73 percent of those polled said health insurance was important, with this realisation being higher (73-75 percent) in older age groups. Even among those in the 23-27 year age bracket, which is relatively less prone to ailments, 65 percent of respondents recognised the importance of health insurance.

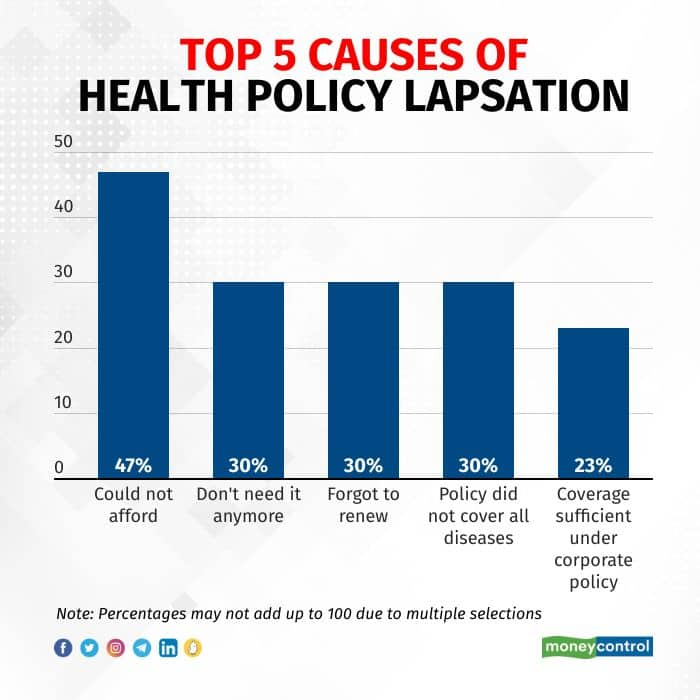

For those who did not purchase health insurance, affordability was a major impediment. Close to 43 percent cited higher premiums as one of the key reasons for not going ahead with health policy purchases and close to one-third attributed it to a lack of sufficient funds. Unaffordable premium was also cited as the top reason for not renewing policies.

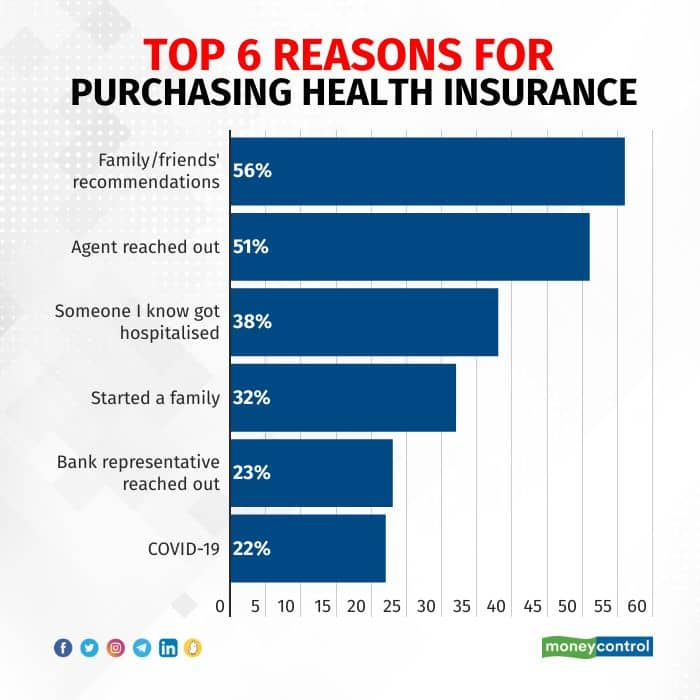

Of those who went ahead with buying health insurance plans, a large majority (88 percent) were influenced by external triggers. According to the survey, people are more likely to consider buying insurance when a friend or family member recommends it to them (56 percent) or an agent reached out to them (51 percent). Fear induced by watching someone known to get hospitalised (38 percent) and starting a family (32 percent) were the other top triggers for considering a purchase.

Health insurance policyholders often feel cheated if their insurance company rejects their hospitalisation claim or makes a part payment. While this could result in policyholders choosing not to renew their policy.

“While the promise of better claim support at the time of purchase affects people’s choice of channel, the actual experience of claim decides whether they will continue to stay covered under a health insurance policy… a majority (of those admitted) admitted to having been overwhelmed with the paperwork, or with the insurer raising too many queries,” says the Policybazaar report.

Not being aware of policy terms and conditions (exclusions, waiting periods or sub-limits) was one of the top reasons for claim rejection.

The awareness around the need for life insurance was high at 85 percent. A higher premium was the most common reason for not buying life insurance policies, with 40 percent of the respondents saying so. Another 34 percent said they did not have sufficient funds to make purchases, as per the survey.

While 31 percent said they did not feel any sense of urgency to buy life insurance for another 28 percent of the respondents the process seemed like too much of a hassle.

Affordability — or the lack of it — also figured high on the list of reasons why policyholders chose to let their policies lapse, with 44 percent saying they could not afford the premiums. Not surprisingly, 36 percent chose to discontinue their policies as they were keener on options that offer returns.

Close to 85 percent of respondents said were influenced by recommendations by family members/friends or agents to make the purchase.

“However, unlike in the case of health insurance, fear induced by watching others was as significant a trigger for life insurance consideration (53 percent). This could take the form of watching (other) families suffer in the absence of life insurance for a deceased family member (35 percent) or… feel secure because of a life insurance policy the deceased loved one purchased (34 percent),” the Policybazaar report noted.

Close to one-third (29 percent) said tax-saving was the reason why they decided to buy life insurance policies.

Premiums, brand name, high claim settlement ratio and time taken to process claims are among the top evaluation parameters when choosing life insurance policies.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.