Mirae Asset Investment Managers (India) knows how to break convention and still stick to its path.

After delivering consistent and chart-breaking returns with its actively managed equity funds, all chief executive officer Swarup Anand Mohanty talks about these days are the virtues of passively managed funds.

Since the beginning of 2021, six of the eight schemes that the fund house launched are passively managed. Eight more are on their way, according to filings on the website of the Securities and Exchange Board of India, the capital market regulator.

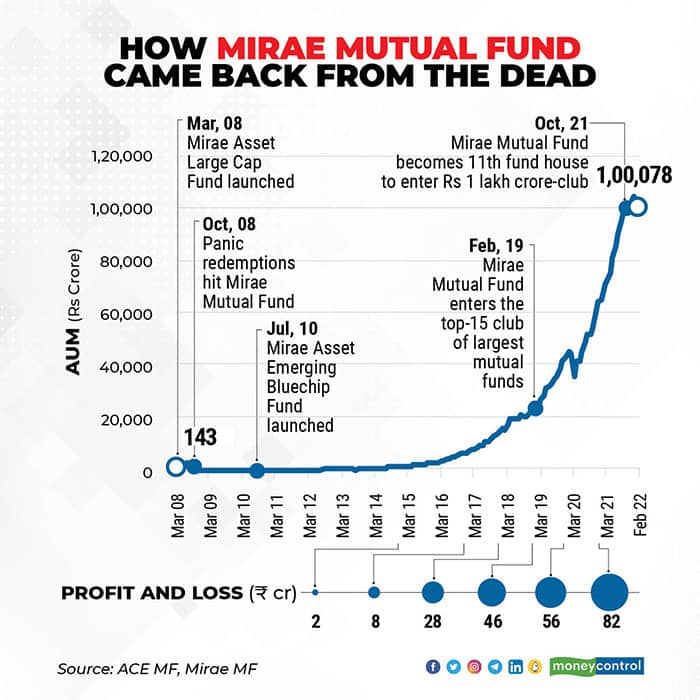

Mirae’s fixation for passive funds comes at a curious juncture of its lifespan. It only recently reached the milestone of managing Rs 1 lakh crore worth of assets, making it the 11th fund house (of 43 in the country) to reach this mark. That’ll be 13 years after investors shunned it in the wake of the 2008 global credit crisis only because the fund house stuck to its convictions.

Why is Mirae suddenly romancing passive funds, especially after the fund house painstakingly built its track record on the equities side and demonstrated that it can beat benchmark indices?

Passive pushActively managed funds have found it harder to beat their benchmarks in recent years. But Mohanty says Mirae’s increased focus on passive funds doesn’t mean he lacks the confidence in his fund management team to beat the key indices.

Mohanty’s strategy points to a distinct fund managerial call about sectors that will perform in the long run – and then launching passive funds to reduce the fund manager risk. Last year, it launched the Nifty Financial Services ETF and in December 2020 it launched the Mirae Banking and Financial Services Fund.

Mohanty said the focus on passive funds is to diversify the AUM mix and look at getting a larger wallet share of investors. To be sure, more mutual fund executives have increasingly started to believe that passively managed schemes offering unique investment ideas will be the future. Some new fund houses including the Sachin Bansal-backed Navi MF focus only on passive schemes for growth. Mohanty’s Mirae wants to be in that space too, given that it is still an equity-led fund house (83 percent of assets come from equity funds).

Also read: Sachin Bansal-backed Navi Mutual Fund launches cheapest Midcap Index Fund

Problem of plenty?Can so many products confuse investors?

Financial planners said such funds have a place in an investor’s portfolio, but may not be ideal for their core portfolios.

“Investors building their international investments should look at broad-based index funds. The theme funds or the funds offering futuristic ideas can be potential alpha generators over time, but also can be highly volatile,” said Vishal Dhawan, founder of Plan Ahead Wealth Advisors.

Also read | Check out MC30; Moneycontrol’s curated list of 30 investment-worthy mutual fund schemes

Mirae MF has launched theme-based passive funds that will invest in areas not available in the domestic market. It also plans to use the wide suite of ETFs managed by sister company Global X ETFs to launch these products.

Also read: A Low expense ratio not enough to buy a passive fund: Swarup Mohanty, CEO, Mirae Mutual Fund

The fund house recently filed three fund of funds that will invest in Global X ETFs – a cloud computing fund, a clean energy fund, and an artificial intelligence & technology fund.

The funds already launched by Mirae MF include Mirae Asset NYSE FANG+, Hang SENG ETF, and Mirae Asset S&P 500 Top 50 ETF.

More innovation can be expected from Mirae MF on the passive side, given that its parent company, Seoul-based Mirae Asset Global Investments, has made multiple investments in the ETF space.

Experts said this should not dilute the fund house’s focus on active schemes.

Team burdenMirae’s equity fund track record is largely credited to chief investment officer Neelesh Surana. He is virtually the face of Mirae’s equity team.

Mohanty said the fund house has increased its team strength over the years. When Surana joined the fund house in 2008, there were only two-three analysts. Today, the fund house has five fund managers and a head of research. Some fund managers who have been moved from their role of sector analysts continue to wear the analyst’s hat and work with other fund managers.

Mirae’s increased focus on passive funds doesn’t place too much of a burden on its fund management team.

“Passive funds are largely driven by the system, not really run by humans (fund managers),” said Kaustubh Belapurkar, director-fund research, Morningstar India.

Mohanty added that Mirae MF is building a separate team for its passive business, with a product head and a dedicated dealer to deal with tracking errors, and it plans to rope in a commodity dealer. For market making (to build liquidity in passive products like ETFs), Mirae MF uses group company Mirae Asset Capital Markets.

Distributor pangsDespite its consistent inflows and strong performance, not everyone is charmed by Mirae.

Mutual fund and distribution officials said NJ India Invest, India’s largest mutual fund distributor by commission income received, does not actively sell Mirae’s mutual fund schemes. Launched by college friends Neeraj Choksi and Jignesh Desai almost two decades ago, NJ India follows a sub-broker model. It empanels thousands of distributors across India, who then fan out to distribute mutual fund and investment products.

“Their commission structure is usually a bit higher than what a mutual fund would pay to other distributors. This is because NJ takes a small cut and passes the rest on to its distributors,” said a distributor who didn’t want to be identified.

For Mirae, this may not result in a big dent in inflows because of its strong and consistent performance. Mirae has even stopped inflows in some of its largest equity schemes in the past.

“Turning away inflows is one of the hardest things to do in fund management. It is a good sign of stewardship,” said Belapurkar of Morningstar.

To be sure, all mutual funds, including Mirae, are with NJ and are available for investors who ask for them. It’s just that NJ doesn’t actively sell them.

After the 2008 crisis, Mirae MF struggled to make a profit, but thanks to its equity scheme growth, earnings have risen phenomenally. The fund house’s profit has grown more than 40 times to Rs 81 crore from Rs 2 crore over the past five financial years (2015-2020). Mirae MF follows a January-December financial year.

The fund house is now looking to repeat its equity success on the passive and debt side, where it is filling up product gaps with new funds. Growth in these categories will widen the fund house’s asset base, but may bring down the pace of profit growth that rose sharply on the back of equity schemes.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.