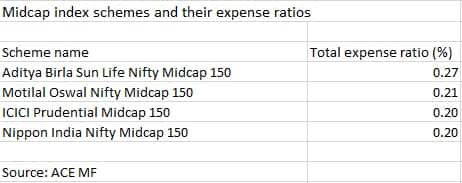

Flipkart co-founder Sachin Bansal-backed Navi Mutual Fund (MF) has launched Nifty Midcap 150 Index Fund, which is the cheapest such fund in its category with total expense ratio (TER) of 0.12 percent.

The new fund offer (NFO) opened on February 21 and will close on March 2.

This is not the first time Navi MF has launched a fund with the lowest TER. Last month, the fund house launched Nifty Bank Index Fund, which will charge TER of 0.12 percent to investors.

Navi MF earlier launched the cheapest Nifty Index Fund and the cheapest Nifty Next 50 Fund.

TERs and tracking errorsIn passively managed funds, required to simply mimic returns of the underlying index, tracking error and TERs can influence how closely the fund is able to track the returns of the index.

Lower the TER, the lesser impact it would have on investor returns vis-a-vis the index. Most index funds and exchange traded funds (ETFs) keep their TER less than one percent. SEBI regulations also require such funds to keep their fees (TER on direct plans) less than one percent as there is no active involvement of a fund manager.

Tracking errors also depend upon whether the fund is managed efficiently or not. For example, the index fund may not be able to immediately deploy the investor flows in the proportion that mimics the index's stock weighs.

Also, if there are redemptions, the fund may be holding onto cash to meet these redemption requests.

Also, exclusion and inclusion of stocks in an index happens at the day's closing price. So, the fund may not always manage to get the stocks included or excluded at the right price.

So, when investing in any passive fund, watch out for these factors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.