Navi Mutual Fund (MF), which is backed by Flipkart co-founder Sachin Bansal, will soon be launching the cheapest index fund -- Navi Nifty50 Index Fund.

The fund will have a total expense ratio (TER) of 0.06 percent in its direct plan. TER stands for the costs charged to investors in asset management fees and other expenses borne by the fund house.

With all other things being the same, a fund with higher TER can lead to slightly lower returns, compared to a fund with lower TER.

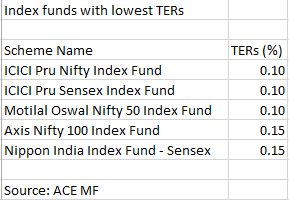

According to data from ACE MF, ICICI Prudential Nifty Index Fund and ICICI Prudential Sensex Index Fund are the two cheapest funds in the industry at present, with TER of 0.10 percent.

The new fund offer (NFO) of Navi Nifty50 Index Fund will be open for subscription between July 3, 2021 and July 12, 2021.

Investors need not rush to invest in NFOAdvisors say investors should not just look at the fund because it has low TER. “Wait and watch to see how the fund is doing, is it able to track the index without much variation? The size of the index fund also matters, as larger funds usually have more liquidity,” says Ravi Kumar TV, founder of Gaining Ground Investment Managers.

“It is likely to be more difficult for an index fund with smaller asset base to closely track the index due to impact of inflows and outflows and the cash component it holds,” says Amol Joshi, founder of Plan Rupee Investment Services.

Also, experts say investors should also take a call on how much they want to invest in index or passively-managed funds and how much in actively-managed funds.

“Index funds usually do well when market valuations are at extremes. However, when there is lot of sector rotation happening in the markets, or switch from growth to value stocks, active funds tend to do well,” Kumar says.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.