Indian mutual fund houses have opened their doors once again, albeit selectively, to investments in their overseas funds. However, investors in such funds have to deal with a minor complexity — it takes a bit longer for international funds to get their net asset values (NAV).

Recently mutual fund houses such as PGIM India and SBI allowed investors to subscribe to units of their schemes investing overseas. Aditya Birla Sunlife Mutual fund also realigned its international equity offerings by merging two schemes. Investor interest in schemes investing overseas is going up in certain pockets.

In fact, some investors have also been getting their account statements on email a few hours later and in some cases even a day later. What has changed?

NAV declaration timelines

Mutual Fund (MF) schemes must disclose their daily NAVs by 11 pm Indian time. Fund houses are supposed to value all the securities held in their portfolios and compute the NAV for that day. The latest price at which each security was traded is to be considered. But this has led to a practical difficulty for schemes investing overseas.

ALSO READ: Exclusive small-cap stocks held by top small-cap MF schemes

Some of the securities trade in markets that remain open beyond the 11 pm deadline. In some cases, only the previous day’s NAV for overseas mutual fund schemes in which Indian mutual fund schemes have invested money will be available till 11 pm. For instance, the US market, the most popular international market for domestic investors to diversify abroad, opens at 9:30 am EST, which is about 7 pm India time. By the time the US markets shut for the day, the 11 pm India deadline for Indian MF NAVs passes.

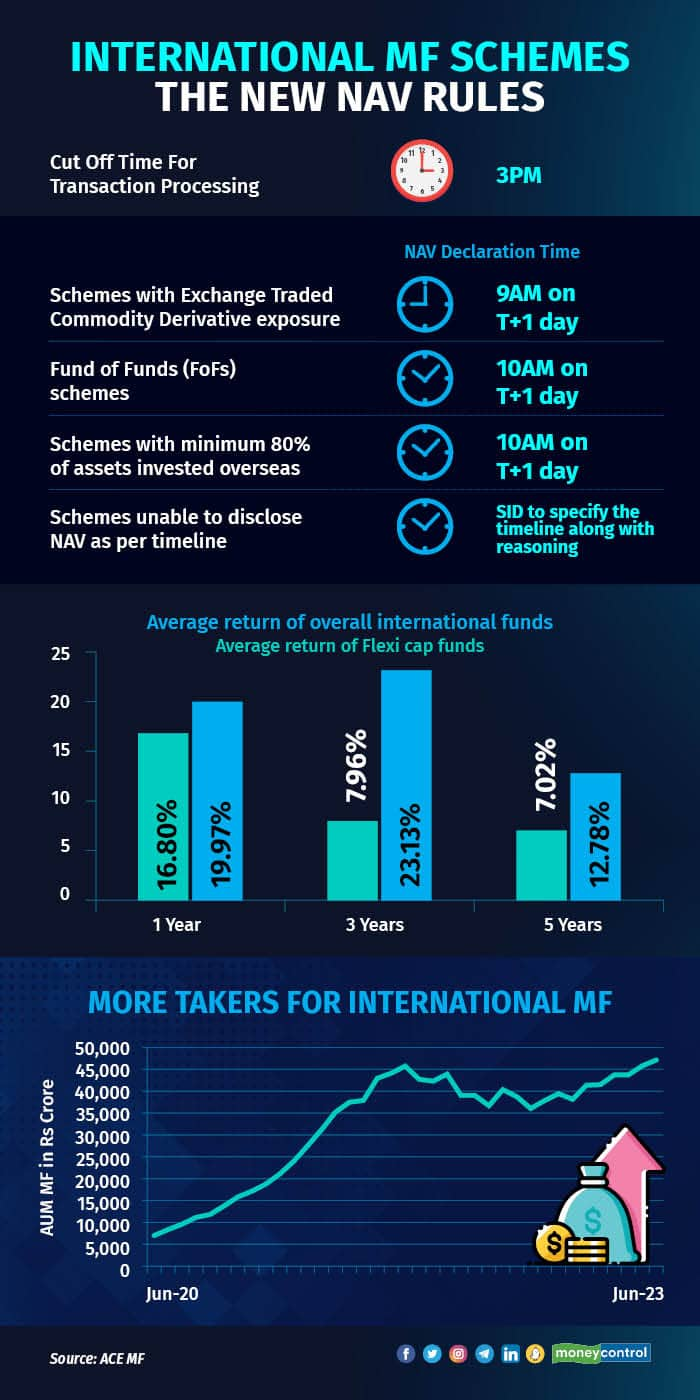

In March 2023, capital market regulator Securities and Exchange Board of India (SEBI) offered some relaxation. It allowed fund houses to declare NAVs of their international schemes on the next day (T+1). For example, in case an Indian mutual fund scheme invests in units of schemes overseas, then such a scheme has to declare the NAV by 10 AM on the following day (T+1) of the business day.

ALSO READ: Made multiple wills? Don’t make the mistake that Aretha Franklin did

If the underlying scheme is taking longer to announce its NAV, then the fund house has to make it clear in the scheme information document (SID).

Why this change?

The regulator wants fund houses to report true NAVs by factoring in the same day’s price. This presents a fair picture of the scheme’s performance. In case of big moves in prices of underlying securities, it may show an NAV away from the true worth of the unit, if the fund houses use the previous day’s prices to compute the NAV of a given day.

In the revised timelines, the NAV for the business day captures the value of all the underlying securities on a given day and presents a true picture of the scheme.

How does this impact investors?

The change does not materially impact investments in Indian mutual fund schemes. The rules pertaining to cutoff times, processing of transactions and exit loads remain the same. If the investor has completed the purchase transaction and the fund house has received money for that transaction before the cutoff time for a given business day (3 pm) he gets that day’s NAV. The only change that would happen is, the confirmation may get delayed as the fund house needs to mention the NAV in the confirmation message.

Earlier a fund house would confirm the purchase transaction getting processed early the next business day. Now, investors will get the confirmation after a few hours, or in some cases, a day later. In the case of a sale transaction, too, the confirmation gets delayed. All other aspects remain the same.

ALSO READ: Samco MF garners Rs 409 crore via Active Momentum Fund NFO, restricts fresh investments

At Moneycontrol, we suggest investing in international funds as part of your asset allocation. The slight delay in NAV declaration will not make a difference to your investment.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!