Insurers’ rising claim ratios due to the COVID-19 pandemic and new regulatory guidelines that came into effect from October 1, 2020 have pushed up premiums across the board.

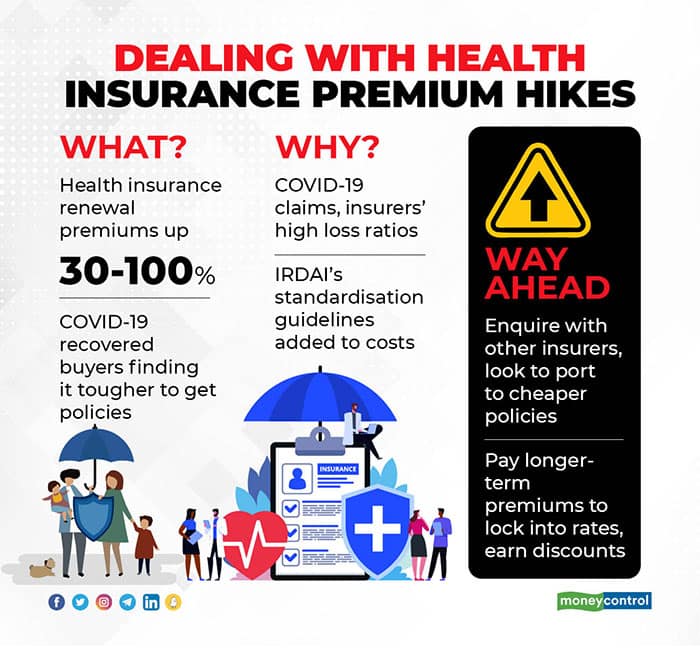

Several policyholders have seen their premiums at renewal shoot up 30-100 percent in some cases over the last few months. With the second wave of the deadly pandemic likely to push up claims further, insurers’ loss ratios are bound to come under pressure. “Compared to the first wave’s peak, the claim volume has increased 20-50 percent, depending on the region. It is a little early to predict the extent of premium hikes, if any, as we don’t know when the peak will come – a steady state has not yet been achieved. Insurers are in the wait-and-watch mode,” says Bhabatosh Mishra, Director of Underwriting, Products and Claims, Max Bupa.

The average claim size for the company has gone up from Rs 1.2-1.3 lakh in the first wave to Rs 1.4 lakh in the second wave. Mishra feels that the impact on premiums will be known after 2-3 months after insurers gather data to analyse claims. However, the insurance regulator has abolished claim-based loading – so, your premiums will not go up just because you made a claim. “Any increase will come into effect across the board, for geographies, age-groups and other segments," says Mishra. That is, depending on claims received, the insurer could raise premiums for an entire age-band or region, for instance.

Reasons for premium hikesBesides the new norms and COVID-fuelled high claim ratios, regular medical inflation and age-linked rate increases can also push up renewal premiums. Additionally, several insurance companies have, for long, adopted the practice of withdrawing existing products and replacing them with new ones with additional features, but also higher premiums. In these cases, policyholders are simply not given the option of continuing with the existing policy, an issue that Moneycontrol had highlighted earlier.

However, in March, the regulator (IRDAI) instructed insurers not to modify or add new benefits to existing products that resulted in premium hikes. Instead, it asked insurers to offer new benefits as add-ons or optional riders, with premiums transparently disclosed. In future, this could bring down complaints of customers having to pay more for features they never asked for.

Keeping premiums in checkIf your insurer sends a renewal notice quoting exorbitant premiums, your options are limited. Yet, there are certain steps that you can take to bring down your premium burden.

For one, you can look at switching or porting to another insurer while retaining the waiting period credit for pre-existing diseases. That is, these diseases will be covered from day one, if you held the policy for at least four years. This is because most policies come with a waiting periods of one to four years for pre-existing diseases. “Before accepting the renewal premium, you can enquire with other insurers and ascertain their premium rates. You might be able to get a better deal,” says Abhishek Bondia, Co-founder, Securenow.in.

If you are a senior citizen, this task will be tougher, as other insurers, too, will be reluctant to take you on board, given your age and pre-existing illnesses. In such cases, you can consider buying senior citizen health plans, which are cheaper, though they come with several restrictions.

The other option is to pay two or three-year premiums upfront, which will not only earn you a discount, but also lock in the premium rate for the next two years. For example, if you were to buy Care Health Insurance’s Rs 10-lakh cover, your annual premium works out to Rs 9,031. Over three years, you would have to shell out Rs 27,093. However, if you choose to pay a lump-sum instead, you will get a discount of 10 percent. Your premium over three years will work out to Rs 24,382. Moreover, it is likely that you will save more than 10 percent – premiums can increase every year and see a sharp spike when you move from one age-bracket to another. Paying premiums upfront will help you lock into the rate for three years.

Finally, senior citizens in particular need to build a healthcare kitty too. Since senior citizen policies come with restrictions that will reduce the amount of claim paid, it makes sense to have a back-up fund to take care of such expenses.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.