Chennai-based FundsIndia.com (Wealth India Financial Services), one of India’s earliest online mutual fund (MF) investment platforms, changed hands once again, when private equity (PE) firm, WestBridge Capital bought it over from the existing PE investors, Inventus Capital, Foundation Capital and Faering Capital, recently.

WestBridge Capital’s acquisition and its intent to scale the platform’s business-to-business (B2B) channel perhaps points to backing off on robo advisors; a trend many experts thought the Rs 40 trillion Indian MF industry was moving towards. Robo advisors provide financial planning and investment services through automated algorithms and software to build and manage one’s investment portfolio, and can include automatic rebalancing, tax optimisation, and more.

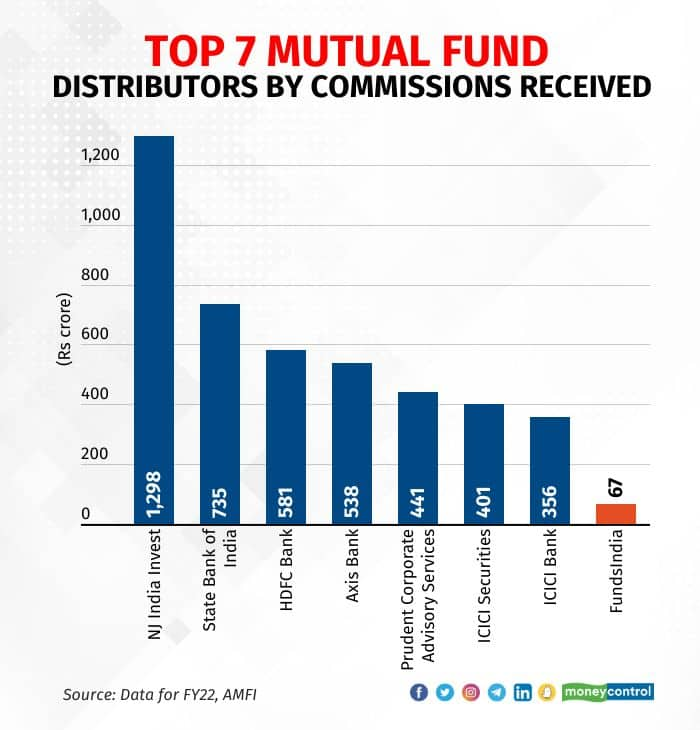

The firm has also hired Manish Gadhvi, who was earlier a senior official at NJ India Invest, India’s largest MF distribution firms by commissions received. As CEO of the B2B business, Gadhvi is now tasked with growing the distributor-led channel at FundsIndia.

A few years ago, the advent of online MF platforms that enabled easy investment in direct (no commission) MF plans, or those not sold through a distributor, had raised questions about the future of distributors. If you can buy a MF with the click of a button, from the comfort of your home or office, who needs a distributor, right?

But for many, investing is not just about the ease of transacting. What many investors also want is personalised advice from someone they know and can trust. That’s where MF distributors (individuals) come in. They accounted for 28 percent of the MF industry’s assets in 2022-23 going by Bandhan Mutual Fund’s MF Trend FY 2023 Report.

And this perhaps is what underpins the shift in strategy at FundsIndia.

Also read: Confused about which mutual funds to invest in? Check out MC30

Going physical

Fundsindia.com sells regular MF plans (those that charge a commission) both online (B2C), and also through its army of distributors (B2B), who then connect with their respective clients.

To scale up their existing B2B model, FundsIndia will rely on a network of on-ground distributors to sell MFs to customers. Even today, the platform has 800 MFDs empanelled with it. The way forward is to deepen and expand that partnership.

At present, the B2B model accounts for just over a third of FundsIndia’s assets under management (AUM) of around Rs 11,000 crore. The business-to-consumer (B2C) AUM comprises the remaining two-thirds.

WestBridge Capital now wants to develop both channels.

“There are customers who prefer to invest on their own. But there are many who want someone known to guide them. Therefore, we think both channels make sense. They are like the right and left hand,” says Sandeep Singhal, co-founder and Managing Partner, WestBridge Capital.

Commenting on FundsIndia’s proposed plans, Vijay Kuppa, CEO, InCred Money, draws parallels between the direction in which FundsIndia is leaning and the business model that NJ India, the country’s largest MF distributor, follows. “InCred Money itself is planning to pursue this model. NJ India follows a sub-broking model where they partner with individual MF distributors (MFDs) who have the last-mile connect with investors, to distribute their financial products,” says Kuppa.

Relying on distributors

So, why the need to revisit the distributor model? The aim is to tap into the personal connect that MFDs have with their clients to garner more investor money. FundsIndia already has a connect with customers — its team of relationship managers keep in touch with clients — but the MF platform lacks a physical presence.

“People tend to trust individual distributors more than corporate employees who come and go,” says Gadhvi, and adds: “There are just 70,000 individual ARN holders (application reference number, which is assigned to an MFD), versus four million insurance agents. We need more MFDs.”

Kuppa makes a similar point. “In India, the largest distributors of financial products, such as LIC and the banks, typically push products by going beyond the digital-only route. If you want to grow the business fast, you have to collaborate with those on the ground, someone the investor knows and trusts,” says Kuppa.

In turn, the on-ground person gets the tech and operational support that the big player can provide.

Speaking of their strategy for FundsIndia, Singhal says, “The core strength of distributors is their relationship with clients, not research, and that is where Fundsindia comes in.”

Also read: Sweet medicine: Small-cap pharma and healthcare stocks that MF intake

A better catch?

But FundsIndia is not the first online-only player to go down the physical route.

Scripbox, a Bengaluru-based digital wealth management platform, has followed a similar approach but executed it very differently. Scripbox has grown its AUM and expanded its customer base across cities by acquiring (and not simply partnering) with MFDs over the past few years. At the same time, clients of these MFDs have likely benefited from Scripbox’s digital and research capabilities.

But has the shift from online-only to collaborating with MFDs been driven mainly by the need for a larger client base? Or has it also been about targeting a different kind of customer — one with deeper pockets, though less tech savvy in comparison with the small-ticket-size millennial investor?

According to Kuppa, the key reasons for going down the physical route are easy scalability and lower upfront costs. In this model, you don’t incur costs on customer acquisition, but you share margins with the partner distributors. He adds, “Yes, it can help you get a higher value customer. This has more to do with what the customer is comfortable with. Someone older with more money may have been investing through MFDs for 15-20 years. Digital is a more recent phenomenon.”

Also read: We want to ensure there is performance in every scheme going forward: LIC MF CEO

The way forward

Talking about the future of the wealth sector, one industry hand who did not wish to be named said, “Those who service high-end clients provide personalised service. They will anyways make money. The challenge lies in catering to middle-level customers. Here, some kind of aggregation or consolidation is likely to happen, not necessarily by buying out companies, but by collaborating with MFDs to leverage their relationship with the customer.’’

According to Singhal, when it is about taking a loan, people don’t care who is giving it to them as long as it’s the cheapest. “But when it comes to investing money, then they need someone to guide them. Here, many people are not comfortable investing at the click of a button,” he adds.

Also, it’s not just about picking the best investments but also about remaining invested. Morningstar India’s Mind the Gap Report (data as of June 30, 2022), which highlights the gap between investor and fund returns, illustrates this point. For example, the report shows that an investor’s 3-year return was lower than the fund's by 3.20 percentage points — a result of churn instead of buy-and-hold by investors. Likewise, the 10-year equity return fell short of the fund return by 7.34 percentage points.

Chennai-based MF distributor D Muthukrishnan, who Moneycontrol spoke with recently, said the biggest mistake people make is that they don’t stay invested. He mentioned that a few years ago, Prashant Jain (former chief investment officer of HDFC Mutual Fund) had said that only 2 percent of the mutual fund’s AUM stays invested beyond 10 years. “Where I have succeeded as a distributor is that I have changed my clients’ behaviour to a larger extent,” said Muthukrishnan.

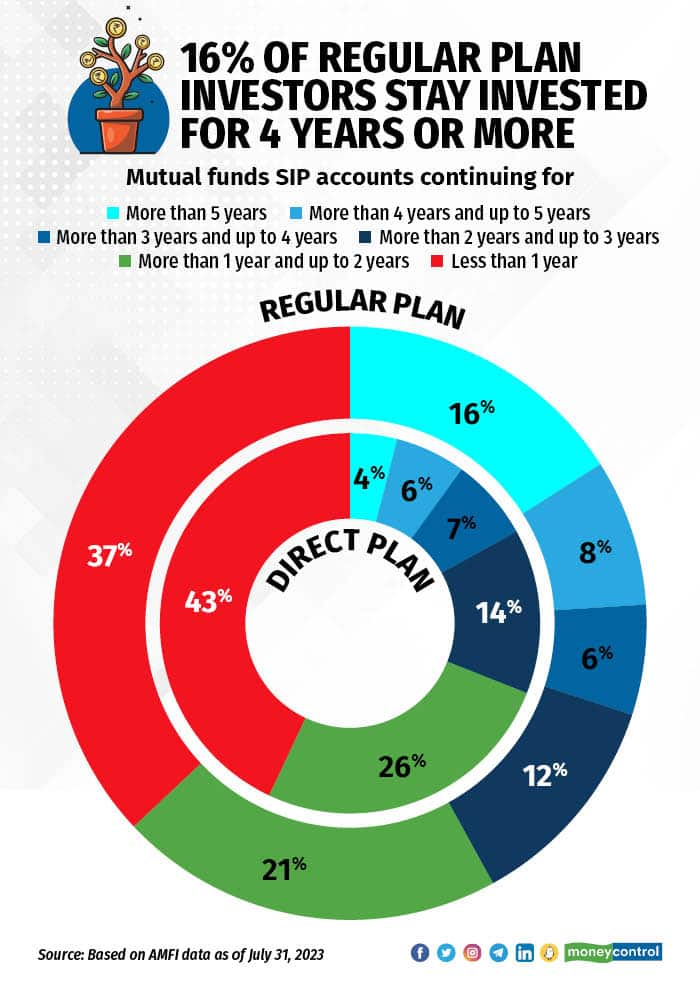

Data from MF industry body AMFI also seems to suggest something similar. As of July-end, 2023, systematic investment plan (SIP) numbers show that those who invested in regular plans (via distributors) have remained invested longer than those who invested in direct plans (without distributors). (see table for more details).

An industry source who did not wish to be quoted, summed it up thus: “You need someone to advise you on spending less and saving more for your goals. The focus must be on getting an inflation-plus return. Investment management is a behavioural science, and you need a human being (supported by technology) to manage a client’s behavior. Robo advisors alone don’t cut it.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!