Usually, the savings bank account requires you to maintain a certain balance. If your balance falls below this limit, your bank charges you. It could either be monthly or quarterly minimum balance you need to maintain. The charges could be a fixed amount, a percentage of the shortfall, or both, depending on the bank’s norms.

If you hold a savings account in one of the top private sector banks, the minimum balance is Rs 5,000 to Rs 10,000. In this pandemic, it becomes a challenge to maintain a minimum balance in savings accounts for customers who face cuts in salary or job losses.

In such a situation, having a zero balance savings account is the ideal option as there is no stipulated minimum balance requirement. You have the right to withdraw the entire funds any time and can maintain zero balance in this basic savings account. The bank won’t charge you for maintaining zero balance in the account. ICICI Bank, HDFC Bank, the State Bank of India (SBI), Bandhan Bank, Federal Bank, Kotak Mahindra Bank, IDFC First Bank are some firms offering such an account.

Here are the details of opening a zero-balance savings bank account.

How to open a basic savings account with zero minimum balance?To open a basic savings account, you should be Indian resident above the age of 18. Importantly, you shouldn’t be holding any other savings account with the same bank. For instance, if you are holding a regular savings bank account with SBI, then it should be closed within 30 days of opening a basic savings bank deposit account. Some banks may even insist you to close the regular savings bank account and only then apply for this basic savings account with zero minimum balance benefit.

ICICI Bank and Kotak Mahindra Bank, among others, allow you to open the basic savings account with zero minimum balance from their websites and mobile applications. You need to fill in the requisite details in the online application form and submit PAN details, Aadhaar or driving license number to complete the know your customer (KYC) process while opening the account.

Alternatively, you may visit the nearest bank branch with the requisite documents to open the account.

Yes, you can open the basic savings account jointly and appoint one nominee for your account.

What are the transactional limits in a basic savings account?Some of the key transaction limits of various banks are as follows. First, the aggregate of all credit in a financial year should not exceed Rs 1 lakh. If transactions exceed the limit, no further credit transactions will be permitted in your account till the end of that financial year. Second, the balance at any point of time should not exceed Rs 50,000, no further credit transactions will be permitted until the balance goes below Rs 50,000. Third, the total withdrawals and transfers in your account should not exceed Rs 10,000 in a month.

What does the joining kit contain?While opening a basic savings account, banks issue a basic RuPay ATM-cum-debit card. There is no annual maintenance charge for this card. Besides this, you get access to net banking and mobile banking facilities that allow you to check your account balance and pay utility bills. A pass book is issued by some of the banks.

The cheque book is not issued with this account. Withdrawal is allowed only using the form at bank branches or through ATMs.

Are there charges and limits to the frequency of withdrawals?Yes, this account comes with a limitation on withdrawals. Banks allow a maximum four cash withdrawals free of cost in a month, including ATM withdrawals at own, other bank's ATMs, over the counter from bank branch, or Aadhaar Enabled Payment System (AEPS), etc. From the fifth withdrawal onwards, charges are applicable. For instance, SBI charges Rs 15 plus GST for every additional cash transaction and HDFC Bank charges Rs 150 plus GST per cash withdrawal transaction.

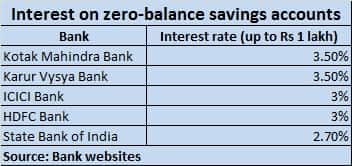

Moneycontrol’s TakeThere are several parameters that you need to consider while opening a zero balance savings account, which include interest rates, transaction charges, cash withdrawal and deposit limits.

The features and charges vary from bank to bank. It’s important that you assess your monthly cash inflow and outflow for the last three to six months; if they are within the prescribed limit set by banks, then having zero-balance basic savings account is beneficial. However, this account has limitations to deposits and withdrawal which you need to understand before opening an account; otherwise, you will end up paying additional charges.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.