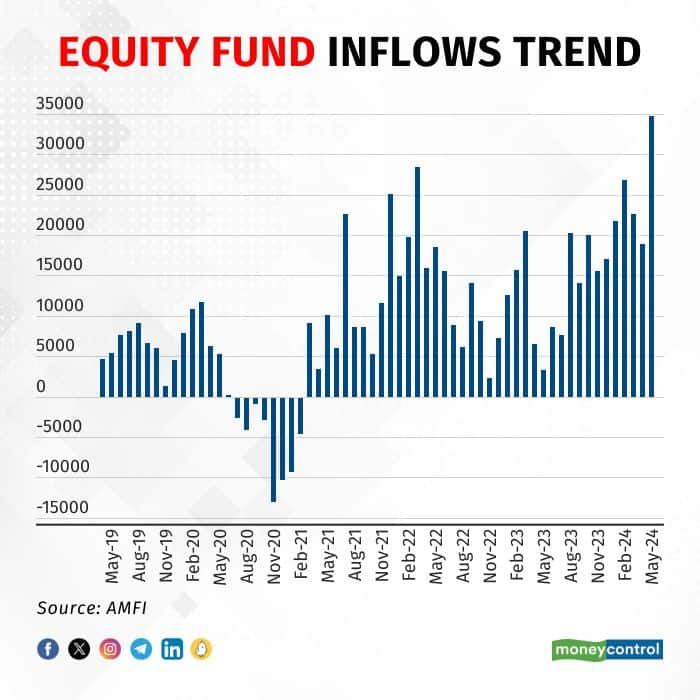

Equity mutual fund inflows surged 83.42 percent to a record high of Rs 34,697 crore in May, according to the data released by the Association of Mutual Funds of India (AMFI), the industry trade body for mutual funds, on June 10.

Inflows into open-ended equity funds remained in the positive zone for the 39th month in a row in May.

Net inflows into equity mutual funds zoomed past the Rs 30,000 crore level for the first in May 2024, as the previous record for net inflows was Rs 28,463 crore, which was hit in March 2022.

The surge in net investments into open-ended equity funds was fuelled by sectoral and thematic funds, which saw net buying of Rs 19,213.43 crore during May. Notably, HDFC Manufacturing Fund, which was launched during the month, garnered Rs 9,563 crore from investors during its new fund offer (NFO) period.

"Political stability creates an environment conducive to sustainable economic growth, attracting investments and fostering long-term investments. Global growth is sustaining its momentum in 2024 and is likely to remain resilient, supported by rebound in global trade. The overall outlook for Indian capital markets remains positive, supported by strong fundamentals, and favourable demographics," said Venkat Chalasani, Chief Executive, AMFI.

Also read | Why you should keep an eye on liquidity, price deviation and tracking error while investing in ETFs?

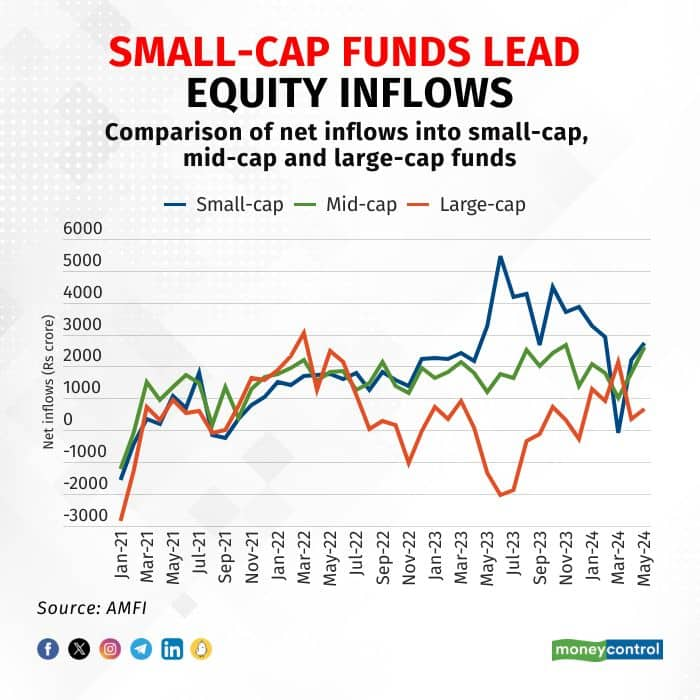

Further, inflows remained strong in smaller-caps as small-cap and mid-cap funds saw net inflows of Rs 2,724.67 crore and Rs 2,605.70 crore, respectively. Investor interest remained largely lukewarm in large-cap funds as the category saw net investments of Rs 663.09 crore during the month.

The investment via systematic investment plans (SIPs) rose to Rs 20,904 crore in May against Rs 20,371 crore in April. Monthly investments via SIPs had topped the Rs 20,000-crore landmark for the first time ever in April 2024.

The number of new SIPs registered in May stood at 49,74,400, while the SIP AUM was highest ever at Rs 11.53 lakh crore for May compared with Rs 11.26 lakh crore for April 2024.

“Record inflows were aided by NFO listings and investors taking advantage of volatility to add equity schemes to their investments through SIPs as well as lumpsum,” said Manish Mehta, National Head - Sales, Marketing & Digital Business, Kotak Mahindra Mutual fund.

Equity mutual fund inflows had slumped 16.42 percent to Rs 18,917.08 crore in April 2024.

Also read | Should you invest in the National Pension System?The surge in inflows happened even as Indian equity benchmarks traded largely flat in May as the BSE Sensex and the NSE Nifty inched lower by around 1 percent.

In the fixed-income category, net inflows slumped 77.73 percent during the month to Rs 42,294.99 crore.

Strong inflows were seen in Liquid Fund category at Rs 25,873.38 crore, followed by Rs 8,271.75 crore in the Money Market Fund. However, small net outflows happened in Floater Fund, Credit Risk Fund, Medium Duration Fund categories.

In the hybrid fund category, which invests in more than one asset class such as equity, debt and commodities, saw net inflows to the tune of Rs 17,990.67 crore. Most of the buying happened in the Arbitrage Fund category, which saw net inflows of Rs 12,758.12 crore in May.

Also read | How should debt fund investors invest post the RBI policy?Among other schemes, index funds saw net inflows of Rs 4,490.35 crore, while gold exchange-traded funds (ETFs) saw net buying of Rs 827.43 crore.

Thanks to the fresh flows into equity and debt funds, overall open-ended mutual funds saw net inflows of Rs 1.11 lakh crore during May.

The overall assets under management of the mutual fund industry, including open-ended and closed-end funds, stood at Rs 58.91 lakh crore as of May end. The AUM for the month of April was Rs 57.26 lakh crore.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.