Arbitrage funds have seen a lot of inflows lately, primarily because of the removal of adverse tax changes to debt funds in 2023.

Arbitrage funds behave as debt funds (have a similar return profile), and are interestingly taxed as equity funds, which is lower compared to debt funds.

The big question is: Should you switch from debt funds to arbitrage funds?

What are arbitrage funds?Arbitrage funds need to invest a minimum of 65 percent of their corpus in equity-related instruments to qualify for equity taxation. However, since these funds work on the arbitrage principle, they buy stocks in the cash market and simultaneously sell in the futures market at a different price, thereby offsetting the entire net equity position. They also hold about 35 percent in debt instruments. This structure makes arbitrage funds a comparatively low-risk option.

Returns and volatilityArbitrage funds use low-risk strategies to exploit price inefficiencies between different markets to generate returns.

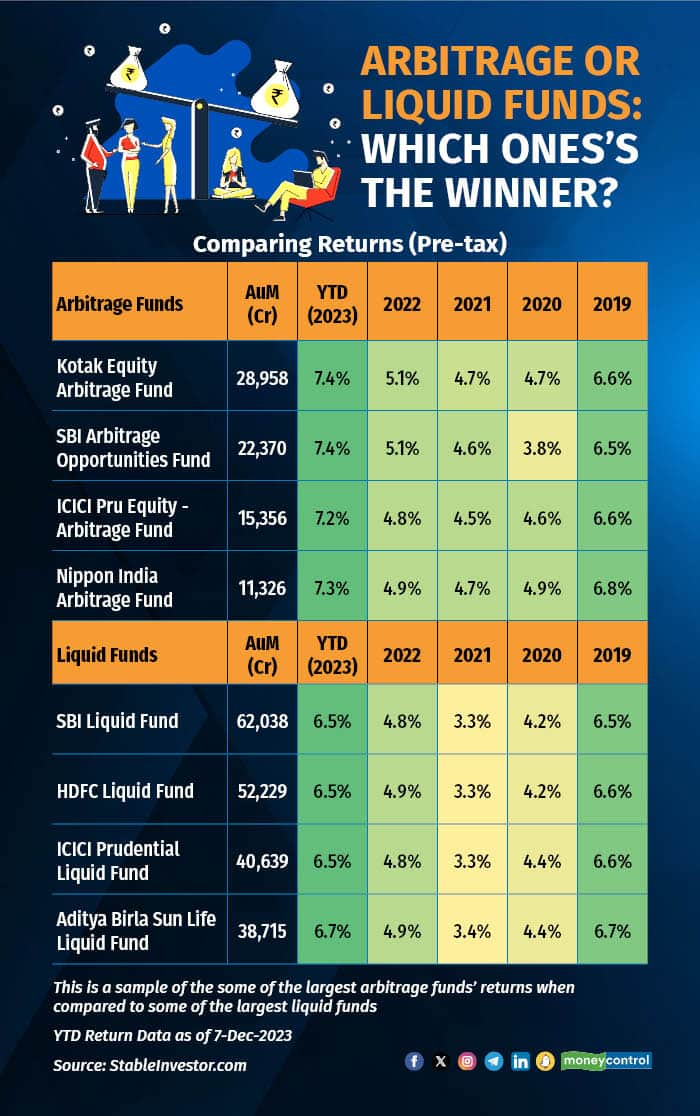

These have often been compared with liquid funds, given the similar return profile, as can be seen below in comparison of the four largest schemes (by AUM) in both categories:

But after the recent debt fund taxation changes, there is no doubt that given the same return buckets, the arbitrage funds can be more tax-efficient compared to liquid funds if you belong to the higher 20-30 percent tax slab and are looking to hold for more than a year (to qualify for 10 percent LTCG taxation for arbitrage funds).

But before giving the trophy to arbitrage funds, we need to get a bit more into the details.

Also read: Confused about which mutual funds to invest in? Check out MC30Given the potential of arbitrage opportunities in the equity markets, at times arbitrage funds can deliver much higher returns than liquid funds. But arbitrage funds can also fluctuate a lot on a daily basis and have poor runs in a short-term (weekly or monthly) basis if the market environment is such.

Also, while arbitrage funds are low-risk investments, their returns can vary depending on market conditions, interest rate scenarios and the available spot-future arbitrage opportunities. A volatile market offers more opportunities to arbitrage funds in general.

Not only that, given the structural nature of arbitrage opportunities, if more players enter the space and come after the opportunity, then the extent of arbitrage (or the opportunity itself) will reduce or cease to exist. So, the size of the opportunities available and the fund size have an impact on how best arbitrage fund managers can generate returns.

Also read: Where to invest Rs 10 lakh today, after Sensex crossed 70,000-mark?Expense ratio spannerIn recent times, the capital market regulator, the Securities and Exchange Board of India (SEBI) has been deliberating about having the brokerage, Securities Transaction Tax (STT), etc. included in the expense ratio of the scheme. If this proposal comes into force, then given the nature of arbitrage funds (which need to trade a lot and have high turnover), this will further negatively impact their returns.

Can you use Arbitrage funds instead of Debt funds?First things first, arbitrage funds do have an upper hand when it comes to taxation structure. More so, if you as an investor belong to higher tax brackets.

Now comes the key question we started with. The debt fund taxation is no longer attractive. So, does it mean that you can replace all categories of debt funds with arbitrage funds instead?

The answer is no. Let’s see why:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.