Most often when you think of financial goals like buying a house or buying a car, you think of three important questions: Which dream house or car you want to buy? What will be the cost of buying that things to make your dream a reality? Will you be able to buy that house/car you desired or you just need to lower down your expectations as per your budget.

These questions need to be answered honestly to yourself once you are heading towards achieving your financial goal. Also, if you plan wisely towards your long-term financial goals, your dream can come true.

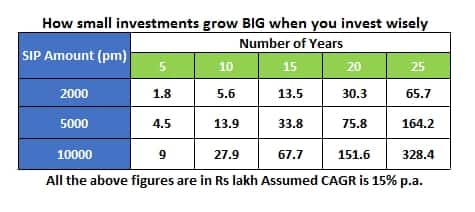

If you invest regularly, even a small amount on a monthly basis, the amount you invest grows bigger and bigger as per the time horizon. Here is an example of how your money would grow in a systematic investment plan of a mutual fund at an assumed annual growth rate of 15 per cent:

To achieve that much of wealth, you need to start planning for your financial goals from today. However, before doing so, you need to know other factors too which help you achieve your goal as per your need and want.

Harsh Gahlaut, CEO of FinEdge said that before planning one’s financial goal, you need to keep a check on the following five factors:

=> Is it specific and time-bound? Ideally, financial goals should be defined as clearly as possible, in terms of the precise target amount, the goal date, and the monthly saving that you can channelize towards it. Loosely defined, wishy-washy goals are the first to fall by the wayside when the going gets tough. Specific and time-bound goals tend to instil higher commitment and savings discipline from investors.

=> Is it realistic? It’s wonderful to dream big, but financial goals need to be practicable and seem ‘within reach’ in order to be truly effectual. Choose a financial goal that demands savings discipline and commitment, but not a so-called ‘black swan event’ for it to materialise!

=> Has it been adjusted for inflation? What costs Rs 100 today will cost much more than Rs 100 a decade later! Education costs are inflating at 9-10% per annum, and medical expenses at 11% per annum. Even household expenditures inflate at 5-6% per annum over the long term. When planning for your future goals, make sure you’re not doing so keeping the present cost of achieving your goal in mind.

=> Where does it figure on your priority list? Successful Financial Planning is all about prioritising your goals effectively. Segregate your ‘needs’ and ‘wants’ and accord a higher priority to your needs. For instance, an aspirational goal such as buying a holiday home in Shimla must take a backseat to accumulating a corpus that’s large enough to fund a lengthy retirement.

=> What is the best asset class to save into for this goal? Many people put all the pieces together nicely, only to falter at the last step. Channelizing long-term savings into low-risk/ low-return asset classes such as recurring deposits is as cardinal a mistake as saving for a one-year goal into equity oriented mutual funds. Your choice of savings instrument must be neatly aligned with your time horizon, which should supersede your risk tolerance when it comes to goal-based savings. For your long-term goal based savings, it’s always best to choose low-cost investments that enforce savings discipline and provide relatively steady & tax-efficient long-term returns (such as Mutual Fund SIP’s). Stay away from life insurance policies that masquerade as savings tools.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.