In the investment tightrope-walk between safety and returns, balanced advantage funds (BAFs) may provide the edge.

Over the last year, BAFs gave an average return of 4 percent. Large-cap funds, in comparison, gave a return of just 1.9 percent on average. At least six new BAFs have been launched in the last 12 months, and the largest of those collected close to Rs 14,500 crore in its new fund offering a year ago.

Not surprisingly, the Balanced Advantage Funds (BAF) category has become one of the mutual fund industry’s most popular categories of schemes.

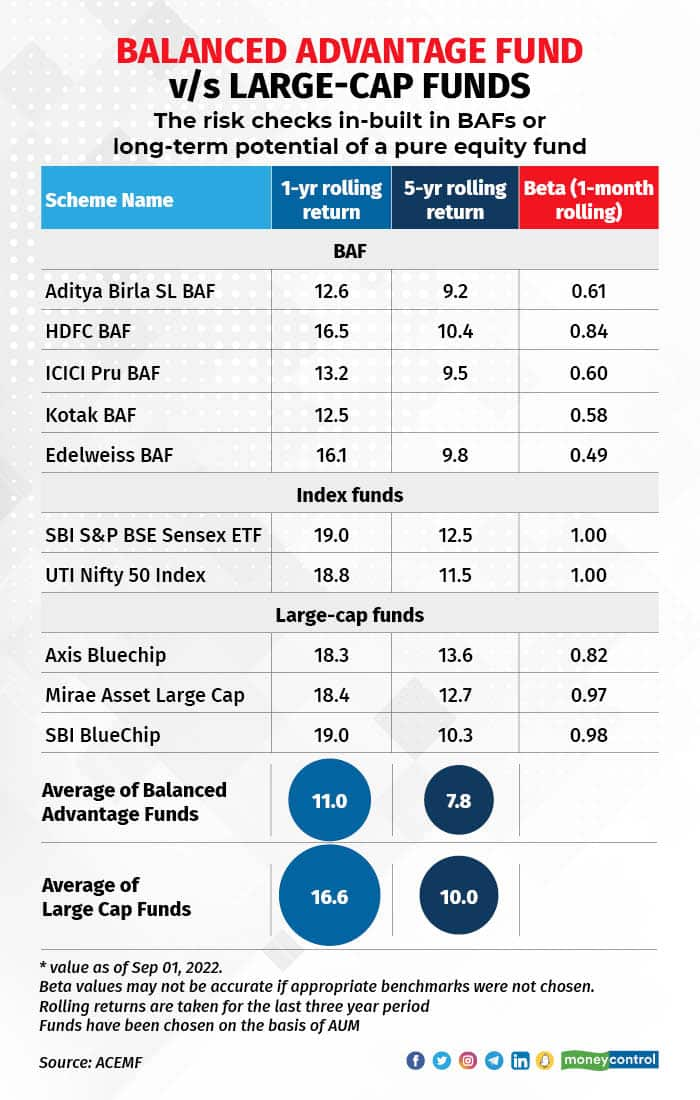

And given the current market volatility, BAFs are fast becoming the safer bet as they are far better at containing risk levels than traditional equity funds than the relatively lower-risk large-cap equity funds (see the scheme beta levels in table).

Also read | Franklin Templeton collects nearly Rs 800 crore for its balanced advantage fundA Moneycontrol analysis of BAF and large-cap equity fund returns show that there is very little to differentiate between the two categories over a 10-year time period (rolling returns).

Does that mean you should simply dump your large-cap equity funds and just stick to BAFs?

Market cycles have a sayThe current market cycle has been markedly unpredictable, with a sharp crash and then a spike in equity markets in March 2020. What seemed like a smooth uptrend, however, has proved to be a rollercoaster ride since the end of 2021.

But volatility is BAF’s friend. Asset allocation strategies in such funds tend to limit the fall in net asset values (NAV) in a wildly fluctuating market compared to pure equity strategies. But the belief was that this will also limit the upside (in NAV) in case of long-term returns, especially since in the long run volatility in equity prices evens out. Nevertheless, the past one-year returns seem to suggest otherwise.

The starting point of a data set is very important, says Chintan Haria, head, product development and strategy, ICICI Prudential Asset Management Co Ltd. Haria says that the time period of return also matters. “The statistical base impacts the outcome we see and that may be why BAFs and large-cap equity funds look similar (at times). The performance trajectory for both types of schemes is otherwise very different and so is the solution provided by these products,” says Haria.

A look at the long-term rolling returns, going back three years, for the largest BAF strategies shows that returns are competitive, but plain-vanilla large-cap funds are able to deliver a premium of at least 2-3 percentage points over BAF performance. The story is similar for periods of five to ten years as well (see table for more details)

While BAFs are better equipped for volatility in the interim, a pure equity fund can outperform in the long run.

While BAFs are better equipped for volatility in the interim, a pure equity fund can outperform in the long run.This is the key to comparing both category returns correctly. In the short run, market movements dictate how a BAF behaves and is able to differentiate from a large-cap equity fund. But if you stay invested for the longer term, a pure equity fund is more rewarding than, say, a hybrid fund.

Moreover, all BAFs are not the same.

According to Rushabh Desai, founder, Rupee with Rushabh Investment Services, says, “It’s not accurate to compare pure equity to BAF, because BAF has a different strategy altogether. It is a hybrid/dynamic-based strategy and individual scheme strategies are not standardised; some are pro-cyclical, some are countercyclical and some can be static asset allocation strategies too.”

Still, why does a BAF work?What BAFs do well is to reduce portfolio risk when the market gets overheated and increase the risk conveniently when there is opportunity in the market. All thanks to their inherent nature, the way these funds are structured to benefit from equity and debt markets and seamlessly moving between them.

Based on their parameters and triggers, some BAF portfolios had reduced allocation to equity reasonably before the sharp correction seen in March 2020. This did not happen due to any foresight or prior knowledge of the crash, rather it was a result of valuations and the signal to sell high. Once the crash happened and valuations became attractive again, the buy equity signal was triggered.

That is something not many individual investors do, if left on their own, with their direct stock and bond portfolios. “For a large section of investors who worry about the volatility in equity investing and are unable to rein in behavioural bias during volatile periods, BAF is an apt solution. The automatic balancing of asset classes cuts through the lines of an individual investor’s greed and fear to maintain an efficient allocation despite the external noise,” says Haria.

This then helps preserve capital to an extent during market corrections, while at the same time ensuring participation to a large extent in returns during a market rally.

What should you do?No market-linked strategy is perfect. While BAF has the advantage of preserving value in a downside, one cannot vouch for outperformance in a prolonged bull market.

Moreover, it’s a category where individual schemes, despite being in one category, have varied portfolio construction guidelines. As a result, some BAF strategies inherently have higher equity risk than others and the individual scheme performance trend can vary widely depending on the market conditions.

It's wiser then, to choose a BAF only after understanding its underlying strategy and the basis of its dynamic asset allocation. At the same time, know that an asset allocator fund in the very long run of 10-20 years is going to fall short of a pure equity fund in terms of performance.

“For new investors who do not understand markets and want to get an experience in equities, BAF offers a relatively lower risk and lower volatility strategy to begin their investing journey. It is also good for senior citizens who would like to balance out the risk of pure equity investments as it can contain the downside,” says Desai.

This means it is also very important for you to know the goal behind your investment. BAF and pure equity large-cap funds both have distinct places in an individual investor’s portfolio—the former acts as the balance while the latter can take the lead in driving long-term wealth creation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.