The price of Bitcoin was just above $86,786 on November 24, as of 7:00 am. That’s up 0.78% in the last 24 hours.

The price of the largest cryptocurrency is prancing with higher highs and higher lows this month, and dipped as low as $80,760.66 and as high as 111,700 levels. The fluctuation in bitcoin’s price is just another example of the volatile nature of cryptocurrency. Bitcoin hit the lowest in April 2025, when its price hovered around $75,000 level.

"Bitcoin is attempting to break the resistance at $88,000 as market sentiment points towards recovery. Derivatives data indicate that top traders are gradually increasing their long exposure. Futures funding rates have risen from four percent to six percent, indicating early signs of stabilization. Additionally, Bitcoin spot ETFs recording positive net inflows of over $238 million have also contributed to the momentum. If these trends hold, Bitcoin could make a move toward $96,000, with $80,000 continuing to serve as a strong support zone," said Edul Patel, CEO of Mudrex.

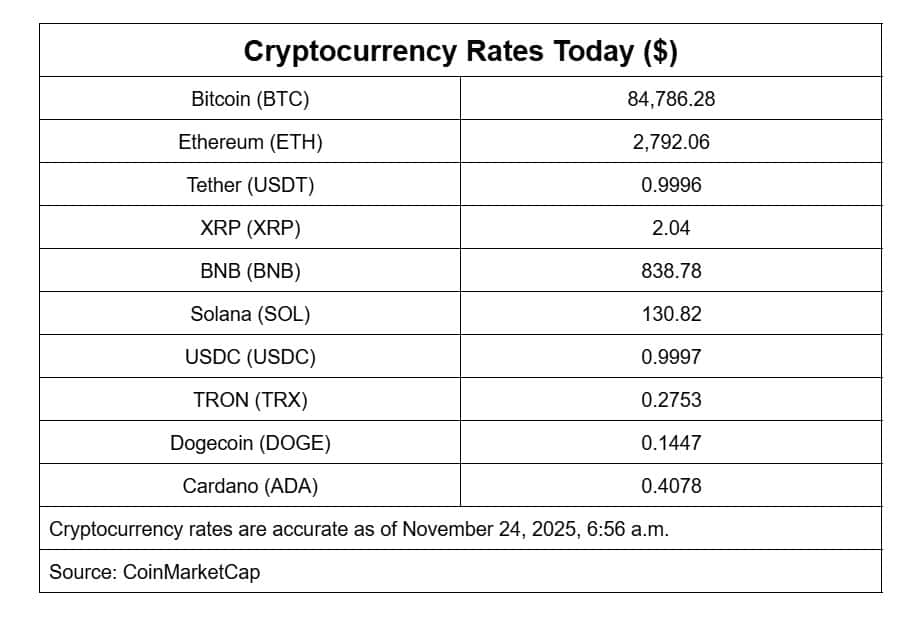

Meanwhile, prices of other tokens have recovered, with Ethereum up 0.70 percent, XRP 0.40 percent, USDC at 0.03 percent, and Solana is up 0.80 percent in the last 24 hours.

According to CoinSwitch markets desk daily commentary, Bitcoin tested $82,000 on Friday after nearly $2 billion in long positions were liquidated. The catalyst behind this was mainly mixed US jobs report, looming macro uncertainty around a potential December rate cut and an intraday reversal in U.S. equities. After the flush-out, BTC rebounded to $85K as buyers stepped in, later stabilizing within the $85,000–$87,000 range and briefly approaching $88K.

"Institutional activity improved, with BTC ETFs seeing $238 million in inflows and ETH ETFs ending an eight-day outflow streak. For now, BTC is likely to remain range-bound until a macro or Fed catalyst shifts sentiment. BTC holds support near $86,000 and faces resistance around $88,000, with upside toward $88,500–$89,000 if momentum strengthens," it added.

Check out below to see prices of top 10 cryptocurrencies.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.