Markets have fallen a lot more than what is within the comfort levels of most people. It has most investors unawares. But that’s the market for you. This time, the trigger was COVID-19. Such events are bound to occur periodically over the years.

But I wanted to touch upon an interesting idea to show how things can be for retirees. There is a world of difference between retiring at the peak of a bull market and doing so during a bear-market bottom.

We will use some basic arithmetic to show you this difference.

Planning earlySuppose, as a 50-year-old, you plan to retire in five years’ time; with due financial planning done years back, you already know that you would need Rs 3 crore for retirement at the age of 55. The number is not small, but you managed to save sufficiently till now and have (by the current age of 50) accumulated Rs 2.5 crore.

So how does that place you on the road to the Rs 3 crore target by the age 55?

You have Rs 2.5 crore now. Mathematically, you only need to generate 3.7 per cent annually for the next 5 years for Rs 2.5 crore to become Rs 3 crore. And getting 3.7 per cent every year isn’t too challenging.

But as is the case with many of us, you don’t just want to earn 3.7 per cent. You want to have ‘more’.

So you decide to keep a major part of the corpus in equity for the next 5 years as well. Remember, the proper advice for people nearing retirement is to reduce their equity allocation. But still, you belong to the ‘what-can-go-wrong’ and ‘five-years-is-a-long-time’ school of thought.

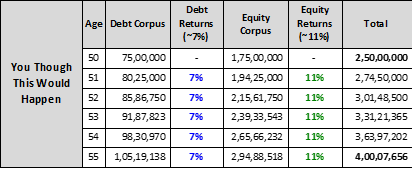

And so, you decide to have 70 per cent in equity and 30 per cent in debt. That is, you split the existing corpus of Rs 2.5 crore into two parts: i) Rs 75 lakh in EPF + debt funds and ii) Rs 1.75 crore in equity funds.

As per your assumption, you could generate about 7 per cent from debt and about 11 per cent from equity every year for the next five years. So, your ideal scenario would be:

So, if everything works out as you think, you will have Rs 4 crore just before retirement (at 55)!

But here is the problem. Returns from Equity aren’t available on demand.

You don’t know if the next five years (from age 50 to 55) will witness a bull or a bear market. What would happen if this were the beginning of a three-year-long bear market before recovering in the subsequent two years?

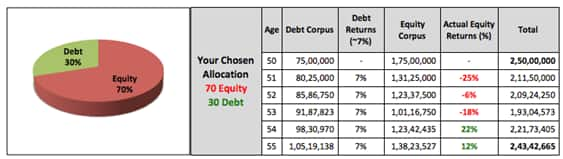

With a few assumptions, let’s see how your chosen portfolio allocation of 70:30 Equity:Debt would have done in these five years.

Instead of having a retirement corpus of Rs 4 crore, you will end up with just Rs 2.43 crore. So, your greed leaves you with an insufficient retirement corpus. You can still work for a few more years, but the damage has been done due to riskier portfolio allocation.

And you really cannot blame just the poor equity returns in the last five years. It’s rather your fault that you took unnecessary risks with higher equity allocation when even a low-risk debt portfolio would have been sufficient.

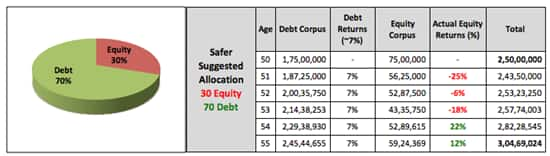

I am sure you are curious about how a different portfolio (with lesser equity, let’s say 30 per cent) would have done in the same markets?

Here’s your answer:

It’s nowhere near what your dream corpus of Rs 4 crore. But it still meets your basic requirements of Rs 3 crore.

We need to realize that bull or bear markets are not in our hands. But what we do with our portfolio is. And to manage the risks that your retirement savings face, it’s always better to be conservative in the years closer to your retirement.

You don’t want your retirement to be at the mercy of any animal (bull or bear), right?

(The writer is the founder of StableInvestor.com)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.