On September 15, the Union Cabinet announced a moratorium of four years for the payment of the Adjusted Gross Revenue (AGR) dues, providing a relief to the debt-strapped telcos - Vodafone Idea and Bharti Airtel. What will be the impact on banks having exposure to telecom companies particularly Vodafone Idea?

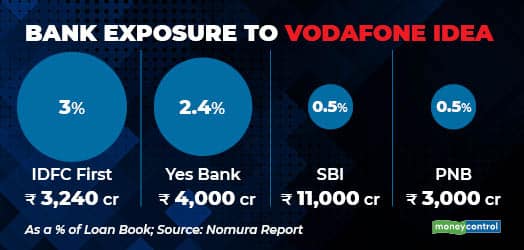

Just to get some perspective, following is the banking sector exposure to Vodafone Idea.

Vodafone Idea's gross debt, as on March 31, 2021, is estimated to be at least about Rs1.9 lakh crore. Eight top banks led by SBI have large exposure to the firm. In terms of percentage to book, IDFC First Bank, YES Bank and IndusInd Bank top the list. SBI has around Rs 11,000 crore exposure to Vodafone Idea which constitutes 0.5 per cent of its loan book whereas IDFC First has Rs 3,240 crore exposure which is around 3 per cent of the loan book.

Others include Yes Bank (Rs 4,000 crore or 2.4 percent of the book), PNB (Rs 3,000 crore or 0.5 percent of the loan book), Axis Bank (Rs 1,300 crore or 0.2 percent of the loan book), ICICI Bank (Rs 1,700 crore or 0.2 percent) and HDFC Bank (Rs 1,000 crore or 0.1 percent). The numbers are based on a Nomura report.

The moratorium on AGR dues would instantly avert a default risk for banks. This is good news. “payment moratorium will provide reasonable relief to ailing Vodafone. Company may look at options to resurrect, raise capital and avoid default atleast in the near-medium term,” said Anand Dama, analyst at Emkay Global.

But, that doesn’t mean all is good.

The telecom companies will still have to pay interest on the dues under moratorium at an interest rate per annum of MCLR+2 per cent to protect NPV (net present value) for the govt. Penal interest which was chargeable on monthly basis has been annualized.

Bank Exposure to Vodafone Idea (Graphic: Moneycontrol)

Bank Exposure to Vodafone Idea (Graphic: Moneycontrol)

“Our quick discussion with bankers suggest that though AGR dues may not come down based on preliminary assessment,” said Dama.

“Separately, calculation methodology (prospectively) of AGR will not include non-telecom revenues, while spectrum will be available for 30 years instead of 20 years with exit option after 10 years. Conversion of debt to equity will be looked at after four years with decision in the hands of the government, Dama said.

Yet, the government’s decision is expected to offer interim cash flow relief to the sector where two of the three largest private telcos are saddled with dues.

The Supreme Court had in October 2019 mandated that telecom operators pay Rs 1,19,292 crore to the Department of Telecommunications as AGR dues. Of this, Bharti Airtel’s dues are pegged at Rs 43,980 crore, while Vodafone Idea’s dues were Rs 58,254 crore.

A bigger relief is for smaller lenders with the cabinet decision. That’s because larger banks may not have to worry much because as a percentage of the book, exposure is not very high. Also, most banks had started providing for likely losses from Vi. Banks have been preparing for this for a while. But, that may not be the case with smaller lenders.

“It is certainly a good news for banks indirectly,” said Sidhharth Purohit of SMC Global Securities. “Still, one needs to wait for the details of what will be the burden on account of interest payment,” Dama said.

In a letter to Cabinet Secretary Rajiv Gauba on June 7, Kumar Mangalam Birla had sought clarity on AGR, adequate moratorium on spectrum dues and floor pricing, adding without immediate and active government support Vi’s operations would be at an "irretrievable point of collapse".

Birla said investors had also sought clarity on these issues. He said that, with a “sense of duty” towards 27 crore customers, the telecom giant was willing to hand over its stake to a public sector unit (PSU), a government entity or a domestic financial entity.

“These are bold and welcome moves by the Government recognizing the need of the hour,"said Vikrant Kumar, Partner, Saraf & Partners.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.