While higher interest rates were anticipated in FY19, non-banking financial companies (NBFCs) were caught completely off guard on the shrinking and in some cases complete withdrawal of liquidity triggered by defaults by group companies of Infrastructure Leasing & Financial Services (IL&FS).

The resulting impact on debt mutual funds' risk appetite has raised concerns about how NBFCs will meet their funding needs.

As recent as April, debt mutual funds (MFs) gorged on NBFC papers. Now, they seem to have limited appetite and can no longer digest issuances by NBFCs.

Such behaviour of MFs is akin to a flock of birds that takes comfort in each other’s company and flies away at the slightest sound of risk. Not only does it aggravate the liquidity situation, it also has the potential to become a systemic nightmare while allowing fund managers to get a peaceful sleep. To be fair to fund managers, their decisions are dictated by redemption requests (outflows) that are on a rise and is a prime reason for the liquidity crunch.

Against this backdrop, we try to understand the linkage between MFs and NBFCs and the cause of risk aversion of MFs. We further try to decipher if the same will have broader ramification for NBFCs and their stock prices.

NBFCs growth have significantly outpaced overall credit growth in recent timesNBFCs have gained importance in the Indian financial system, the third largest segment after banks and insurance companies, thanks to their phenomenal growth in past five years.

The aggregate balance sheet size of the NBFC sector as on March was Rs 22.1 lakh crore. Loan book of NBFCs grew 21 percent in FY18, double the growth in advances book (10 percent) of the banking system.

Bulk of growth was fuelled by mutual funds Many factors contributed to the growth in NBFCs like strong credit demand, pull back by public sector banks, expanding distribution network and falling interest rates. But the most important factor has been benign liquidity provided by mutual funds.

While banks have been the main source of borrowings for NBFCs, they have been increasingly replaced with market-based instruments in recent years

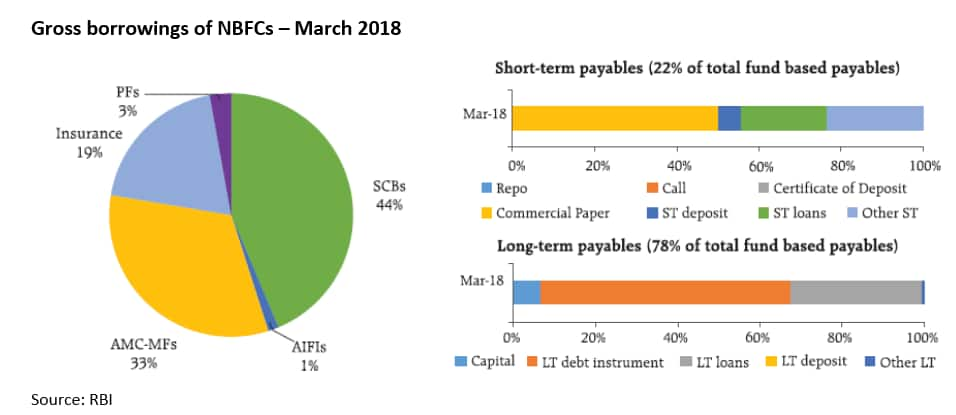

As per RBI’s Financial Stability Report (FSR), published in June, NBFCs were the largest net borrowers of funds from the financial system, with gross payables of around Rs 7,17,000 crore as at March-end.

Trying to map the degree of interconnectedness, RBI’s report showed that NBFCs received the highest funds from banks (at 44 percent of total funds received by NBFCs) followed by asset management (at 33 percent) and insurance companies (at 19 percent).The break-up of total payables of NBFCs between long and short term funds shows NBFCs significant reliance on commercial papers (CPs) as a founding source.

Housing finance companies (HFCs) were the second largest borrowers of funds from the financial system, with gross payables around Rs 5,28,400 crore as at FY18-end. The borrowing pattern of HFCs was quite similar to that of NBFCs, except that MFs contribution to HFCs gross borrowings was higher at 32 percent.

What led to increased exposure of mutual funds to NBFCs? Under immense pressure to shore up their total funds under management in order to stay ahead in the league tables, AMCs have been growing their debt and liquid funds. Though AMCs earn very low fees from these schemes (especially on liquid schemes), they are able to garner vast amounts from institutional investors.

Debt funding by MFs to NBFCs stood around Rs 2,30,000 crore as at March-end. It more than doubled between September last year and March. While the exposure to NBFC papers as percentage of debt AUM of MFs works out to around 18 percent, the same will be much more if we exclude government securities.

Large part of exposure is through CPs Borrowing through CPs has increased over time, reflecting the lower cost of raising funds through these instruments. Commercial paper outstanding tripled to Rs 5.1 lakh crore over a five year period.

Rising rates forced many NBFCs especially HFCs to resort to short term borrowing through CPs as shorter term rates are relatively low. As a result, share of CPs in the overall MF funding to NBFCs increased to 50 percent in April from 35 percent in September last year, as per rating agency ICRA.

Rollover risk due to high linkages between MFs and NBFCs The current scenario seems to be mini flashback of the 2008 crisis. The MF industry faced a liquidity challenge during the 2008 financial crisis following the Lehman bankruptcy, witnessing significant outflows over a short period. This time around, the liquidity crunch has been triggered by the homegrown issue of default by IL&FS group companies rather than external factors.

Excessive reliance of NBFCs on MFs have made them vulnerable to liquidity shocks. The reduced risk appetite of institutional investors seems to have increased redemption pressure, which in turn has led to rollover risks for the short term debt of NBFCs.

Growth of NBFCs to slowdown Falling stock prices of NBFCs is clearly the spillover of credit or liquid markets. While the cost of funds will move up, limitation of funding source could pare growth of NBFCs, which is the biggest concern for an equity investor today. While earnings estimates will decline, valuation multiples for NBFCs have de- rated and could remain sluggish in the near term.

Many NBFC stocks were priced to perfection, assuming a perpetual strong earnings growth (upwards of 30 percent) scenario. While valuations of many NBFCs have fallen following the recent sell-off, we don’t see a quick bounceback until liquidity situation eases for them. Investors will be better off staying invested with large NBFCs with strong parentage and lesser funding issues.

Current liquidity situation While support from RBI will help in the immediate term and avert any bigger liquidity crisis, a lot hinges on the outcome of the IL&FS issue. In case of any adverse event, we can expect complete freezing of liquidity.

Even with a favourable outcome, we see limited demand for NBFC papers from MFs over the next 3-6 months as the liquidity scare tends to linger on for some time.The amount redeemed from MFs by institutional investors will find its way to bank deposits. We expect banks, especially private sector, to plug the gap on the funding side for NBFCs, though that will be at higher cost.

We have in the past witnessed that MFs go into hibernation following a credit event but do make a comeback. While we see that MF funding cannot be a perennial logjam, there is some time to go before MF gains confidence again. In the intermittent period, liability side pain will be inevitable for many NBFCs highly reliant on MFs.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.