Highlights - Retail fuel prices inching up gradually

- Disconnect between global crude and retail fuel prices- Sharp uptick in Excise duty keeping retail prices high- Marketing margins of oil marketing companies rose during March-May, now normalising--------------------------------------------------------

There has been a glaring disconnect between the global crude prices and the retail prices of petrol and diesel here over the last few months. Despite sharp correction in global crude prices, the retail prices had remained at high levels owing to simultaneous steep hikes in excise duty by the central government and elevated levels of marketing margins by oil marketing companies (OMC).

There was negligible correction in retail fuel prices during March-May when global Brent prices were slipping. Now that Brent crude prices have started inching up, retail prices have been revised upwards for the 8th consecutive day on Sunday.

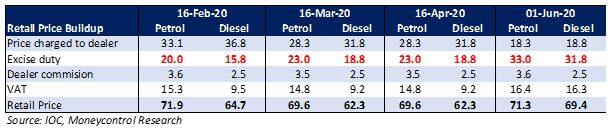

During the past few months when the crude prices remained soft, the central government had announced hikes in the excise duty charged on petrol and diesel in order to shore up its coffers. The excise duty on petrol has gone up from around Rs 20 per litre in February to Rs 33 per litre now. Similarly, the duty on diesel had gone up from Rs 16 per litre in February to Rs 32 per litre now. The tax on petrol was Rs 9.48 per litre in 2014 and that on diesel was ₹3.56 a litre.

Due to this steep uptick in the excise duty, the benefit of the soft global crude prices has not been transferred to the retail consumer and the price of petrol and diesel in retail outlets has remained high. Nearly 70 percent of the price paid by the consumer for a litre of petrol or diesel is towards taxes (excise duty and VAT).

While initially the retail prices remained flat as the hike in excise duty was being compensated by the dipping crude oil prices, in the last few days the crude prices have slowly started inching up and are now touching the $42 per barrel mark. Due to this, oil marketing companies are now revising up the retail prices of petrol and diesel to protect their marketing margin.

Impact on the fiscal mathsThe hike in excise duty brings in some cushion for the strained fiscal pockets. The government is expecting to collect an additional revenue of around Rs 1.6 lakh crore in FY21. However, given the sharp drop in demand for petrol and diesel amid the reduced travel and transport due to the Covid spread, actual collection could be very different. Given the tight fiscal situation, the benefit from additional excise duty would help in filling up some gap in the revenue and expenditure mismatch.

Impact of marketing margins on OMCs

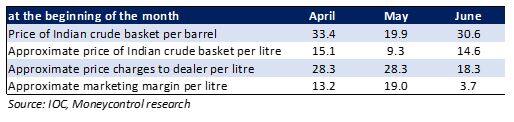

During the phase of falling global crude prices, since retail prices were not revised down, oil marketing companies saw huge surge in their marketing margins. Margins, which generally remain around Rs 2-3 per litre, were taken as high as approximately Rs 13-19 per litre during April and May. Our calculations suggest that these margins have now come down and in order to protect their margins, oil marketing companies have now started upward revision in retail prices.

Steep and sudden fall in global crude prices have battered the profits of OMCs owing to high inventory losses. Low demand for retail fuels and other refining products is also impacting the throughput at refineries and the overall top line and margins. Amid this, OMCs have little cushion to absorb loss in marketing margin.

OutlookSharp rise in excise duty and marketing margins kept the retail fuel prices high during March-May. Despite steep fall in global Brent crude prices and the Indian crude basket, prices in retail fuel outlets saw little revision. While OMCs had seen sharp surge in their marketing margins during this period, the current marketing margins seem to fall in line with their long term average. And due to this they have little cushion to absorb the inching crude oil price and periodic retail price revision may not be avoided if global crude continues to inch up.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.