Moneycontrol research

Highlights:- Improved prospects for refrigerant gases; new capacity to add growth- Flagship agro-chemicals products doing well despite slowdown in a few geographies- Traction in new launches for specialty chemicals (agro and pharma end markets) are a key watch- Rs 424 crore capex for PTFE to help forward integration of the fluoropolymers segmentSRF, the largest fluorochemical company in India, has reported a broadly strong set of numbers with robust contribution from the Chemicals (33 per cent of Q1 FY20 sales) and Packaging Film (38 per cent of sales) segments. In the context of a series of profit warnings from global majors, a steady operating performance was the key highlight of the results. While the company’s flagship products in specialty chemicals have maintained the momentum, the management decision to extend the refrigerant gases value chain to fluoropolymers improves the case for investment.

Also read: Refrigerant gas plays turn investment-worthy as they re-position for fluorine chemistry

Key positives

Sales surged by 9 per cent YoY, largely backed by a 26 per cent growth in Chemicals and an 11 per cent growth in the Packaging Film segment. Within Chemicals, the performance of Fluorochemicals was aided by higher sales of refrigerants and an improved contribution from the Chloromethanes plant. Note that the end-markets of the refrigerants business have seen a mixed trend in recent times. Extended summers have led to higher sales volumes for air conditioners and refrigerators, while the auto industry has been in the grip of a cyclical slowdown in demand.

On the flip side, in the Chemicals business, there was a slower-than-expected recovery after the Dahej site was closed in April. The management mentions that the loss of production in April and May was a temporary phenomenon, and the segment should be able to meet its customers’ requirements on a full-year basis.

In the case of specialty chemicals, SRF faces headwinds on the global Agro-Chemicals front as the industry is experiencing an extended slow down. Having said that, the management emphasises that SRF is witnessing growing demand for its flagship products for the agri-market. In the quarter gone by, it launched two new intermediates in this end market. In the case of the Pharma segment as well, the company has launched two new molecules, and the ramp up will depend on how the final formulations find traction.

The Packaging Film segment benefited from new capacity additions last year. Within the segment, steady demand helped BoPET (biaxially-oriented polyethylene terephthalate) films business, though an adverse supply-demand situation continues to weigh on the BOPP (biaxially-oriented polypropylene) films business.

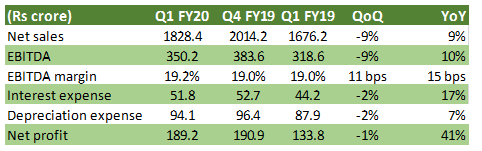

Q1 financials

Key negatives

The Technical Textiles (24 per cent of sales) segment was a laggard, and posted a sales de-growth of -11 per cent YoY. The segment’s operating margin contracted by 80 bps due to inventory losses amid raw material volatility. This segment face challenges from a subdued near-term outlook for the automotive sector for its product, Tyre Cord Fabric.

GIDC has placed some restrictions on water discharge at the company's Chemicals facility in Gujarat. SRF believes these restrictions are temporary. Meanwhile, the company plans to recycle a part of the water discharged by the facility. Nevertheless, till the restrictions are removed, there would be some impact on the plant’s production and margins. Note that the Chemicals segment margin contracted by 340bp YoY in Q1, owing to an absence of operating leverage.

Other observations

The company announced Rs 424 crore capex for setting up an integrated facility for PTFE (polytetrafluoroethylene). This would add a capacity of 5,000 tonnes (asset turnover: 1.5x-1.7x) and the project is expected to be completed by Oct’21. With this, SRF plans to enter the fluoropolymers segment of fluorocarbons to derive cost advantage from the integrated value chain. This plant would have R-22 refrigerant gas as feedstock.

The company has successfully developed a refrigerant, R-467A, which would be used as a substitute for R-22 and would be sold under the FLORON brand. It has been developed using patented technology that received certification from the American Society of Heating, Refrigeration, Air-conditioning Engineers – ASHRAE.

Outlook

We continue to like SRF’s business transition given the challenges in refrigerant gases industry and the opportunities for value-added applications in specialty chemicals. SRF increasingly caters to the growing opportunity in ozone-friendly hydrofluorocarbons (HFCs). The company is spending about Rs 356 crore to build an integrated facility to produce key HFCs (HFC 134a, HFC 32 and HFC 125). It targets commissioning the plant, which will double capacity to 50,000 tonnes, by the end of Q2 FY20 (previously expected for June-July’19). Additionally, in the case of the Specialty Chemicals business, the company maintains guidance for 40%-50% growth in spite of moderate pick up in Q1.

In the medium term, we expect continuous investment and R&D into complex fluorine applications to propel the topline growth. Further, the company’s decision to foray into fluoropolymers seems promising, as do benefits that will accrue from the feedstock advantage.

As far as stock price is concerned, the stock corrected by 15 per cent from its 52-week high after profit warnings from the chemical majors. However, the steady Q1 result and a promising outlook have helped the stock rebound sharply.

Currently trading at 16.4 x FY21e earnings, the SRF stock provides an accumulation opportunity in every decline.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.