-------------------------------------------------

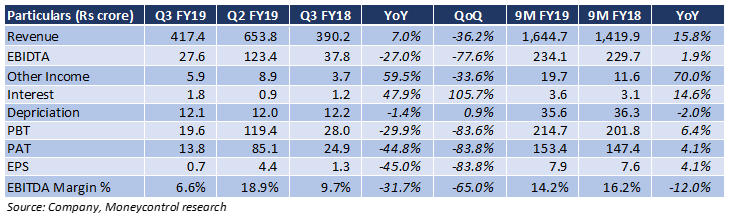

Rallis India reported a disappointing third quarter ended December 2018 with a substantial contraction in profits and margins despite a uptick in revenue. Overhang of high input costs ate away the profitability for yet another quarter.

The 7 percent YoY uptick in revenue was majorly on account of price upticks especially in the international markets. Foreign exchange exposure worked in favour and had a positive impact on income.

Earnings were impacted due to certain one off items which were taken on account of delay in receipts on sales. While provision have been made in line with the policy, the management does not recognise these as bad debts and expects to recover them in Q4FY19.

The company is now focusing on launching more specialty products with higher margins which should help improve margins in the future.

Rallis has started foraying into backward integration projects to ensure smooth availability of inputs and to cut off from the vagaries of supply disruptions. This could help in improving margins in the long term.

Key negativesOwing to adverse conditions there was industry wide cash stress which resulted in a stretched working capital position for the company during the quarter. This led to higher working capital loans which increased the interest cost.

The domestic markets remained on a weak footing and price upticks during the quarter were minimal. However, raw material cost continued to rise on account of the China supply issues. This led to substantial erosion of margins and profits. Rallis imports close to 45 percent of its raw materials from china.

Volumes during the quarter remained largely flat

Metahalix (the seed business) saw a 12 percent YoY contraction in revenue and continued to be unprofitable for another quarter.

While the price of many chemicals has started to come off, the management does not expect significant relief in the near term.

Crop acreages and reservoir levels are lower YoY in the current Rabi season. This could mean a continued stress on the company’s performance in Q4FY19.

Other notesWhile the management sees API (active pharmaceutical ingredient) as an attractive segment, foray into only one molecule that too organically is somethings which is not profitable and the company might look at addressing this in the coming quarters. While there is no visibility, management indicated chances of an inorganic expansion to make the segment profitable.

Rallis is planning a Rs 800 crore investment in the next 5-6 years for building a facility in Dahej for the manufacture of formulation, technicals and associated intermediary products for both domestic and international markets. The first Rs 100 crore phase of this investment is scheduled to be completed by March 2019 and the next Rs 173 crore phase by December 2019. The project is expected to bring about stronger backward integration

Rallis' management has approved full integration with Metahelix – the seed business of the company with Rallis. It also plans to look out for expansion in the seed portfolio and is open to go the inorganic route.

Outlook

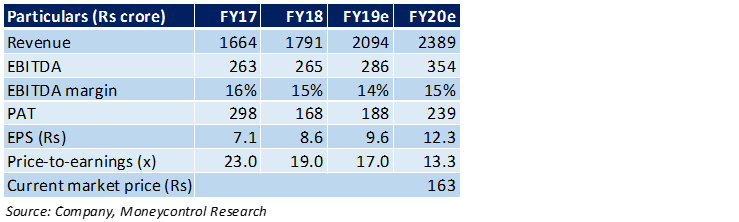

The stock has corrected almost 13 percent in the last 12 months and is currently almost 42 percent below its 52 week high post which it is trading at a 2019E P/E of 17x. The management is working to foray into a more profitable product mix which would augur well for the company’s margins in the longer term. Commercialisation of new molecules would be something to look out for.

With a renewed look on the company’s strategy and announcement of capex (which was not there since past 3-4 years), we see the group might turn around from the current mess in the long term. However, the company is currently impacted by external operating environment, and we believe the overhang would continue in the near term

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.