Should investors be worried about the sharp increase in the MSP (minimum support prices) of copra for the upcoming crop year? It’s a legitimate concern about Marico’s profitability, with copra purchases constituting about half of the cost of goods.

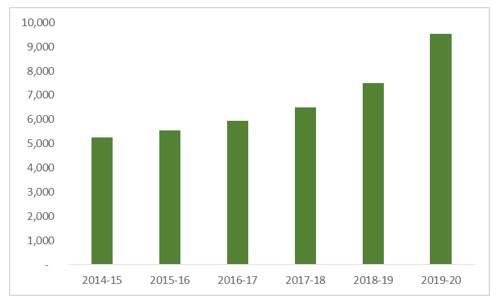

MSP hiked by 27 percent The Cabinet Committee on Economic Affairs (CCEA) hiked MSP for copra by 27 percent to Rs 9,521 per quintal for the upcoming crop year. The hike in MSP is recommended by the Commission for Agricultural Costs and Prices (CACP) based on various factors like the cost of production, trends in the domestic and international prices of edible oils, overall demand and supply of copra and coconut oil, etc. In the recent past, MSP prices have been way below the prevailing prices in the market. As per Marico’s management, the new MSP price is below the prevailing market price of copra by around 15-20 percent.

MSP prices for milling copra (per quintal)

Demand-supply is the key decider in copra prices Copra prices are largely determined by the prevailing demand-supply equation. In fact, in the previous deflationary cycle, copra prices breached the prevailing MSP briefly. This is also on account of the fact that government copra purchase is miniscule compared to aggregate demand in the country.

In per our recent interaction with CEO Saugata Gupta, he said the company benefits from the start of a deflationary cycle in copra pricing. Copra normally follows 18-24 month cycle and it is already in the third or fourth month running.

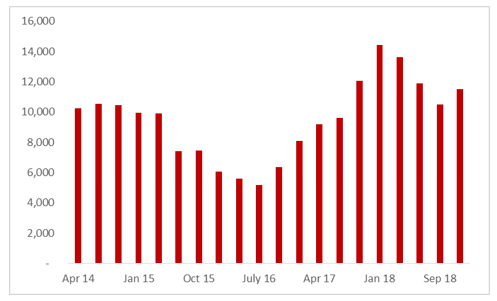

Now it is possible that we may not see copra prices collapse the way it happened in 2015-16, given the new MSP. A lot depends on the extent to which government implements procurement. But then, copra prices are already about 25 percent below its January 2018 high.

Market prices for Calicut copra (per quintal) Source: MaricoOpportunity to invest in new products

Source: MaricoOpportunity to invest in new productsIn the quarter gone by, Marico has already seen a sequential improvement in gross margin due to lower input cost. At the company level, however, it is deploying gains behind positioning new products. The management pointed out that there are a significant number of new products in the pipeline and thinks there is a good opportunity to invest in them. Going forward, benign crude prices can also add another lever for gross margin improvement.

Diversification on track Improved business context has kept us constructive on the counter. The stock has rallied 25 percent from the lows of October 2018 and is now trading at 42 times FY20 estimated earnings. We are also enthused by the fact that Marico wants to reduce its dependence on Parachute and Saffola and drive new offerings in the premium segment. We acknowledge that categories like male grooming, serums, hair nourishment and foods are expected to have a significantly higher share in the next five years. In our view, investors can participate in this increasingly diversified consumption story by buying on dips.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.