Anubhav Sahu Moneycontrol Research

Sales of Colgate-Palmolive (India) grew 6.4 percent in Q3 FY19, mainly aided by year-on-year volume growth of seven percent. Sequentially, however, sales declined by six percent.

At the gross margin level, there was a 10 basis points (100 bps = 1 percentage point) contraction, but earnings before interest, tax, depreciation and amortisation (EBITDA) margin improved 120 bps on account of lower operating cost due to reduction in employee and advertising expenses as a percentage of sales.

Volume growth YoY

Source: Moneycontrol Research

While volume growth was ahead of consensus expectations, its six-year CAGR (compounded annual growth rate) of 3.7 percent volume growth speaks of a weak underlying growth trend.

Its market share had shrunk over the years due to popularity of Patanjali Ayurved’s offering. Growing interest for the naturals category helped other players, as well, like Dabur India. While Patanjali’s overall sales momentum has slowed down, channel checks suggest key products like Dant Kanti are still performing well. Dabur continues to deliver strong performance in the oral care segment, though the management warned of high competitive intensity in lower price toothpastes. Hence, it is difficult to say if Colgate has started clawing back its market share.

Sales have been rangebound for the last six quarters, hovering around Rs 1,050 crore. However, it has been working on reducing costs, resulting in a 180 bps and 110 bps decline in raw material and employee cost, respectively, as a percentage of sales over the last six quarters. Nevertheless, that also gives it a leeway to spend more on advertising (around 11.5 percent of sales) and trade promotions. The company’s cost saving initiatives have helped it post a 28.6 percent EBITDA margin.

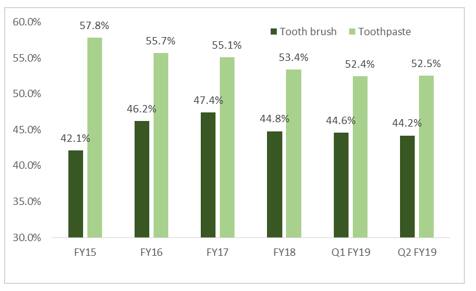

Market share trend

Source: Moneycontrol Research

Even though the competitive intensity has moderated, volume growth is expected to be at best in line with the average of the oral care sector. While we don’t see any pricing-led growth in the near term, emphasis on the naturals category is expected to continue along with newer launches.

Stabilisation in volumes and improved operating performance has helped it re-rate recently. The stock has risen 27 percent from its October 2018 lows and now trades at 42 times FY20 estimated earnings (in line with the sector's average). We believe the company’s current valuation factors in near term triggers.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.