HDFC Bank, one of the largest and most profitable private sector banks, posted yet another quarter of strong performance with net profit increasing by 20 percent year- on -year backed by robust growth in loan book.

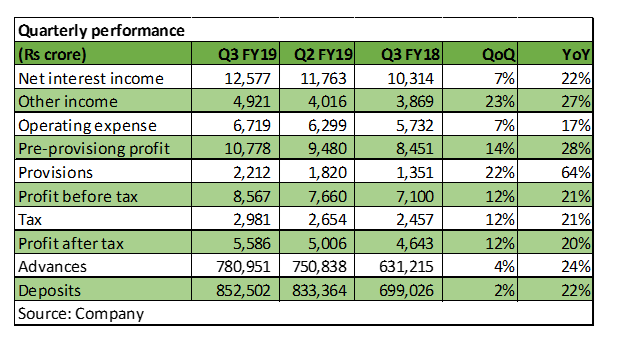

HDFC Bank's Q3 FY19 numbers were consistent as ever. Net interest income (NII, difference between interest income and expense) increased by 22 percent, driven by a loan book growth much above the system average and a stable net interest margin (NIM) of 4.3 percent.

Non -interest income grew by 27 percent YoY.

The bank's operating leverage improved significantly as its core cost-to-income declined to 39.5 percent as against 41.2 percent in Q3 last year led by a controlled growth in branch network and digital initiatives.

Provisions increased by 64 percent YoY as the bank made some contingent provisions on its agriculture lending books.

HDFC Bank reported total advances of Rs 780,951 crore as of the end of December 2018, an increase of 24 percent over last year. Within the total advances, both domestic retail and corporate lending witnessed a robust growth of 24 percent each. The bank’s performance is commendable as it continues to grow its loan book at much ahead of system average despite the higher base.

Deposits grew by 22 percent YoY. The growth in time deposits was much stronger at 29 percent YoY compared to its current and savings accounts (CASA) deposits growth of 13 percent YoY. As a result, its CASA ratio dipped slightly to 41 percent as compared to 42 percent in last quarter.

The bank continued to maintain its impeccable asset quality with gross and net non-performing assets at 1.4 percent and 0.4 percent respectively as of the end of December 2018. It reported floating provisions of Rs 1,451 crore, whose coverage is more than adequate at 115 percent of its gross non-performing loans.

HDFC Bank has been the most consistent performer on the street for many years delivering earnings growth in the high-teens. Its loan growth continues to be strong (ahead of the industry), its margin is steady and asset quality remains as pristine as ever. Notwithstanding its large size, HDFC Bank is gaining market share at an accelerated pace aiding sustainable high earnings growth.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.