Marico’s Q1 FY19 earnings were in line with volume growth, aided by weak base, rural growth and normalisation of trade channels. As the company transitions through challenges of higher input cost and competition in the hair care category, it may not be easy for it to deliver higher volumes in coming quarters, particularly on a strong base. In the medium term, the management’s execution of its diversification strategy (Saffola oils, Saffola food and male grooming portfolio) assumes importance.

Q1 FY19: Impacted by higher copra prices

Source: Moneycontrol Research

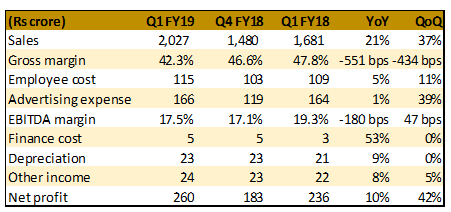

Q1 FY19 sales grew 20.5 percent year-on-year (YoY). Domestic volume growth was strong at 12.4 percent (overall volume growth: 10.4 percent) though it came on a weak base (9 percent degrowth in Q1 FY18). International business (20 percent of Q1 FY19 revenue) was mixed, posting 3 percent volume growth (7 percent constant currency sales growth), wherein only the Middle East North African (MENA) region (14 percent of international business) saw a decent traction in volume growth.

Gross margin contracted on account of a surge in copra cost (42 percent YoY, -6 percent quarter-on-quarter). Consequently, earnings before interest, tax, depreciation and amortisation (EBITDA) margin contracted but was partially offset by moderate increase in employee cost, other expenses and advertising spends.

Cost of other raw material (liquid paraffin, rice bran, high-density polyethylene) components were up in tandem with sales growth.

Parachute: Uninspiring volume growth Parachute sales were up 38 percent YoY aided by series of price hikes (26 percent higher) since December last year. Volume growth of 9 percent was uninspiring given the low base (-9 percent). The management expects 5-7 percent volume growth for Parachute in FY19. However, competitive pressure needs to be closely watched.

In the case of Saffola edible oils, there was a volume pick up (10 percent versus -9 percent in Q1 FY18) after four weak quarters. The management expects growth to reach earlier levels in the next few quarters.

Positive takeaway for the CSD and rural recovery For the fourth consecutive quarter, rural growth (28 percent YoY) was ahead of urban growth (16 percent). Canteen Sales Department (CSD) grew 15 percent after a recovery in Q4 FY18. Improving contribution from e-commerce is noticeable. In FY19, contribution from e-commerce is expected to exceed 2 percent of domestic turnover as against around 1 percent in FY18.

Outlook and valuation While the Q1 FY19 result has been in line with our expectations, the industry expects sustained recovery in rural areas and higher share of e-commerce.

For the India business, the management has kept its volume growth guidance at 8-10 percent, with EBITDA margin of about 20 percent. While volume guidance banks more on the product portfolio other than Parachute, the company’s ability to defend higher margin would be tested in times to come. Elevated competition in the hair oil category, amid price hikes, remains a factor to monitor.

Other than that, the key monitorable remains copra price trajectory (the management expects lower prices in H2 FY19) and turnaround in Saffola refined oil. While we take note of improved volume growth for Saffola Oil, we don’t read much into it given its weak base. While Marico’s stock is trading (40 times FY20e earnings) at a discount to the market leader, it may be early to call out a sustained recovery given the competitive pressures.

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.