Jitendra Kumar Gupta Moneycontrol Research

Led by strong execution and pick-up in traffic, IRB Infrastructure Developers reported a 37% growth in total income during the quarter-ended December 2018, despite interest cost and tax negatively impacting.

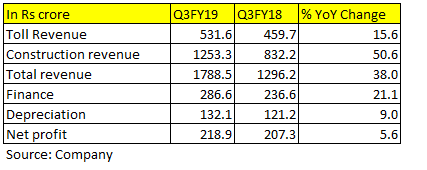

Key positives The result was ahead of expectation largely on account of robust (51% year-on-year) growth in the construction segment revenue at Rs 1,253 crore. In an otherwise dull environment, the management pushed for higher execution. That apart, most of its toll projects, including major ones such as Ahmadabad-Vadodara reporting an 11.86% growth in toll revenue. Toll segment revenue, which accounts for 30% of total revenue, grew 15.6% YoY to Rs 532 crore.

Key negatives While revenue growth was strong, the company witnessed marginal profit growth as a result of increased proportion of engineering, procurement and construction (EPC) revenue in the overall revenue mix to 70% in the Q3 FY19 from 64% in Q3 FY18.

EPC revenue attracts a tax of close to 34% and this is precisely the reason why tax expenses during Q3 jumped around 53% to Rs 169 crore, which is in line with 51% growth in EPC revenue.

This along with 21% growth in finance cost had impacted net profits, which grew 6% to Rs 218.9 crore.

Key observations In the absence of fresh bidding ahead of elections, focus will continue on execution and achieving key project milestones. Of the four projects it bagged last year, the company achieved the appointed date on one. The management is further looking for appointed dates for two more projects and financial closure on one. The remaining three projects are worth about Rs 5,000 crore in size. Once the company achieve the appointed date and financial closure, it should go for construction soon.

Outlook With an order book of close to Rs 12,500 crore, or 3.3 times its FY18 EPC revenue, the company has strong revenue visibility. Moreover, with toll revenue growing at decent pace, earnings growth should also be reasonable in coming quarters. At the current market price of Rs 140 a share, the stock is trading at less than one-time its book value.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.