Nitin Agrawal Moneycontrol Research

Minda Industries, an auto component manufacturer, has announced its merger with Harita Seating. Minda is a leading supplier of automotive switches, lamps and horns while Harita is a manufacturer of complete seating solutions to commercial vehicle, tractors and buses.

As per the contours of the merger, shareholders have been given two options to choose from.

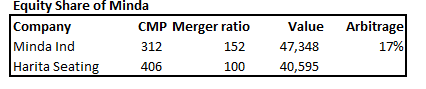

Option 1: 152 fully paid up equity shares of Minda for every 100 fully paid up equity shares of Harita. As per the merger ratio, there is an arbitrage opportunity of 17 percent for the investors. This would lead to 4.5 percent equity dilution for Minda.

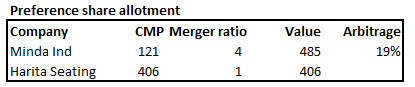

Option 2: 4 fully paid up non-convertible redeemable preference shares of 100 each at a premium of 21.25. Duration of preference share is 3 years with yield to maturity (YTM) of 7.5%. Under this scheme, there is an arbitrage opportunity of 19 percent.

There are multiple synergistic benefits which would come through this merger. Minda is expected to benefit from the merger as this would widen its product portfolio, access to Harita's clientele and leverage the R&D capabilities of Harita. Additionally, since asset turnover for Harita is 4x, it will result in better ROE and ROCE to Minda.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.