Highlights: -Delta Corp posted a strong topline growth and significant expansion in its EBITDA margin - Online gaming and luxury cruise casino offers huge potential - Sikkim and Nepal casinos to aid topline - Buy the stock for the long term --------------------------------------------------

Delta Corp (Delta), the only listed player in the casino (live, electronic and online) gaming industry in India, has posted a very strong set of numbers in the last quarter of FY19. Healthy topline growth, coupled with strong operations performance, helped the company report a robust earnings. With multiple growth drivers in place, we advise investor to buy the stock with an eye on the long-term.

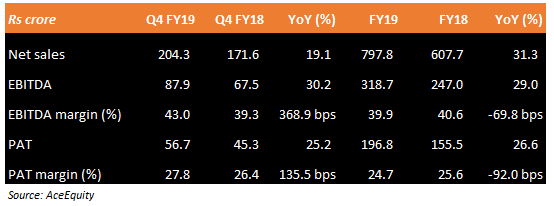

Quarter at a glance

Strong volume growth In Q4, Delta posted a 19.1 percent year-on-year (YoY) growth in topline, led by 21 percent growth in casino gaming revenues. Growth in the casino business was on the back of a 40 percent growth in visitations.

Online gaming revenue grew in double-digits (11 percent), whereas the hospitality segment saw eight percent growth.

Strong operational performance Earnings before interest depreciation, tax and amortisation (EBITDA) margin expanded 369 bps, led by recovery in online gaming. The latter's earnings before interest and tax (EBIT) improved to 24 percent as compared to 14 percent in the same quarter last year.

Outook There are multiple growth drivers for the company:

Foray into cruise casinos The company has made a strategic investment of $10 million to acquire 25 percent stake in Jalesh Cruises, a luxury cruise, to be operated in India from April. It will have 25-30 tables in the cruise casino and will pay the operator a fixed fee of $5 per person per day. This is expected to generate a revenue of Rs 25-30 crore per year for the company. Scaling up of operations at Jalesh Cruises would result in a significant revenue upside.

Focus on online gaming The management is aggressively focusing on online gaming as it could be the next big thing, with growing internet penetration and the availability of online payment options. Delta has already acquired Adda52.com, a poker website, which is clocking strong growth. It has invested Rs 15.5 crore in Halaplay, a platform which provides leagues in all international and domestic cricket, T20s, World Cup, Kabaddi etc. Halaplay will benefit from the ongoing IPL contest and the upcoming Cricket World Cup 2019 and Cricket T20 World Cup.

Upcoming Goa’a casino land policy The Goa government’s new casino land policy is expected to usher in structural changes. It could lead to the creation of gaming zones and formalise the industry. Delta, being the leader, is well placed to benefit. It has already started working in this direction and has acquired 100 acres of land.

Sikkim and Nepal casinos to drive revenue The Sikkim casino has emerged as a growth driver after the opening of Pakyong Airport, which lead to an increase in tourists. Nepal Casino, which is expected to be operational in the next 60 days, too should aid growth.

Valuation At the current market price of Rs 259, the stock trades at a valuation of 28 times FY20 and 23.5 times FY21 projected earnings, which is in line with its historical price-to-earnings estimates.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.