Cera Sanitaryware, a leader in the sanitaryware segment, reported decent volume and topline growth in a challenging FY18 as the industry witnessed multiple disruptions throughout the year. It has been a steady compounder and doubled its topline and bottomline in the past five years. The stock has seen multiple re-ratings on account of its consistent financial performance and has gained more than 5 times over the same period. A careful reading of its latest annual report throws interesting insights into the management's growth strategy and industry trends.

Growth across business segmentsThe company operates in three business segments: sanitaryware, tiles and faucets. On a segmental basis, revenue from sanitaryware grew around 8 percent, faucets 22 percent and tiles 44 percent on account of a low base.

Sanitaryware segment was running near optimum capacity utilisation during last fiscal. In the faucets division, the company commissioned its Zamac handle manufacturing plant which helped reduce imports.

While sanitaryware and faucets are manufactured fully in-house, Cera operates in the tile segment through a mix of outsourcing and joint ventures. Anjani Tiles, Cera’s subsidiary with 51 percent stake, recorded a strong revenue growth during FY18. Packart Packaging (JV for manufacture of corrugated boxes) also witnessed improved capacity utilisation during the fiscal.

While sanitaryware and faucets are manufactured fully in-house, Cera operates in the tile segment through a mix of outsourcing and joint ventures. Anjani Tiles, Cera’s subsidiary with 51 percent stake, recorded a strong revenue growth during FY18. Packart Packaging (JV for manufacture of corrugated boxes) also witnessed improved capacity utilisation during the fiscal.

Besides expanding its domestic presence, the management is eyeing growth by entering overseas markets. Cera has already set-up a showroom in Dubai and opened a warehousing facility at Sharjah to cater to the UAE market.

Natural gas is an important constituent in the manufacturing process for Cera and constitutes around 18-20 percent of the total cost basket. The company has long term contracts with GAIL (India) and Sabarmati Gas to secure the gas supplies. However, pricing and quantity of the gas is governed by availability, international pricing and the contract agreements.

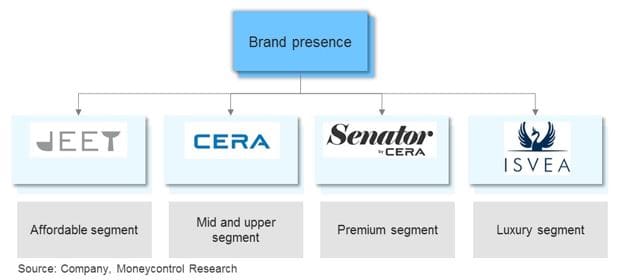

Presence across multiple customer segments

Over the last 12 months, the company introduced two new brands to cater to different customer segments. In October last year, it announced the launch of a new brand ‘Jeet’ to cater to the fastest growing affordable segment. Jeet’s product portfolio consists of basic sanitaryware: European water closets, Orissa pans, wash basins in different sizes and urinals. In March, it unveiled a new brand ‘Senator’ offering a premium range of sanitaryware, faucets, wellness and mirrors. With the launch of these two new brands Cera has expanded its portfolio across multiple segments.

The management is constantly upgrading its manufacturing capabilities by focusing on R&D and developing latest technologies. It has introduced 3D printing, robotic glazing and trap glazing techniques in its manufacturing processes to have a more controlled and uniform finishing across its product lines. In an endeavour to offer innovative and eco-friendly products, it has introduced a new 4 litre flushing system, which has the same effectiveness as 6 litres flushing system, thereby reducing water consumption by nearly 30 percent.

Over the medium term, the company plans to further automate its manufacturing plants by introducing robots across its manufacturing process. It plans to ramp-up its robotic glazing system for plaster moulding and also introduce robotic systems for casting, raw material consistency and quality control.

Outlook and recommendationCera expects 15-18 percent revenue growth in FY19 led by double-digit growth in the faucets and tiles segments. Sanitaryware is expected grow at high single-digits. The management has guided to a 100-150 bps margin improvement for FY19 on account of product premiumisation and price hikes.

We remain optimistic on the long-term prospects of Cera and recommend one to accumulate the stock as it enjoys market leadership position in the industry.

We remain optimistic on the long-term prospects of Cera and recommend one to accumulate the stock as it enjoys market leadership position in the industry.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.