Anubhav Sahu

Moneycontrol Research

While Bhansali Engineering Polymer’s (BEPL) weak quarterly result was expected on account of a fire at one of its plants, the management’s decision to review near term capacity expansion plan came as a surprise. This moderates the expected earnings trajectory and can weigh on the stock price in the near term.

The company’s mega greenfield project of 200,000 tonne per annum (tpa) remains a priority and can potentially recast domestic market demand-supply balance in times to come. BEPL’s strong balance sheet, guidance for better capacity utilisation and promising end markets remain key positives. The ongoing stock price weakness provides an opportunity to accumulate as valuation froth has reasonably settled in our opinion.

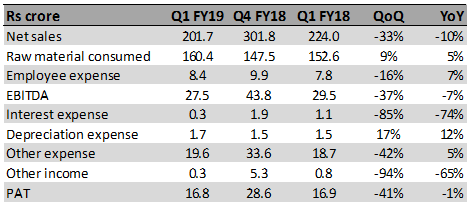

Sales contract by 1/3rd in Q1 due to fire

Source: Company

In Q1 FY19, the company posted a sharp decline in sales (-33% quarter-on-quarter and -10% year-on-year) due to month’s disruption at its Satnoor plant on account of a fire. Sequentially, net profit declined around 41 percent due to a 133 bps contraction in earnings before interest, tax, depreciation and amortisation (EBITDA) margin and lower other income (-94 percent QoQ) despite a fall in other expenses and finance cost. On a YoY basis, net profit was flattish, partially aided by lower tax expenses.

Near term capacity expansion plan on hold

The management has kept on hold the second leg of its expansion from 100,000 tpa to 137,000 tpa at its Abu road unit. In the last quarter, the company completed capacity expansion to 100,000 tpa from 80,000 tpa. For existing capacity, it expects 75 percent utilisation in FY19.

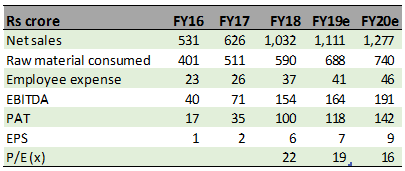

Financial projections and valuations

Source: Moneycontrol Research

The company’s quarterly performance suffered a setback on account of an unforeseen incident. Operationally, BEPL appears to be on track to reach optimum utilisation levels by end of the current fiscal. Review of further capacity expansion in existing plants seem to be driven by plans for an integrated plant at Pipavav port (by March FY21), partially motivated by the need for higher operational efficiencies. In our opinion, the management should keep a watch on better utilisation and supply-demand dynamics before expanding further.

After the quarterly result and capacity expansion update, we have revised down our near term earnings projections. The stock has also corrected 40 percent from its 52 week high.

Consequently, the stock is now nearing a reasonable trading multiple (16 times FY20 earnings). Investors with a long term investment horizon can consider accumulating it, given strong end markets, improved balance sheet and positive insider activities (promoters increased share holdings, paid off debt and released pledged shares).

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.