- Industry struggled due to Jet fiasco - IndiGo further expanded its market share and maintained its leadership - Recent increase in oil prices to impact players in the industry - Soaring ticket prices may continue to put passenger growth under pressure --------------------------------------------------

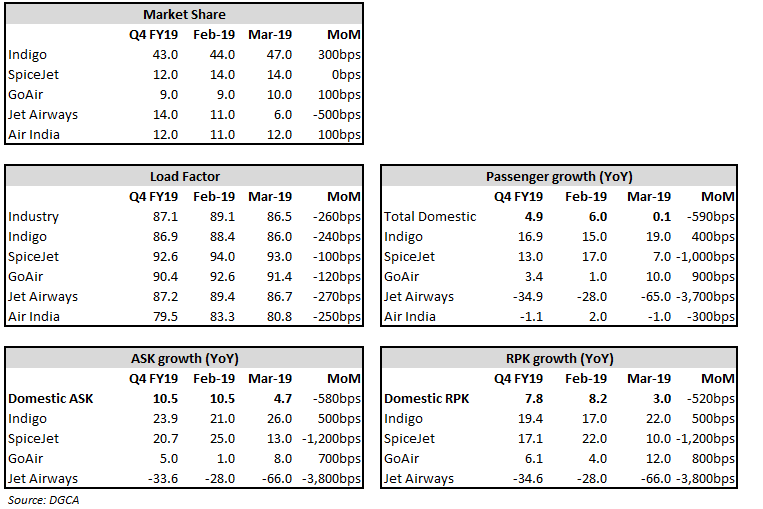

Indian aviation industry struggled in the month of March on the back of ticket cancellations, led by Jet Airways' financial concerns. This led to flat passenger growth in the month on year-on-year (YoY) basis. Grounding of Jet's flights affected the industry's capacity growth as well, which was down 580 bps on month-on-month (MoM) basis. Industry's revenue passenger kilometre (RPK) growth was also down 520 bps and overall load factor was down 260 bps.

Though grounding of Jet's operations has brought in the pricing power in the industry, significant rise in oil prices (up 33 percent since Jan 2019) would impact the operating profitability of the companies. Moreover, soaring ticket prices would stunt passenger growth, affecting the topline. Further, the stock prices of IndiGo and SpiceJet have risen significantly on the expectations of gaining Jet’s market share. While we are comfortable with IndiGo and SpiceJet's position, the current prices leave little room for comfort.

Operating Statistics for March 2019

IndiGo Interglobe Aviation (IndiGo), the leader in Indian aviation industry, is the clear winner and beneficiary of the problems of debt-laden Jet Airways. It registered a YoY passenger growth of 19 percent and expanded its market share by 300 bps. During the month of March 2019, it grew its capacity by 26 percent. In the month, load factor contracted to 86 percent from 88.4 percent it registered in the last month.

SpiceJet SpiceJet's growth momentum hit a speed breaker after grounding of Boeing 737 max due to safety concerns. It registered 7 percent YoY growth in its passengers.

It continues to maintain load factor above 90 percent but the same contracted by 100 bps (MoM). What is noteworthy in case of SpiceJet is the significant capacity addition by it. Its capacity registered a YoY growth of 13 percent.

GoAir A small player in Indian skies in terms of its market share also gained 100 bps market share for the month. It also witnessed a strong YoY passenger growth of 10 percent up 900 bps on MoM basis. It also maintained its load factor above 90 percent though it contracted by 120 bps on MoM basis. GoAir’s capacity addition growth was lower than other players.

Jet Airways Significant debt burden and interest outlay had started putting Jet Airways’ day to day operations under pressure and now the situation is such that it had to temporarily stop all its operations.

(Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here)Follow @NitinAgrawal65For more research articles, visit our Moneycontrol Research page.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.