After a gruelling March followed by a nimble recovery in April, the month of May saw some profit-booking in the first half followed by consolidation in the last week.

Overall, the Nifty50 fell 2.84 percent during May, though broader market outperformed the frontliners as Nifty Midcap index and smallcap index fell 1.7 percent and 1.84 percent, respectively, suggesting a shift in investor sentiment.

Despite, a rather gloomy month for the equities and capital market in general, the majority of the Portfolio Management Services (PMSes) schemes Moneycontrol looked at outperformed the benchmark, rising as much as 6.5 percent during May.

Nearly 60 percent, or 80 of the 133 PMSes, generated index-beating returns and about 24 schemes gave positive returns on a month-on-month basis during May, data collated by PMS AIF World, a research-backed financial services firm, shows.

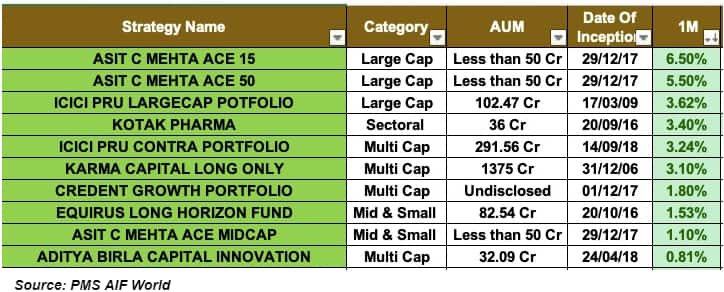

The top 10 PMSes across largecap, midcap & smallcap, multicap, sectoral and thematic schemes rose 1-6 percent.

Asit C Mehta Ace 15, a largecap based scheme, was the leader of the pack. The scheme is managed by Akhil Rathi - Vice President, PMS & Research at Asit C Mehta Investment Interrmediates.

As on May 30, 2020, Asit C Mehta Ace 15 had 20 stocks in its portfolio with a corpus of less than Rs 50 crore. It focuses primarily on largecap technology stocks while other major sectoral holdings are industrials, consumer discretionary, energy and financials.

Some of its top holdings include Aurobindo Pharma, Hero MotoCorp and HCL Technologies.

Closely following Asit C Mehta Ace 15 was another offering from the research house - Asit C Mehta Ace 50 - which returned 5.5 percent during May. Managed by Rathi, the PMS focuses on sectors such as technology, consumer discretionary, energy, financials and consumer staples.

As on May 30, Infosys, HCL Technologies and TCS were some of the major stocks in its 50-stock portfolio.

Other top performing PMSes were ICICI Prudential Largecap Portfolio, Kotak Pharma, ICICI Prudential Contra Portfolio and Karma Capital Long Only among others.

Speaking on the current investment scenario that has been heavily dictated by the COVID-19-led economic disruption, Kamal Manocha, CEO and Chief Strategist at PMS AIF World said that despite the unprecedented times, 2020 presents a good opportunity to long-term investors who have a 10-year investment horizon.

"As far as equity investments are concerned, we see the year 2020 more from the perspective of opportunity rather than fear. Our stance is to be cautiously optimistic," he wrote in a monthly newsletter.

"Invest in quality, understand risk, review consistency. This means portfolios comprising of debt-free businesses, backed by credible research, philosophy and consistent performance track record," Manocha wrote adding that investors should follow asset allocation diligently.

Portfolio Management Services cater to wealthy investors and the professional fee charged by them is slightly higher than regular mutual funds (MFs). The minimum investment in a PMS scheme is Rs 50 lakh in India.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!