One of the questions that everyone from seasoned investors to newbies in the market ask is: How much returns do you expect in the markets?

And the figure most have in mind is that Indian equity markets compound at 15-16 percent per annum. The reason?

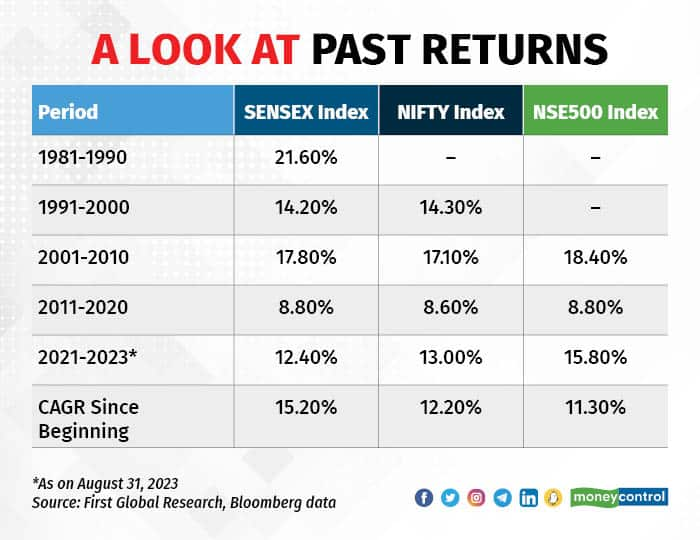

That has been roughly how the Sensex has annually compounded returns in the little over four decades it has been in existence.

But what you may not know is these returns vary hugely, not just year to year but over very long periods of time.

The returns, i.e., the compounded annual growth rate (CAGR) from the Indian market each DECADE have been 21.6 percent in the 1980s, 14.2 percent in the 1990s, 17.8 percent in 2001-10 and a mere 8.8 percent in 2011-20!

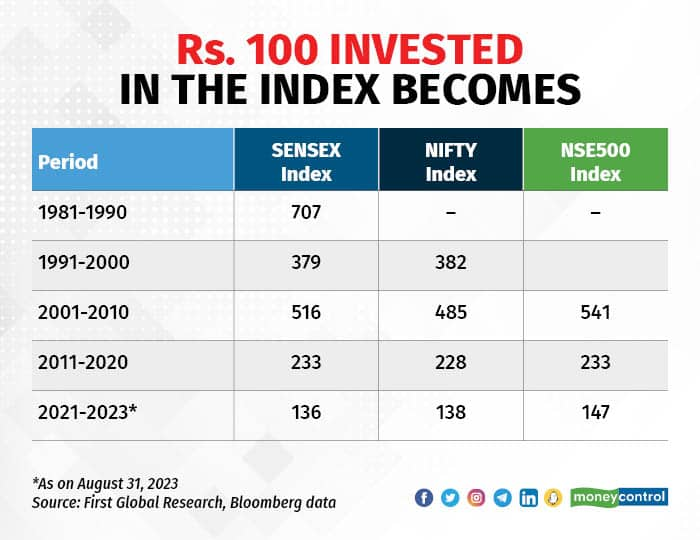

And even these numbers do not really capture the magnitude of the difference we are talking about.

Thus Rs. 100 invested in 1981 would have become over 700 by 1990 i.e. gone up 7 times.

In contrast, money invested in Indian equity indexes in 2011 would have gone up only around 2.3 times over the whole decade.

Once you account for the fact that inflation averaged over 5 percent in that decade and fixed deposit rates were also over 7 percent for a number of years in this period, you did not really get compensated for taking the additional risk of investing in equities.

Also read: Staff churn rises for banks, may impact productivity: Jefferies

And this is without picking and choosing the entry and exit points.

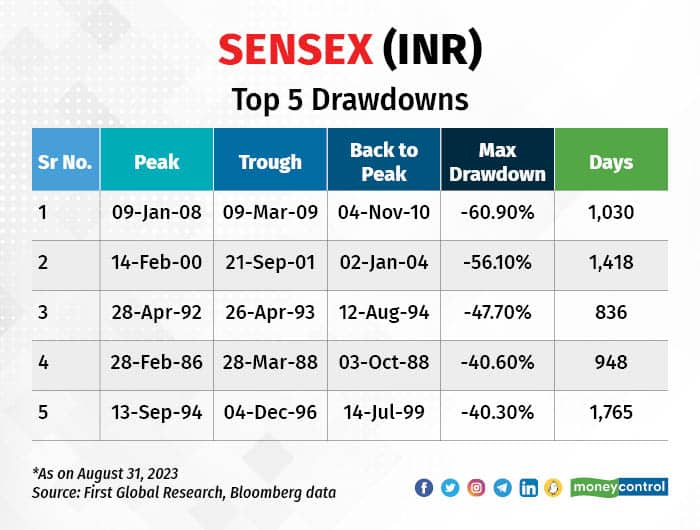

If one looks at highs and lows, the differences can be even starker.

For example, the top five losing streaks of the Sensex brought it down by 40 percent to a whopping 60 percent-plus.

In case you needed any reminders that equity returns can be volatile!

Subconsciously, a number of investors think of volatile returns as meaning that equity markets returns can vary widely within a range, that is returns can go up and down. But the real killer is that your very capital can be eroded substantially in the interim.

Also read: Jupiter Life Line Hospitals IPO offers growth, market dominance. Should you subscribe?

And this is not a peculiarity of the Indian market.

If one looks at the well-known US indexes, we see this same pattern of very stark differences in compounding, not only in individual years but for decades altogether. Thus the S&P 500 compounded at 4.7 percent in the 1960s, 4 percent in the 1970s and then accelerated to 9.3 percent in the 1980s and nearly 15 percent in the 1990s.

Of course in the first decade of this century, the US indexes gave no returns whatsoever!

Even if one looks at a 20-year period, money invested at the beginning of the 1960s in the S&P 500 would have risen to only 2.3 times over the 20 years to 1980.

But equity investments rose nearly 10 times in the next 20 years of the eighties and nineties, making certain investors and fund managers appear brilliant.

You might think that understanding history is all very well, but is this information of any use in the real world?

The short answer: it is.

While just because a market (or a sector/stock) has underperformed for two years, three years, five years, or even 10 years does not mean that it will outperform in the next period, if a decisive change in trend does happen, it is likely to be sustained.

When the market came out of the whole decade (2011-20) of low returns, it was clear that the outperformance would continue...which is something I have been pointing out since 2021.

This was a period when the Indian market came out of its trend of underperformance both relative to its own history as well as relative to global markets. Hence it did outperform significantly in both 2021 and 2022.

That is also why the risk of a crash remains low because the market is still much below its long-term trend line.

The risk of a crash becomes high when markets are way above their long-term trend.

This is why even in current markets the risk is of missing out on an upmove rather than risking a crash - at least in the large-cap, stable end of the market. Will write about the small-cap saga another time.

Always step back, look at data, analyse the big picture and you will get insights that you never will when you are caught up in trying to 'understand' day-to-day stock price movements, which, (surprise surprise !) are actually mostly random noise with no underlying causes.

(Devina Mehra is the Founder and Chairperson of First Global, a leading Indian and Global investment Management firm. She is a gold medalist from IIMA and has been in the Investment business for over 30 years. She tweets @devinamehra and can be contacted at info@firstglobalsec.com or www.firstglobalsec.com)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.