It's the final countdown to the Budget 2020 and volatility is one the rise. After falling for the first two days of the Budget week, Nifty found some stability on Wednesday.

The market is likely to remain volatile ahead of January F&O expiry, and then it will react to the announcements on the Budget Day on Saturday, 1 February. Most experts feel that the upside remains capped and chances of some bit of profit-taking are much higher in case the Budget disappoints D-Street.

“The expectations are high we can expect major volatility. We feel upside is not more than 3 to 4 percent but if the budget fails to fulfill expectations then sell-off would be more severe,” Shrikant Chouhan, Senior Vice-President, Equity Technical Research, Kotak Securities told Moneycontrol.

“The strategy should be to buy deep out of money put options of 11,700 so that loss will be minimal,” he said.

From a markets standpoint, any extension in the timeline of LTCG on shares from 12 months to 24 months, and a cut in personal income tax cut will be cheered by investors.

Taxpayers expect the deduction under section 80C of the Act to increase from 1.5 lakh to at least 2.5 lakh which is unchanged for the past six years. On the other hand, sectors like Real estate, Auto and insurance might get some relief from the upcoming Budget, suggest experts.

The government is likely to bite the bullet of a fiscal slippage (I-direct estimate of fiscal deficit at 3.8% for FY20E) as it believes resurrecting growth will be the key prerogative.

“The current need of the hour is to spur consumption, accelerate the investment cycle and employment as GDP for FY20E has slowed down to sub-5.0%. Hence, in our view, a slide in the fiscal deficit path would be a welcome step at this juncture provided it spurs consumption and revives employment and economic growth,” Dharmesh Shah, Head - Technical at ICICIdirect.com told Moneycontrol.

“The key areas of the Budget to watch would be how the government initiates policy measures that would boost local manufacturing as well as support job creation. Higher allocation on infrastructure side from the government will continue to remain key focus area,” he said.

We spoke to various experts and collated strategies which investors could deploy to save themselves from the event day volatility:Expert: Gaurav Garg, Head of Research at CapitalVia Global Research Limited- Investment AdvisorVIX (Volatility Index) has crossed its 200 Day Moving Average and thus we can see a lot of Volatility in upcoming sessions. In this scenario, high-value positions should not be made at a single point, but long positions should be initiated at every correction thus always initiating trades at optimum levels.

Straddle strategy can be a good choice in the upcoming Budget as the market may see a volatile trade. In a Straddle strategy, a trader purchases a call option and a put option on the same underlying with the same strike price and with the same maturity.

The strategy enables the trader to profit from the underlying price change direction, thus the trader expects volatility to increase.

Expert: Rajesh Palviya, Head Technical & Derivative Research at Axis Securities Ltd.During the volatile event of Budget, traders can opt for Iron Butterfly strategy as the range indicated in the option chain of 6th February 2020 weekly expiry is between 12,500 on the upside, and 12000 on the downside being highest open interest concentrated area.

The levels of 12500 Call has OI of 4.40 lakh share, and that of 12000 put having OI of 4.30 lakh as per recent data. In addition to this even current week 30th Jan 2020 expiry is also indicating a similar range further strengthening the probability of market most likely to trade in the above-mentioned range.

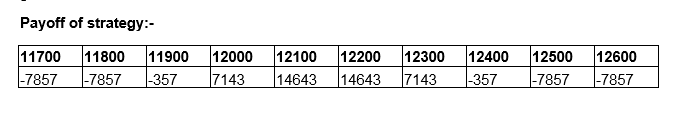

In this strategy traders need to sell one lot each of 12200 Call at Rs. 142 & 12100 Put at Rs.146 of 6th Jan 2020 expiry and simultaneously buy one lot each of 12500 CALL at Rs. 44 & 11800 PUT at Rs. 50 of 6th Jan 2020 expiry.

The total credit inflow for the strategy will be Rs 288 (142 + 146) and debit will be Rs. 94 (44+50) hence after netting off the net inflow from the strategy in terms of the premium will be Rs. 194 which is the maximum profit. The maximum loss in this strategy is Rs. 7900/- while the profit is Rs. 14600/-.Upper BEP or break-even-point is at 12400, and the lower BEP is 11900.

If Nifty closes around the level of Rs 12200 on the expiry date of 6th Jan 2020, then the Long Call option at the higher strike price and Long Put option at the lower strike price which we bought to avoid the risk of unlimited loss will expire worthless.

While the sold Call and Put options premium will shrink which will almost expire close to zero ultimately generating gains.

Nifty should move towards 12600 in the coming weeks. One can adopt the Call ratio strategy to ride the gradual upsides with limited risk on declines.

In this strategy, 1 lot of Nifty 12200 Feb Call option can be bought at 220-230 and 2 lots of 12600 Feb Call options can be sold at 75-80.

The net premium outflow is approx. 70 which is the maximum loss if Nifty declines. The strategy gains 330 points if it reaches 12600. Not only this, it (the strategy) remains profitable till 12930.

Expert: Ajit Mishra, VP Research, Religare BrokingThe Nifty could not surpass the hurdle at 12,400 last week and witnessing profit-taking since then. Considering the sharp directional move from roughly 11,100-12,400 in the last three months, indications are in the favour of profit-taking to continue, followed by consolidation.

We might see the index drifting towards 11,900-11,950 so traders may consider a bearish options strategy- Bear spread.

Traders could buy Nifty Feb 6 12100 PE at 152 and Sell Feb 6 Nifty 11900 PE at 78, Net Premium Paid 74.

Breakeven point = 12026 Level

Maximum Profit = Strike difference – Net Premium Paid

= 200-74 = 126 points

Maximum Loss = Net Premium Paid i.e. 74 Points.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.