The benchmark indices corrected 1.1 percent on May 9, extending their downtrend for another session amid geopolitical tensions between India and Pakistan. Market breadth was dominated by bears, with approximately 1,719 shares under pressure compared to 824 advancing shares on the NSE. Rangebound trading is expected to continue in the upcoming sessions. Below are some short-term trading ideas to consider:

Rajesh Palviya, Senior Vice President Research (Head Technical Derivatives) at Axis Securities

UPL | CMP: Rs 674.75

On the daily and weekly timeframes, UPL is trending higher, forming a series of higher tops and bottoms. The stock is well-positioned above its 20-day, 50-day, 100-day, and 200-day Simple Moving Averages (SMAs), all of which are also inching upwards alongside rising prices—reconfirming bullish sentiment. The weekly and monthly RSI (Relative Strength Index) indicate potential buying interest at current levels. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 730, Rs 755

Stop-Loss: Rs 650

Astra Microwave Products | CMP: Rs 882

On the weekly chart, Astra Microwave has shown the fastest "V" shape recovery at the Rs 860 level. This breakout is accompanied by huge volumes, signifying increased participation. With Friday's close, the stock has decisively surpassed its eight-month "multiple resistance" zone around Rs 870, indicating a strong comeback of bulls. The daily, weekly, and monthly RSI indicators suggest that buying may occur at current levels. The stock is trading well above its 20-day, 50-day, 100-day, and 200-day SMAs, reconfirming bullish sentiment. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 955, Rs 1,060

Stop-Loss: Rs 860

Gokaldas Exports | CMP: Rs 967.3

Since September 2023, Gokaldas Exports has been consolidating within the Rs 720–1,100 range, representing a short- to medium-term sideways trend. Recently, the stock rebounded from its lower-end support zone of Rs 730–720 with high volumes, indicating increased participation near the support level.

A bullish crossover of the 20-day and 50-day SMAs further confirms bullish sentiment. The daily and weekly RSI indicators suggest buying interest at current levels. A "bullish gap area" formed on May 7, 2025, around Rs 899–880 indicates buying pressure at lower levels. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 1,140, Rs 1,215

Stop-Loss: Rs 860

Rajesh Bhosale, Technical Analyst at Angel One

Tata Motors | CMP: Rs 708.5

On the daily chart, Tata Motors has confirmed a Cup and Handle pattern and is displaying a Higher Top Higher Bottom structure for the first time in several months. Despite broader market weakness, it has shown notable strength, supported by robust volumes. The price has also closed above the 89-day Exponential Moving Average (89DEMA) for the first time since September, signaling a potential return of bullish momentum. Hence, we recommend buying Tata Motors around Rs 708–Rs 702.

Strategy: Buy

Target: Rs 770

Stop-Loss: Rs 679

Solar Industries India | CMP: Rs 13,487

Solar Industries has witnessed a remarkable rally in recent sessions. On the daily chart, the stock has given a Flag pattern breakout and surged past last year’s swing high, entering uncharted territory. The breakout is backed by strong volumes, reinforcing bullish sentiment and indicating potential for further upside. We recommend buying Solar Industries India around Rs 13,487–Rs 13,450.

Strategy: Buy

Target: Rs 14,700

Stop-Loss: Rs 12,900

Anshul Jain, Head of Research at Lakshmishree Investments

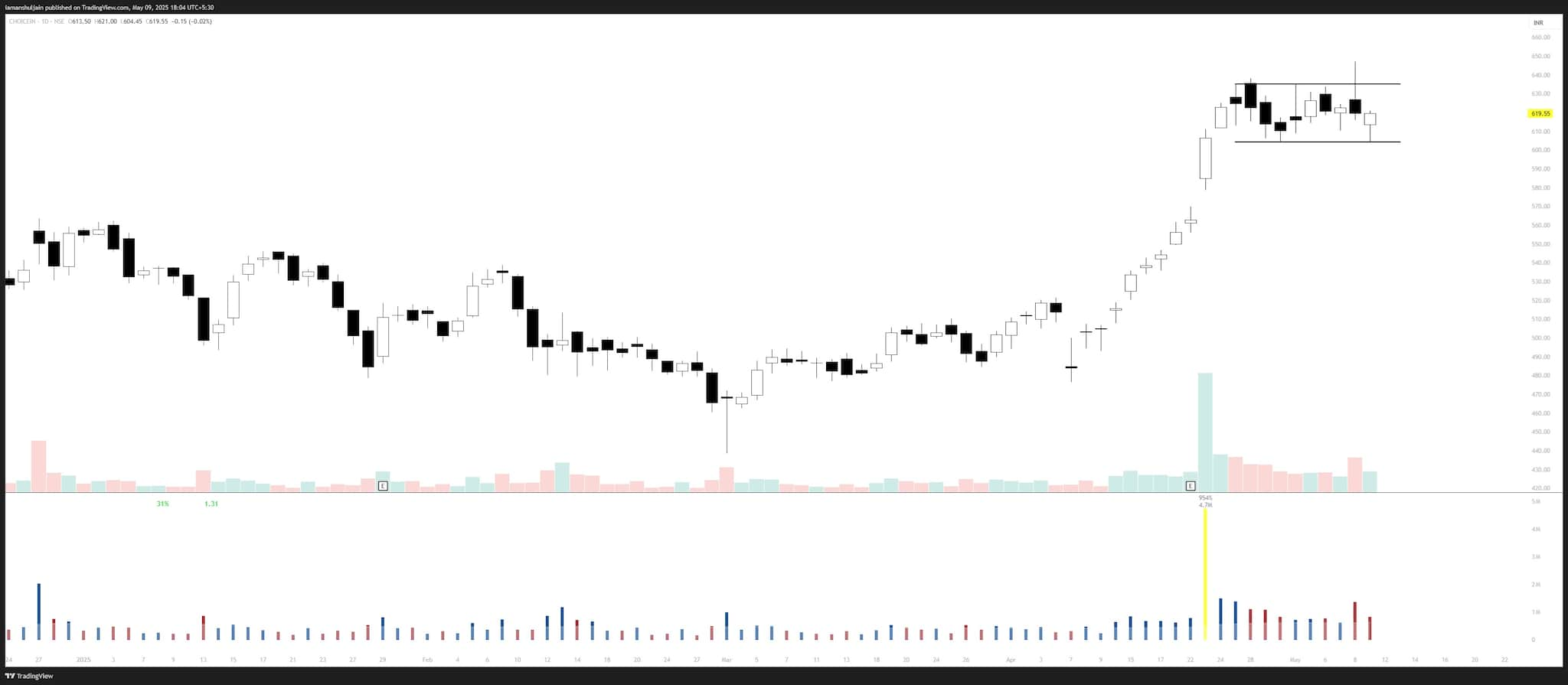

Choice International | CMP: Rs 619.55

Choice International is forming a bullish 10-day flat base, with a pivot breakout level near Rs 640. The pole saw above-average volumes, indicating strong buying interest. The stock is currently consolidating on the 10-day EMA, with a 20-day EMA catch-up likely. A sustained move above Rs 640 could trigger a fresh rally, with an immediate upside target of Rs 700. Traders should watch for volume confirmation on the breakout to validate the strength of the move.

Strategy: Buy

Target: Rs 700

Stop-Loss: Rs 580

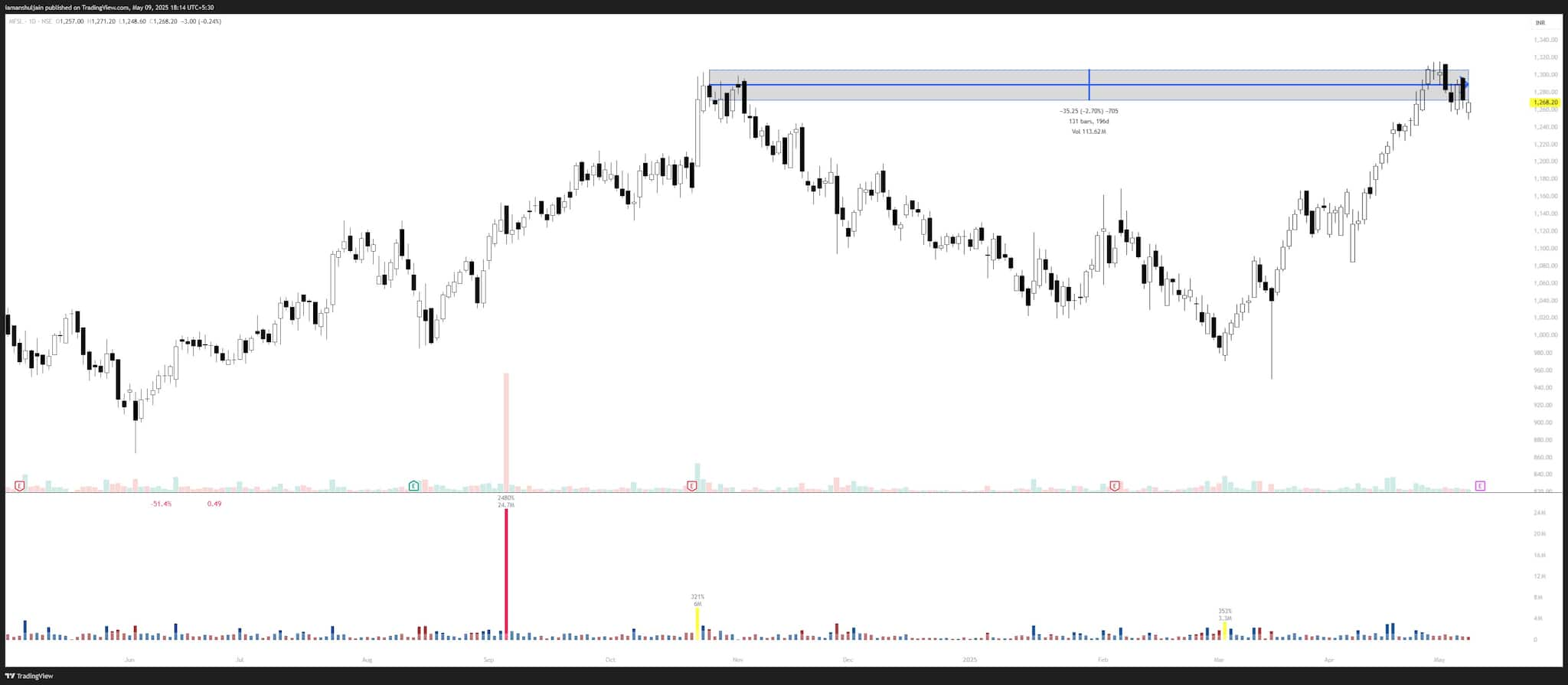

Max Financial Services | CMP: Rs 1,268.2

Max Financial Services is forming a bullish Cup and Handle pattern on the daily chart, with the handle resembling a flag formation. The pivot breakout level is around Rs 1,310. While volumes have stayed subdued during the base formation, a high-volume breakout above the pivot would confirm bullish momentum. If the breakout sustains, the stock could quickly move toward the Rs 1,400 mark. Traders should monitor volume activity closely, as it will be key to validating the breakout strength.

Strategy: Buy

Target: Rs 1,400

Stop-Loss: Rs 1,228

HDFC Life Insurance Company | CMP: Rs 713.6

HDFC Life is forming a massive 219-week Cup and Handle pattern on the weekly chart, signaling a long-term bullish setup. The stock is consolidating just below the pivot breakout level of Rs 753, with low volumes during this phase—typical of a healthy base formation. A breakout above Rs 753 with strong volume could trigger a major uptrend, with bulls eyeing an initial target of Rs 835. This setup offers a compelling risk-reward ratio for positional traders awaiting confirmation.

Strategy: Buy

Target: Rs 835

Stop-Loss: Rs 670

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!