The benchmark indices bounced back after a two-day correction, ending with 0.2 percent gains on July 4, supported by improving market breadth. A total of 1,424 shares saw buying interest compared to 1,213 declining shares on the NSE. Consolidation is expected to continue in the upcoming sessions, with resistance and support at last week's high-low. Below are some short-term trading ideas to consider:

Rajesh Palviya, Senior Vice President Research (Head Technical Derivatives) at Axis Securities

Relaxo Footwears | CMP: Rs 464.75

For the past four months, Relaxo Footwears has been consolidating within the Rs 393–458 range. However, Friday's strong momentum helped the stock decisively surpass Rs 458 on a closing basis, signaling a strong comeback by the bulls. This breakout was supported by huge volumes, indicating increased participation.

Additionally, the stock has witnessed a short-term trend reversal, forming a series of higher tops and bottoms. It is well-placed above its 20-, 50-, and 100-day SMAs, reaffirming a bullish trend. The daily and weekly Bollinger Bands have given a buy signal, indicating rising momentum. The RSI across daily, weekly, and monthly charts shows increasing strength.

Strategy: Buy

Target: Rs 505, Rs 530

Stop-Loss: Rs 455

Chennai Petroleum Corporation | CMP: Rs 771.15

On both daily and weekly charts, Chennai Petroleum Corporation has undergone a short-term trend reversal, forming a series of higher highs and higher lows. On the daily chart, the stock has confirmed a multiple resistance breakout at Rs 735 on a closing basis. This move was supported by significant volumes, highlighting strong market interest.

The stock remains comfortably above its 20-, 50-, 100-, and 200-day SMAs, confirming the bullish bias. The daily and weekly RSI indicates rising strength, while the Bollinger Bands on the daily chart also signal increased momentum.

Strategy: Buy

Target: Rs 855, Rs 930

Stop-Loss: Rs 730

Transrail Lighting | CMP: Rs 742.65

With the recent weekly close, Transrail Lighting has decisively broken above the multiple resistance zone of Rs 700 on a closing basis, reflecting a positive bias. It also registered a new all-time high at Rs 747, indicating strong bullish sentiment. This breakout was accompanied by heavy volumes, suggesting robust participation. The stock is trading above its 20-, 50-, and 100-day SMAs, reaffirming its bullish trend. A daily Bollinger Bands buy signal and rising daily and weekly RSI support further upside potential.

Strategy: Buy

Target: Rs 813, Rs 920

Stop-Loss: Rs 710

Osho Krishan, Chief Manager - Technical & Derivative Research at Angel One

CCL Products | CMP: Rs 884.4

CCL Products has shown renewed momentum over the past few weeks, maintaining a higher highs–higher lows structure. The uptrend began with a reversal from the breakout neckline on the weekly chart, followed by a V-shaped recovery, indicating growing market interest and potential trend continuation. The ADX indicator shows strength on both daily and weekly charts, reinforcing the bullish outlook. Hence, buying is recommended on dips around Rs 880–870.

Strategy: Buy

Target: Rs 1,000, Rs 1,020

Stop-Loss: Rs 810

Bharat Forge | CMP: Rs 1,314.5

Bharat Forge has experienced a decent move and is now consolidating above all significant EMAs and the 200-day SMA. The stock's strength is supported by rising trading volumes and positive momentum. Additionally, it has formed a higher low pattern on the daily chart, along with a positive EMA crossover, enhancing its bullish profile. Technical indicators align with the ongoing momentum. Therefore, buying on dips around Rs 1,300 is recommended.

Strategy: Buy

Target: Rs 1,400, Rs 1,420

Stop-Loss: Rs 1,240 |

Marksans Pharma | CMP: Rs 263

Marksans Pharma has witnessed a gradual resurgence over the last few sessions, culminating in a strong weekly close. The counter is now firmly above all its short-term EMAs on the daily timeframe for the first time in a while, suggesting inherent strength. Notably, it has experienced an Inverted Head and Shoulders breakout, backed by a positive MACD crossover from its signal line, indicating momentum is building. Thus, buying around Rs 260 is advised.

Strategy: Buy

Target: Rs 290, Rs 300

Stop-Loss: Rs 240

Anshul Jain, Head of Research at Lakshmishree Investments

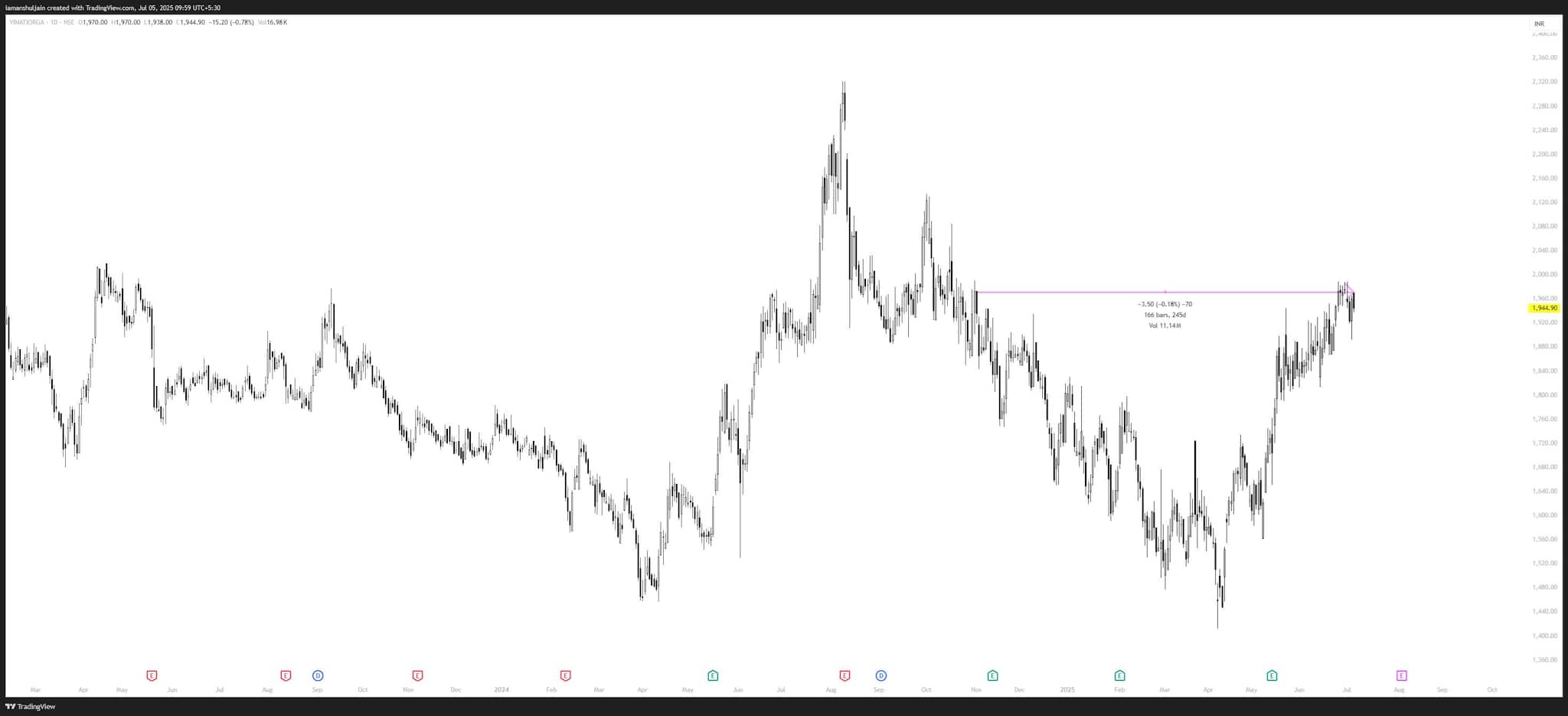

Vinati Organics | CMP: Rs 1,944.9

Vinati Organics is on the verge of breaking out of a 166-day-long rounding bottom pattern, signaling a potential trend reversal. The base structure includes multiple accumulation candles with volumes exceeding 5x the 50-day average, pointing to strong institutional buying. A pre-breakout candle formed on Thursday, often seen before a breakout. A decisive close above Rs 1,980 could trigger fresh momentum, potentially taking the stock towards Rs 2,200 levels.

Strategy: Buy

Target: Rs 2,200

Stop-Loss: Rs 1,900

Titan Company | CMP: Rs 3,686.9

Titan broke out of a 94-day Cup and Handle pattern at Rs 3,650 in mid-June and has since been consolidating for seven sessions. Friday’s candle signals the start of fresh momentum and hints at a possible next leg up. The Rs 3,600–3,650 zone will act as strong support, and any dips into this zone can be used to add. A sustained move above Rs 3,720 may accelerate momentum, opening the path toward its all-time high and a potential move to Rs 3,925.

Strategy: Buy

Target: Rs 3,925

Stop-Loss: Rs 3,600

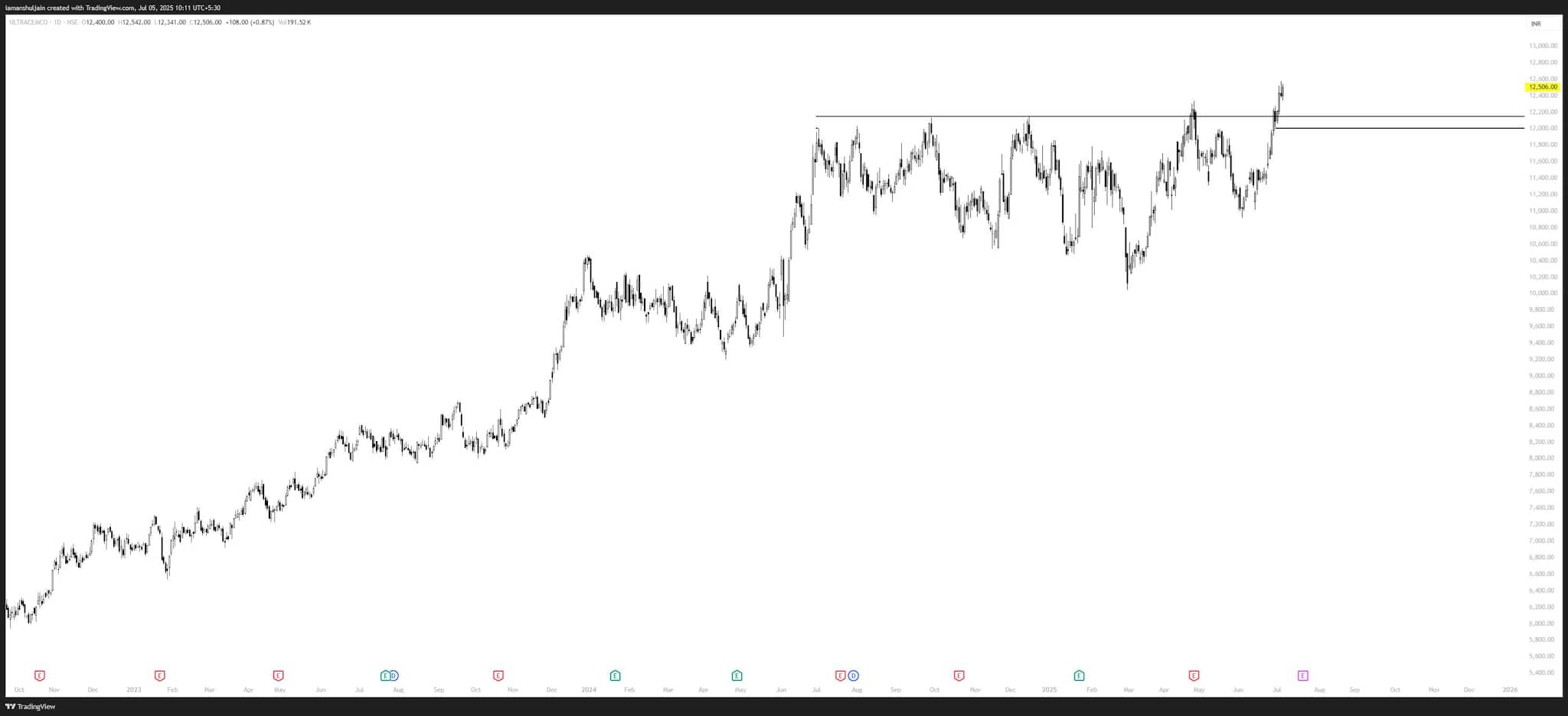

UltraTech Cement | CMP: Rs 12,506

UltraTech Cement has broken out of an inverse Head and Shoulders pattern at Rs 12,200 on the daily charts and closed above this level on a weekly basis, offering strong technical confirmation. Any dip toward Rs 12,200 should be seen as an opportunity to add longs.

The stock’s daily and weekly moving averages and momentum indicators are aligned to support a sustained uptrend. While breakout volumes were muted (common in large-cap stocks), base volumes indicate steady institutional accumulation, reinforcing the bullish view.

Strategy: Buy

Target: Rs 15,500

Stop-Loss: Rs 11,500

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.