The market failed to sustain its morning rally and finished lower on March 10, with selling almost across sectors and a sharp correction in the broader markets. Additionally, the VIX spiked to 14. The market breadth turned negative, with about 2,171 shares declining against 500 rising shares on the NSE. Hence, the benchmark indices, as well as broader markets, might extend the weakness. Below are some trading ideas for the near term:

Jigar S Patel, Senior Manager - Equity Research at Anand Rathi

PB Fintech | CMP: Rs 1,425.4

Policy Bazaar has corrected sharply from the Rs 2,200+ zone and has entered oversold territory. Currently, the stock has found support at its 89-week EMA (Exponential Moving Average), aligning with key technical support levels. Additionally, the weekly RSI (Relative Strength Index) is in the oversold zone, indicating a potential rebound in the coming sessions. Traders may consider taking buy positions in the Rs 1,390-1,410 zone, with a target of Rs 1,480.

Strategy: Buy

Target: Rs 1,480

Stop-Loss: Rs 1,360

Emami | CMP: Rs 568.15

Emami is forming a double bottom near the Rs 510-520 zone and is rebounding from its 200-week EMA. Additionally, the weekly RSI is showing positive divergence and turning upward from the 40 support level, indicating a potential recovery in the coming sessions. Traders may consider entering buy positions on dips near the Rs 550 zone, with a target of Rs 600.

Strategy: Buy

Target: Rs 600

Stop-Loss: Rs 525

Sarda Energy and Minerals | CMP: Rs 502.55

Sarda Energy has been an outperformer, trading near its lifetime high. The stock has confirmed a range breakout near the highs with strong volumes. Additionally, we are witnessing a range shift in the daily RSI, indicating continued strength. Traders may consider entering buy positions near the Rs 490 zone, with a target of Rs 530.

Strategy: Buy

Target: Rs 530

Stop-Loss: Rs 470

Jay Thakkar, Vice President & Head of Derivatives and Quant Research at ICICI Securities

Reliance Industries Futures | CMP: Rs 1,240

Reliance Industries has reversed sharply on account of short covering in the stock. The options activity also suggests that there is a strong Put base until Rs 1,200 levels. As long as these levels are held on a closing basis, the stock is likely to bounce back to Rs 1,300, where the highest Call open interest (OI) resides. In the near term, it is trading above its maximum pain level of Rs 1,230, as well as its 20-day VWAP (Volume Weighted Average Price) level of Rs 1,216, which is a positive sign. Hence, we suggest buying Reliance Industries futures in the range of Rs 1,240 to Rs 1,220.

Strategy: Buy

Target: Rs 1,280, Rs 1,300

Stop-Loss: Rs 1,180

SRF Futures | CMP: Rs 2,906

SRF Futures has provided a breakout from a huge consolidation due to sharp short covering in the stock. As a result, the stock has managed to outperform the markets as well as trade near its lifetime highs. The OI in the futures is at its 1-year low, so the overall positions in the stock are quite low now. There is a positive chance of long buildup from here, which can help the stock to further trend higher. The stock is trading well above its maximum pain level, as well as its 20-day VWAP levels. The immediate resistance is at Rs 3,000, where the highest call OI resides. Hence, the upside probability is higher in this stock. We advise buying SRF futures in the range of Rs 2,910 to Rs 2,880.

Strategy: Buy

Target: Rs 2,970, Rs 3,040

Stop-Loss: Rs 2,840

Nestle India Futures | CMP: Rs 2,258.7

Nestle India Futures has witnessed huge shorts in the futures. However, recently the prices have reversed from the lower levels, i.e., from Rs 2,100, for the second time. This indicates that, in the medium term, Rs 2,100 will act as a very critical support going forward. As long as these levels are held, there is a high chance of short covering in this series. This has been confirmed with the options activity as well, where there is a good Put base at Rs 2,100 and Rs 2,080 levels, as well as at Rs 2,200 in the nearest strike.

The PCR (Put Call Ratio) is at 1.39, which is positive, and the stock has managed to close above its 20-day VWAP level. So, overall, there is a higher chance of further short covering from here. We advise buying Nestle India futures in the range of Rs 2,260 to Rs 2,230.

Strategy: Buy

Target: Rs 2,350, Rs 2,400

Stop-Loss: Rs 2,180

Anshul Jain, Head of Research at Lakshmishree Investments

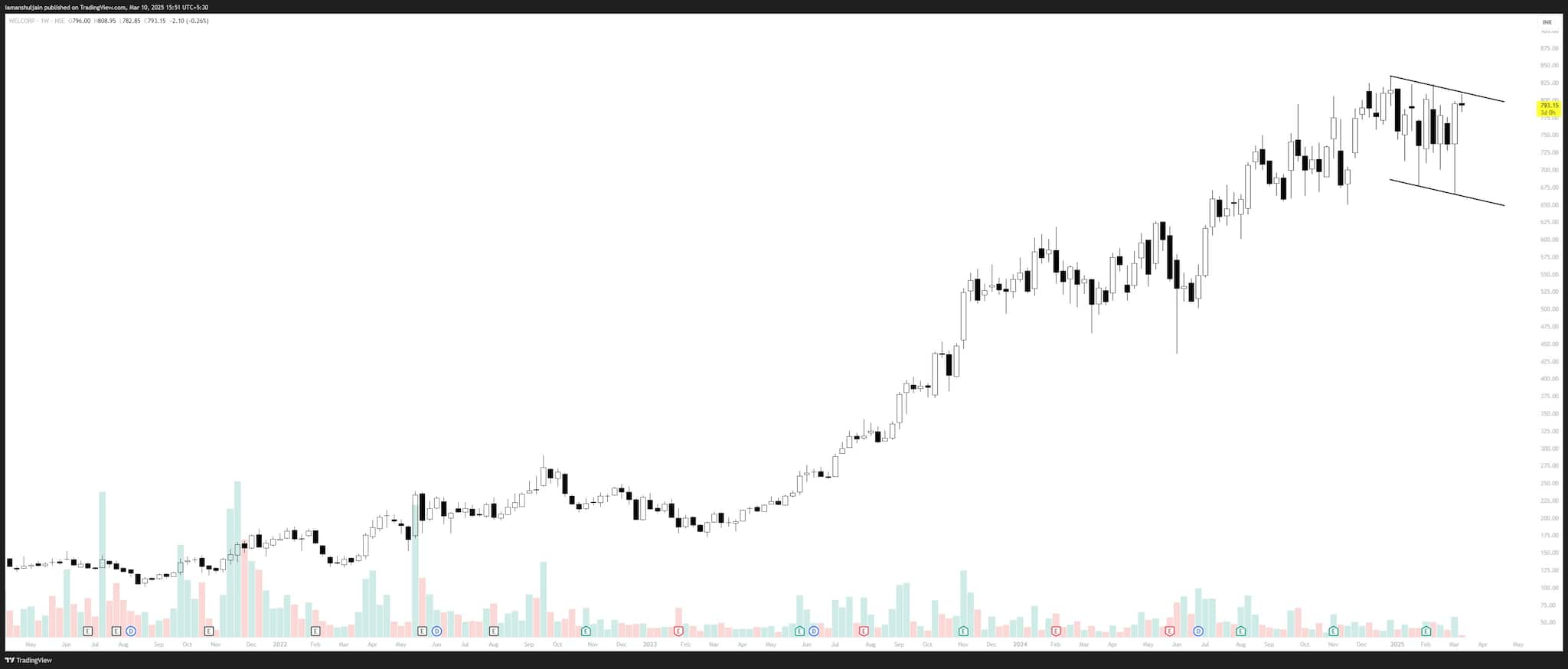

Welspun Corp | CMP: Rs 793.15

Welspun Corp is forming a bullish flag pattern on the daily chart, spanning 12 weeks. Notably, volume trends confirm accumulation, with diminishing volume on down weeks and rising volume on up weeks. Last week’s candle saw above-average volume, a strong precursor to a breakout. A sustained move above Rs 810 will confirm the breakout, potentially propelling the stock toward Rs 950. Investors should watch for sustained strength, as this pattern signals strong upside momentum.

Strategy: Buy

Target: Rs 850

Stop-Loss: Rs 770

InterGlobe Aviation | CMP: Rs 4,627.55

IndiGo has decisively broken out of a weekly pennant at Rs 4,600, backed by a surge in volumes. The current session appears to be a healthy consolidation before the next leg up. A sustained move above Rs 4,650 will ignite immediate momentum, pushing the stock higher. Additionally, the bullish alignment of daily moving averages reinforces the uptrend, acting as a strong propeller. Investors should watch for follow-through buying to confirm the breakout’s strength.

Strategy: Buy

Target: Rs 4,825

Stop-Loss: Rs 4,575

JSW Steel | CMP: Rs 1,013.5

JSW Steel is on the verge of a bullish breakout from an 18-week-long cup and handle pattern at Rs 1,020. Volume trends are ideal, confirming strong accumulation, while bullishly aligned daily moving averages act as a propeller for further upside. Additionally, the stock and sector’s relative strength have turned outperforming, signaling strong momentum. A decisive breakout above Rs 1,020 could pave the way for significant gains, making JSW Steel a potential big winner ahead.

Strategy: Buy

Target: Rs 1,150

Stop-Loss: Rs 980

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.