Key indices Sensex and Nifty yet again closed with losses on August 3, extending their losing run into the fourth consecutive session, due to sustained selling amid weak global cues.

Experts point out that the global cues were negative as US lawmakers struggled to finalise a new stimulus plan while COVID-19 cases continue to rise globally. On the domestic front, banking stocks witnessed profit-booking today ahead of the RBI monetary policy on August 4-6.

Nifty closed 182 points, or 1.64 percent, down at 10,891.60 while Sensex finished 667 points, or 1.77 percent, down at 36,939.60.

"We expect weakness in Nifty to continue towards 10,800 then 10,650-10,600. Hence, we would advise investors to remain defensive in their portfolio approach," said Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services.

"Traders, on the other hand, are advised to stay cautious and keep booking profits at regular intervals. Going ahead, investors would watch out for any development over the US stimulus announcement and RBI credit policy for a possibility of another rate cut - which could provide some cheer to the markets."

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels for the Nifty

According to pivot charts, the key support level for the Nifty is placed at 10,829.87, followed by 10,768.13. If the index moves up, the key resistance levels to watch out for are 11,005.67 and 11,119.73.

Nifty Bank

The Nifty Bank index closed 2.62 percent lower at 21,072.10. The important pivot level, which will act as crucial support for the index, is placed at 20,887.73, followed by 20,703.37. On the upside, key resistance levels are placed at 21,400.13 and 21,728.17.

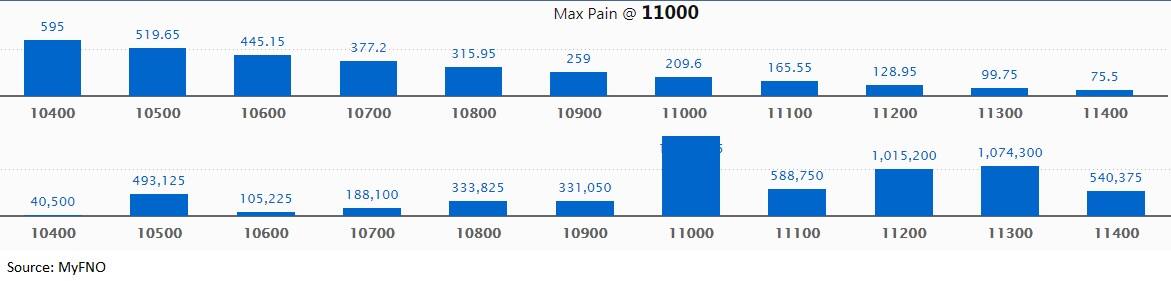

Call option data

Maximum call OI of nearly 17 lakh contracts was seen at 11,000 strike, which will act as crucial resistance in the August series.

This is followed by 11,300, which holds 10.74 lakh contracts, and 11,200 strikes, which has accumulated 10.15 lakh contracts.

Call writing was seen at 11,000, which added 6.1 lakh contracts, followed by 11,400, which added 1.4 lakh contracts.

Call unwinding was seen at 10,600, which shed 1,950 contracts.

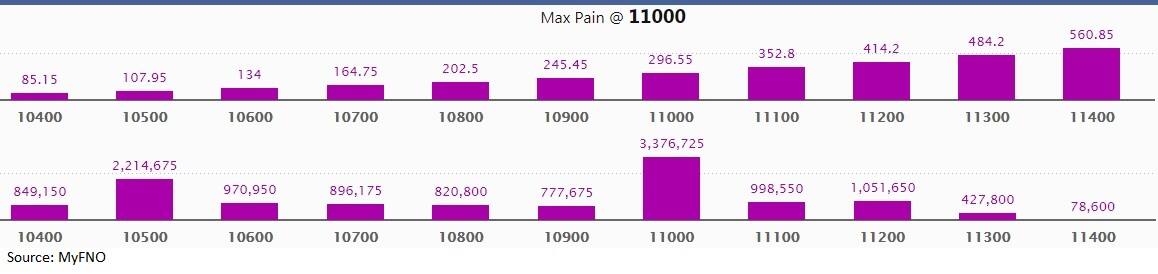

Put option data

Maximum put OI of 33.77 lakh contracts was seen at 11,000 strike, which will act as crucial support in the August series.

This is followed by 10,500, which holds nearly 22.15 lakh contracts, and 11,200 strikes, which has accumulated 10.52 lakh contracts.

Put writing was seen at 10,700, which added 1.94 lakh contracts, followed by 10,600, which added 1.63 lakh contracts.

Put unwinding was witnessed at 11,200, which shed 2.74 lakh contracts, followed by 11,100, which shed 1.54 lakh contracts.

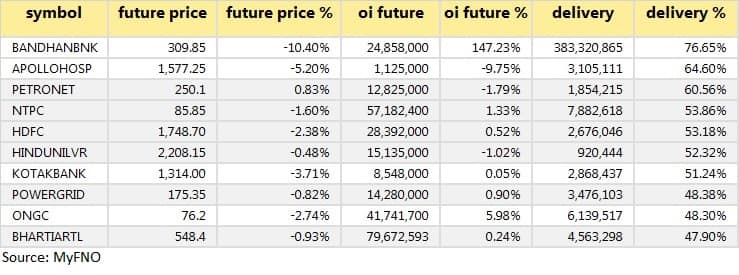

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

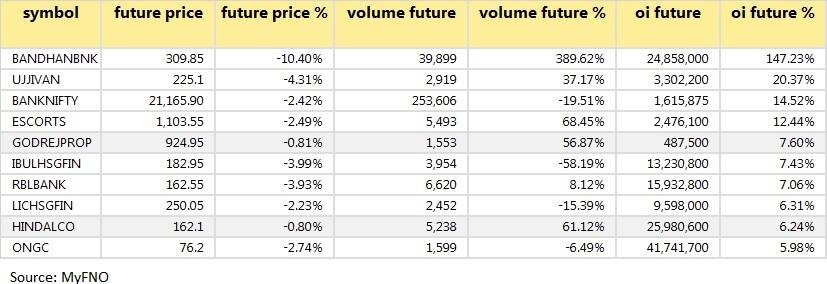

21 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

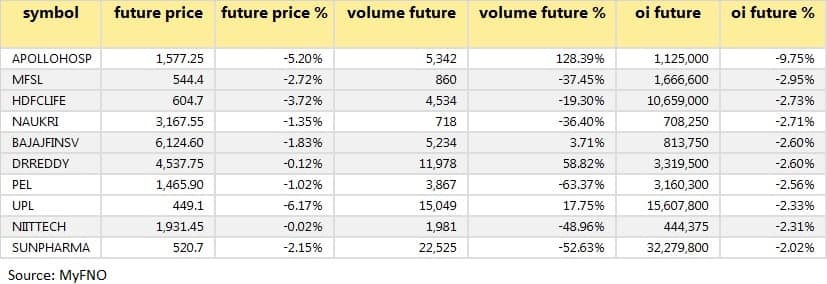

29 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

66 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

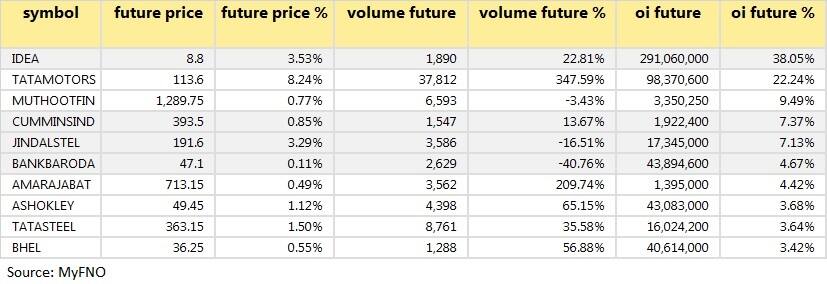

23 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

(For more bulk deals, click here)

Results on August 4

Marksans Pharma, MRPL, Godrej Consumer Products, Gujarat Gas, Century Enka, Astral Poly Technik, Apollo Pipes, Dixon Technologies, Eris Lifesciences, Geojit Financial Services, Hikal, Igarashi Motors, Jindal Saw, JMT Auto, Neuland Laboratories, Sun Pharma Advanced, Taj GVK and Tata Consumer Products, etc.

Stocks in the news

Exide Industries Q1: Net loss at Rs 13.56 crore against a profit of Rs 161.58 crore, revenue down 31.1 percent at Rs 2,526.11 crore versus Rs 3,664.18 crore, YoY.

KEC International: The company has secured new orders of Rs 1,192 crore across its various businesses.

Alembic Pharma:QIP issue opened today, floor price set at Rs 980.75 per share.

Bank of India:The lender deferred the capital raising plan to the next board meeting.

Dhanlaxmi Bank Q1: Net profit came at Rs 6.1 cr against Rs 19.8 cr YoY. NII came at Rs 79 cr against Rs 90.1 cr YoY.

Sagar Cements:India Ratings and Research affirmed credit rating for the company's bank facilities, as 'IND A-', with a stable outlook.

BSE Q1: Standalone profit came at Rs 32.34 cr against Rs 34.36 cr YoY. Total income stood at Rs 138.08 cr against Rs 142.35 cr YoY.

Indian Overseas Bank:CRISIL reaffirmed its ratings on the bank's bonds and deposit programme.

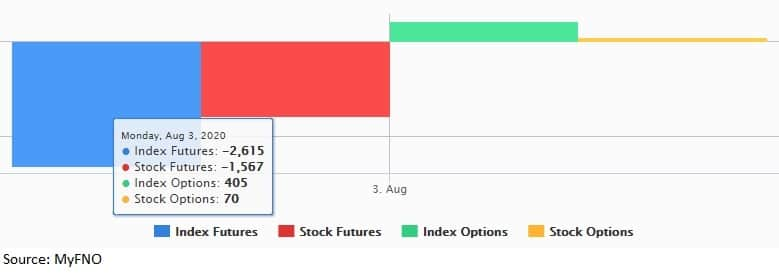

Fund flow

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 7,818.49 crore while domestic institutional investors (DIIs) sold shares worth Rs 135.55 crore in the Indian equity market on August 3, as per provisional data available on the NSE.

Stock under F&O ban on NSE

There is no stock under the F&O ban for August 4. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.