The market paused its eight days winning streak on March 22 as benchmark indices closed lower with market breadth in favour of declines. The 30-share BSE Sensex fell 222.14 points at 38,164.61, and the Nifty was down 64.10 points at 11,456.90.

Nifty faced resistance from strong medium-term trend line placed around 11,570 and slipped lower validating stochastic negative divergence in a volatile session on March 22. The index formed bearish engulfing, a bearish candlestick pattern that suggests halt in up move and reversal of the trend in the short term, said Shabbir Kayyumi, Head of Technical Research, Narnolia Financial Advisors.

As long as the index is trading below March 22 pivot point placed around 11,525, the possibility of filling gap placed in the range 11,343-11,370 cannot be ruled out, while a decisive close above 11,525 will resume up move, he added.

The Nifty Midcap index fell 0.6 percent and Smallcap index also ended lower by 0.4 percent.

We have collated top 15 data points to help you spot profitable trades:Key support and resistance level for Nifty

The Nifty closed at 11,456.9 on March 22. According to the Pivot charts, the key support level is placed at 11,403.33, followed by 11,349.77. If the index starts moving upward, key resistance levels to watch out are 11,541.63 and 11,626.37.

Nifty Bank

The Nifty Bank index closed at 29,582.50, down 249.7 points on March 22. The important Pivot level, which will act as crucial support for the index, is placed at 29,391.43, followed by 29,200.37. On the upside, key resistance levels are placed at 29,890.83, followed by 30,199.17.

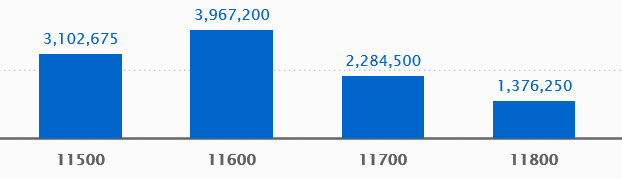

Call options data

Maximum Call open interest (OI) of 39.67 lakh contracts was seen at the 11,600 strike price. This will act as a crucial resistance level for the March series.

This was followed by the 11,500 strike price, which now holds 31.02 lakh contracts in open interest, and 11,700, which has accumulated 22.84 lakh contracts in open interest.

Significant Call writing was seen at the strike price of 11,600, which added 15.85 lakh contracts, followed by 11,500 strike, which added 4.08 lakh contracts and 12,000 strike that added 3.03 lakh contracts.

Call unwinding was seen at the strike price of 11,200 that shed 92,325 contracts, followed by 11,000 strike that shed 74,775 contracts.

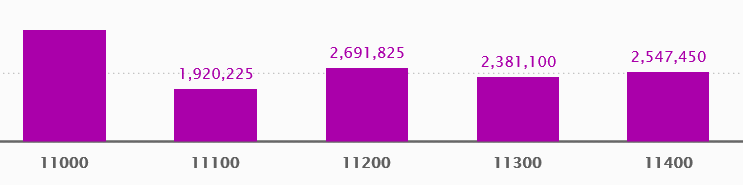

Put options data

Maximum Put open interest of 40.40 lakh contracts was seen at the 11,000 strike price. This will act as a crucial support level for the March series.

This was followed by the 11,200 strike price, which now holds 26.91 lakh contracts in open interest, and the 11,400 strike price, which has now accumulated 25.47 lakh contracts in open interest.

Put writing was seen at the strike price of 11,600, which added 2.60 lakh contracts, followed by 11,300 strike that added 71,775 contracts and 11,200 strike that added 50,025 contracts.

Put unwinding was seen at the strike price of 11,500, which shed 2.72 lakh contracts, followed by 11,000 strike that shed 2.15 lakh contracts and 11,100 strike that shed 1.71 lakh contracts.

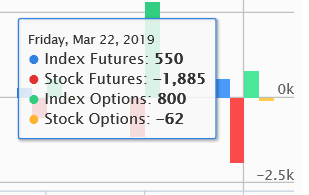

FII & DII Data

Foreign Institutional Investors (FIIs) bought shares worth Rs 1,374.57 crore while Domestic Institutional Investors (DIIs) sold Rs 675.37 crore worth of shares in the Indian equity market on March 22, as per provisional data available on the NSE.

Fund Flow Picture

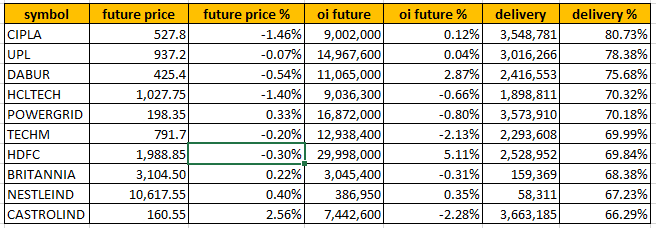

Stocks with a high delivery percentage

High delivery percentage suggests investors are accepting the delivery of the stock, which means that investors are bullish on it.

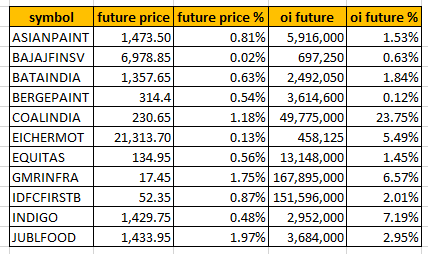

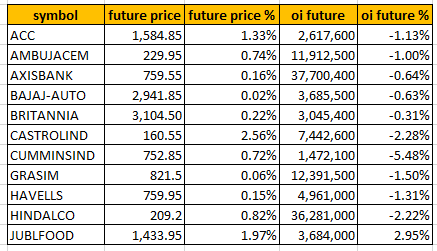

20 Stocks saw a long buildup

25 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

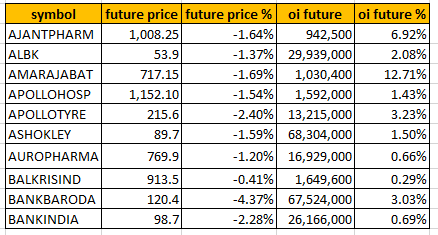

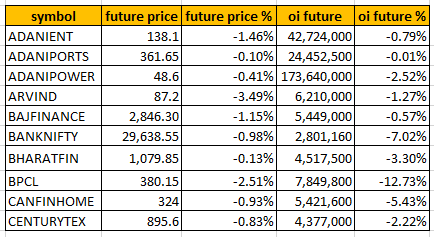

89 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

66 stocks saw long unwinding

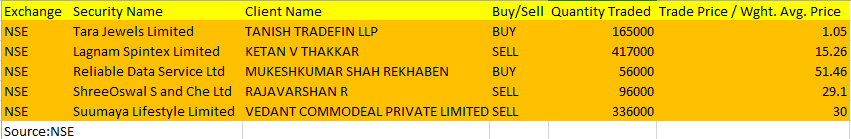

Bulk deals on March 22

(For more bulk deals, click here)

Analyst or Board Meet/Briefings

Krebs Biochemicals & Industries: Board meeting is on March 25 to consider and approve the allotment of shares.

Integrated Capital Services: Board meeting is scheduled on March 27 to take note of implementation of the order of the NCLT.

Acrysil: Board meeting is on March 29 to consider and approve the annual operational plan of the company for the Financial Year 2019-20.

Galaxy Surfactants: Board meeting is on March 29 to consider declaration of interim dividend for the financial year 2018-19.

D&H India: Board meeting is on March 29 to approve the appointment of additional director.

Aris International: Board meeting is on March 26 for the appointment of Sushma Anuj Yadav as chief financial officer of the company.

India Infraspace: Board meeting is on March 27 to consider and approve the appointment of the chief financial officer of the company.

TTK Prestige: Board meeting is on March 29 to consider and approve cancellation of forfeited shares and issue of bonus shares.

Power Finance Corporation: Board meeting is on March 27 to consider and approve a proposal for raising of resources

Atlas Cycles: Board meeting is on April 2 to consider and approve the un-audited financial results of the company for the quarter ended 31st December, 2018.

Stocks in news

Jet Airways: Additional seven aircraft grounded due to non-payment of amounts outstanding to lessors.

Escorts: The company appoints Shailendra Agrawal as executive director.

HDFC: The company raises Rs 1,000 crore via bonds with a maturity period of three years.

SBI: The board gives an extension of validity period for raising Rs 20,000 crore from market till March 31, 2020.

The lender approves issue of bond worth Rs 1,251.30 crore.

Amber Enterprises: The company approves to enter into the definitive agreements to acquire 80 percent stake of Sidwal Refrigeration Industries.

Bharat Gears: The company will issue equity shares on rights basis in the ratio of 1:7. Issue price is Rs 105 per share.

Max India: The company appointed Analjit Singh as the non-executive director and chairman.

Ramco Cements: The company acquires 45 lakh shares of Ramco Industrial and Technology for Rs 10 per share.

Sylph Technologies: The company approves to sale 7,11,598 shares of Sakshi Powertech for a consideration of Rs 5.59 crore at Rs 78.68 per share.

James Warren Tea: The company approves to a buyback of 23,25,000 equity shares at a price of Rs 115.

Manpasand Beverages: The company incorporates a wholly owned subsidiary company i.e. Manpasand Products.

EID Parry: The company declares a second interim dividend of Re 1.

Six stocks under ban period on NSE

Securities in ban period for the next day's trade under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

For March 25, Adani Enterprises, Adani Power, IDBI Bank, Jet Airways, PNB and Reliance Power are present in this list.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.