After six consecutive days of gains, the Indian market witnessed profit booking with both the Sensex and Nifty closing in the red on June 4.

The Sensex failed to hold on to the 34,000 mark and the Nifty witnessed profit taking above 10,100 for the second day in a row.

The Sensex closed down 129 points, or 0.38 percent, at 33,980.70 and the Nifty settled 32 points, or 0.32 percent, lower at 10,029.10.

Nifty Private Bank index fell 3.10 percent, followed by Nifty Financial Service (down 2.64 percent), Nifty Bank (down 2.63 percent) and Nifty Realty (down 1.74 percent). All other sectoral indices closed in the green.

"This pause is largely on the expected lines and we may see further consolidation ahead. However, the Nifty could make another attempt to test 10,250 levels, so traders should utilise further dips around the 9,900 zone to create fresh longs. On the sectoral front, we prefer pharmaceuticals and IT at current levels and select private banking names on dips," said Ajit Mishra, VP - Research, Religare Broking.

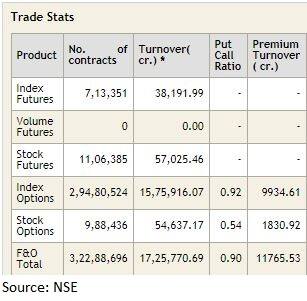

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for NiftyAccording to pivot charts, the key support level on the Nifty is placed at 9,940.97, followed by 9,852.83. If the index moves up, key resistance levels to watch out for are 10,120.52 and 10,211.93.

Nifty BankThe Nifty Bank index closed 2.63 percent lower at 20,390.45. The important pivot level, which will act as crucial support for the index, is placed at 20,090.46, followed by 19,790.53. On the upside, key resistance levels are placed at 20,916.07 and 21,441.73.

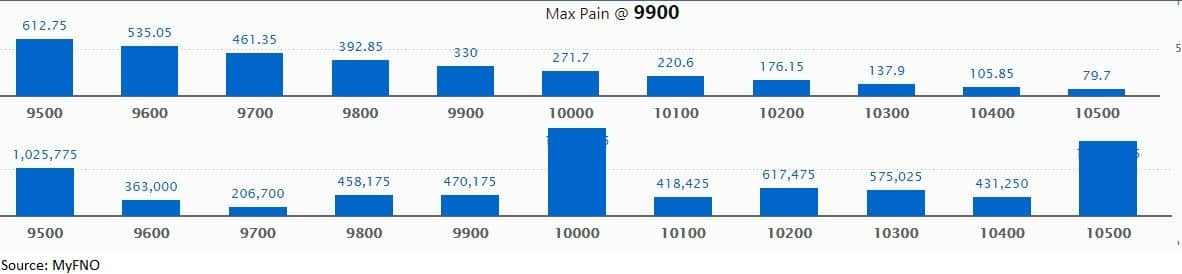

Maximum call OI of 18.66 lakh contracts was seen at 10,000 strike, which will act as crucial resistance in the June series.

This is followed by 10,500, which holds nearly 15.98 lakh contracts, and 9,500 strikes, which has accumulated 10.26 lakh contracts.

Significant call writing was seen at the 10,500, which added 2.72 lakh contracts, followed by 10,000 strikes that added 2.68 lakh contracts.

Call unwinding was witnessed at 9,800, which shed 25,425 contracts, followed by 9,700 strikes, which shed 21,600 contracts.

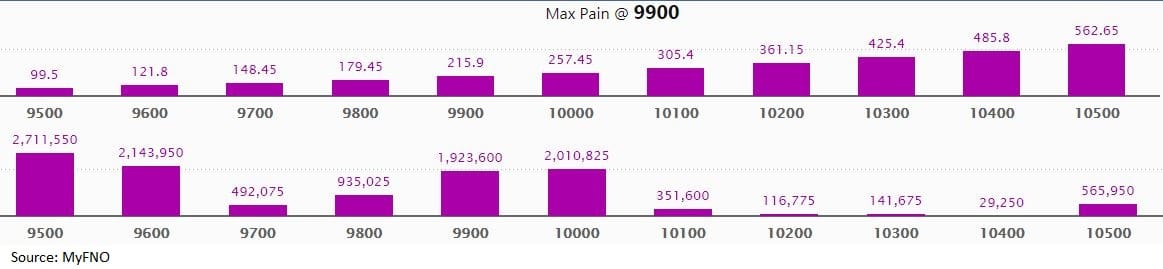

Maximum put OI of 27.12 lakh contracts was seen at 9,500 strike, which will act as crucial support in the June series.

This is followed by 9,600, which holds 21.44 lakh contracts, and 10,000 strikes, which has accumulated 20.11 lakh contracts.

Significant put writing was seen at 10,000, which added 3.22 lakh contracts, followed by 9,500 strikes, which added 3.03 lakh contracts.

Put unwinding was seen at 10,100, which shed 35,925 contracts, followed by 10,200 which shed 20,100 contracts.

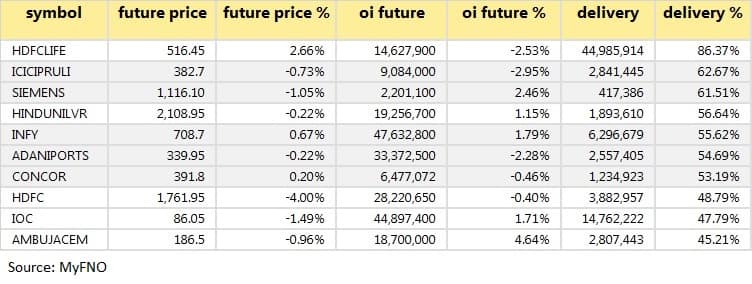

A high delivery percentage suggests that investors are showing interest in these stocks.

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

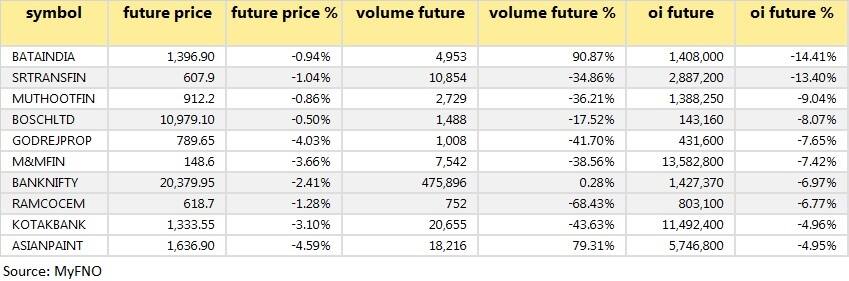

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

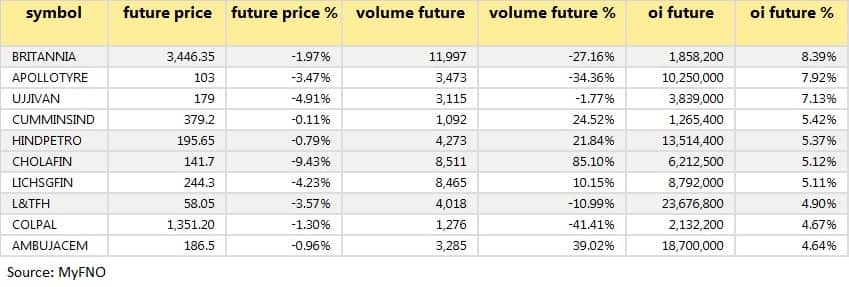

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

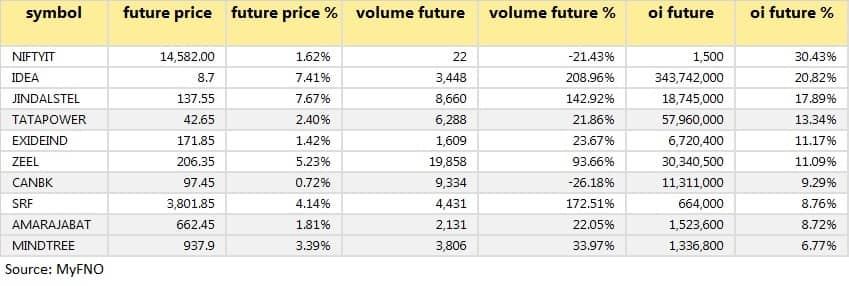

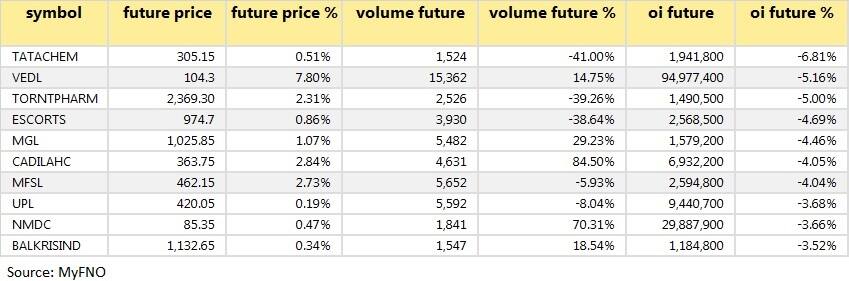

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

State Bank of India, Larsen & Toubro, Exide Industries, Alkem Laboratories, Gateway Distriparks, Greaves Cotton, Gujarat Gas, HFCL, Infibeam Avenues, Jyothy Laboratories and Suven Life Sciences.

Stocks in the news RBL Bank:BNP Paribas Arbitrage sold 36,84,210 shares at Rs 125.86 in a bulk deal on the NSE.

SH Kelkar:Fidelity Investment Trust sold 8,10,800 shares at Rs 65.24 in a bulk deal on the NSE.

SP Apparels:Goldman Sachs International Equity Fund sold 4,00,000 shares at Rs 67.01 in a bulk deal on the NSE.

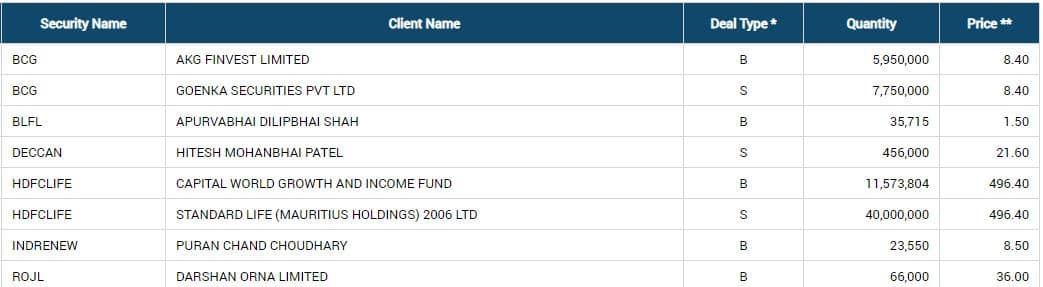

HDFC Life:Standard Life sold 40,000,000 shares at Rs 496.40 in a bulk deal on the BSE.

DLF: Reported a consolidated net loss of Rs 1,864.78 crore. Revenue from operations stood at 1,873.80 crore in Q4 FY20 against Rs 2,660.95 crore in Q4 FY19.

SRF: Consolidated revenue decreased 4 percent YoY to Rs 1,858 crore. PAT rose 8 percent to Rs 194 crore.

RITES:The company's subsidiary Railway Energy Management Company has secured its largest mandate from Indian Railways.

Gulf Oil Lubricants:Ravi Chawla has been reappointed as Managing Director and CEO.

Fund flow

Foreign institutional investors (FIIs) bought shares worth Rs 2,905.04 crore, while domestic institutional investors (DIIs) sold shares worth Rs 847.31 crore in the Indian equity market on June 4, provisional data available on the NSE showed.

Stock under F&O ban on NSENo stock is under the F&O ban for June 5. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!