Unique Strengths related to marketing infrastructure are as follows: • Sales Offices at Kolkata, Mumbai, Delhi, Chennai, Siliguri, Burdwan, Port Blair. • Blue Chip Corporate Customer Base-ITC, Nestle, Unilever, Sun Pharma, ICICI Bank, Axis Bank, LIC, IndianOil, HPCL, etc. • An excellent relationship with Online Travel Aggregators - MakeMyTrip & Golbibo, Yatra & Travelguru, Booking.com, Agoda.com, Expedia, Cleartrip, etc. • Regular business relationship with important Travel Agents - Thomas Cook, Le Passage, Travel Corporation of India, Trail Blazer Tours India, FCM Travel, etc. • Strong Online Presence - Dynamic website, active social media pages, sustained Digital Marketing. The hotel industry is usually characterised by very high staff turnover. Hence one of the key strengths of a good hotel chain is a stable and experienced core management team. In the case of Sinclairs, the core management team including Chief Financial Officer, Senior General Manager, and General Manager have been with the company between 24 to 27 years. The company has tied up with leading inbound tour operators, and there is a long term arrangement for hosting groups from France, Japan, UK, South Korea, Taiwan, etc. Financial Overview:

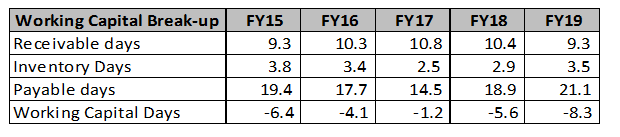

Unique Strengths related to marketing infrastructure are as follows: • Sales Offices at Kolkata, Mumbai, Delhi, Chennai, Siliguri, Burdwan, Port Blair. • Blue Chip Corporate Customer Base-ITC, Nestle, Unilever, Sun Pharma, ICICI Bank, Axis Bank, LIC, IndianOil, HPCL, etc. • An excellent relationship with Online Travel Aggregators - MakeMyTrip & Golbibo, Yatra & Travelguru, Booking.com, Agoda.com, Expedia, Cleartrip, etc. • Regular business relationship with important Travel Agents - Thomas Cook, Le Passage, Travel Corporation of India, Trail Blazer Tours India, FCM Travel, etc. • Strong Online Presence - Dynamic website, active social media pages, sustained Digital Marketing. The hotel industry is usually characterised by very high staff turnover. Hence one of the key strengths of a good hotel chain is a stable and experienced core management team. In the case of Sinclairs, the core management team including Chief Financial Officer, Senior General Manager, and General Manager have been with the company between 24 to 27 years. The company has tied up with leading inbound tour operators, and there is a long term arrangement for hosting groups from France, Japan, UK, South Korea, Taiwan, etc. Financial Overview: Working Capital Analysis

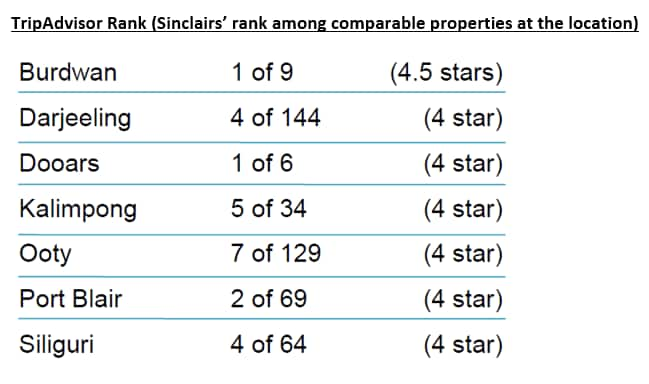

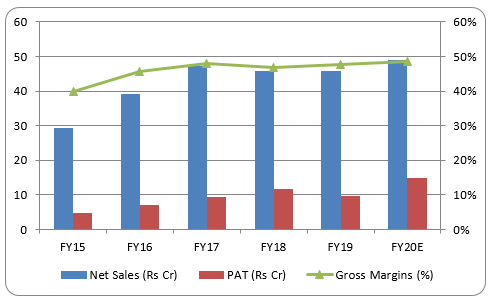

Working Capital Analysis The company’s current market capitalisation stands at Rs 150 crores. It enjoys gross margin levels of over 45 percent, one of the highest in the industry. The company has a strong balance sheet which is debt-free with liquid cash of Rs 53 crores as of September 2019. The company has one idle land parcel in Kolkata which if sold would conservatively fetch around Rs 25 crores. Even if we exclude cash generated from the sale of the land parcel, the company is trading at an enterprise value of Rs 94 crore with an expected FY20E EBITDA of 25 crore (FY 19 EBITDA was Rs 18 crores, 1HFY20 EBITDA is Rs 9.4 crore and 2H is seasonally better than 1H). Hence, this hotel company is available at EV/ EBITDA multiple of less than 4x. The company has a net worth of Rs 103 crore out of which Rs. 53 crore is in cash and cash equivalents. Sinclairs is estimated to report PAT of Rs 15 crores for FY20. With net worth of roughly Rs 50 crores (excluding cash & cash equivalents on books of Rs 53 crores) it will report a strong Return on Equity (ROE) of 30 percent. The balance sheet strength can also be measured from the fact that all seven properties are owned by the company. The unique locations and views offered by some of these iconic properties make it almost impossible to rebuild. The replacement cost of these properties is significantly higher than the current market capitalisation of Rs 150 crore. Outlook The outlook for the company looks strong with improving business & leisure travel and higher rating on TripAdvisor. Port Blair, Andaman facility was on renovation last year which is finished and going ahead should see the benefit of full realisations and higher occupancy. Further, management is talking to a few hotel owners for the lease of new properties where they see synergy in operations. The government has recently announced a reduction in GST rates from 28 percent to 18 percent for premium and luxury hotels which is expected to give a significant boost to the tourist traffic and augurs well for the company which has properties in attractive tourist destinations. The undervaluation can also be put in perspective with the fact that management has increased its stake from 56 percent to 59 percent in the last year. The above is just one illustration of a company where large divergence exists between the intrinsic value and the current market value. Once risk aversion recedes and a semblance of sanity is restored with investors overcoming the fear psychosis of erosion in capital values and lack of adequate liquidity in small and mid-cap stocks, they will start crowding out of the handful of mega-cap behemoths where there is comfort in crowd. (Ajay Bodke is CEO-PMS Prabhudas Lilladher; Dharmendra Dave is a Senior Analyst PMS at Prabhudas Lilladher)

The company’s current market capitalisation stands at Rs 150 crores. It enjoys gross margin levels of over 45 percent, one of the highest in the industry. The company has a strong balance sheet which is debt-free with liquid cash of Rs 53 crores as of September 2019. The company has one idle land parcel in Kolkata which if sold would conservatively fetch around Rs 25 crores. Even if we exclude cash generated from the sale of the land parcel, the company is trading at an enterprise value of Rs 94 crore with an expected FY20E EBITDA of 25 crore (FY 19 EBITDA was Rs 18 crores, 1HFY20 EBITDA is Rs 9.4 crore and 2H is seasonally better than 1H). Hence, this hotel company is available at EV/ EBITDA multiple of less than 4x. The company has a net worth of Rs 103 crore out of which Rs. 53 crore is in cash and cash equivalents. Sinclairs is estimated to report PAT of Rs 15 crores for FY20. With net worth of roughly Rs 50 crores (excluding cash & cash equivalents on books of Rs 53 crores) it will report a strong Return on Equity (ROE) of 30 percent. The balance sheet strength can also be measured from the fact that all seven properties are owned by the company. The unique locations and views offered by some of these iconic properties make it almost impossible to rebuild. The replacement cost of these properties is significantly higher than the current market capitalisation of Rs 150 crore. Outlook The outlook for the company looks strong with improving business & leisure travel and higher rating on TripAdvisor. Port Blair, Andaman facility was on renovation last year which is finished and going ahead should see the benefit of full realisations and higher occupancy. Further, management is talking to a few hotel owners for the lease of new properties where they see synergy in operations. The government has recently announced a reduction in GST rates from 28 percent to 18 percent for premium and luxury hotels which is expected to give a significant boost to the tourist traffic and augurs well for the company which has properties in attractive tourist destinations. The undervaluation can also be put in perspective with the fact that management has increased its stake from 56 percent to 59 percent in the last year. The above is just one illustration of a company where large divergence exists between the intrinsic value and the current market value. Once risk aversion recedes and a semblance of sanity is restored with investors overcoming the fear psychosis of erosion in capital values and lack of adequate liquidity in small and mid-cap stocks, they will start crowding out of the handful of mega-cap behemoths where there is comfort in crowd. (Ajay Bodke is CEO-PMS Prabhudas Lilladher; Dharmendra Dave is a Senior Analyst PMS at Prabhudas Lilladher)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!