'Horn Patterns' are the type of patterns that need to be observed on a weekly scale.

The confirmations of these patterns occurring are more relevant on a weekly scale than a daily scale.

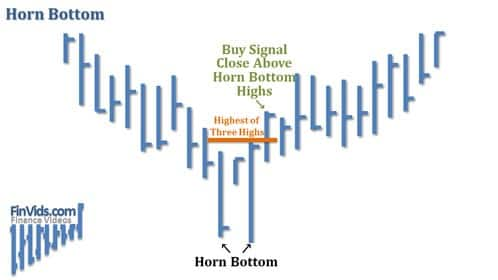

Horn Bottom

During a downtrend, two downward spikes separated by a week on the weekly chart are a confirmation of the horn bottom pattern. This pattern is a short-term bullish reversal pattern. The horns should be clearly visible and should not be apart of the congestion. The twin bottom pattern confirms as a valid horn bottom when price closes above the highest high in the three-week pattern.

Without confirmation, you have no horn. It takes price just over two weeks to climb from the right horn to the breakout price, which is the highest high in the pattern. Tall patterns perform better than short ones. Always look for horns with uneven bottoms for better performance on price breakout.

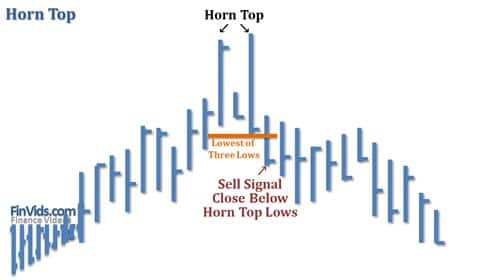

Horn Top

When there is an uptrend or the bull market, two upward spikes separated by a week on the weekly charts are a confirmation of the horn top pattern.

This pattern is a short-term bearish reversal pattern. The horns should be clearly visible and should not be apart of the congestion.

Confirmation occurs when price closes below the lowest low in the chart pattern. Only when that happens does the three-week pattern become a valid horn top. Subtract the lowest low from the highest high to get the pattern height. Subtract the height from the lowest low to get the target price. They can also be sometimes seen as a part of the head and shoulders pattern.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.