Channel pattern is a combination of two lines that are parallel to each other and in combination, these two lines look like a channel when placed on the price chart. In the study of technical analysis, the Channel falls under the category of continuation patterns and is one of the most reliable trends following pattern.

This pattern is important because it helps to indicate the continuation of a bullish or bearish market. When the direction of the price channel is in the upward direction it is considered as the Bullish Price Channel and when the face of the price channel is in the downward direction it is called Bearish Price Channel.

Channel patterns are an integral part of technical analysis, but successful traders combine these techniques with other technical indicators to maximize their odds at success.

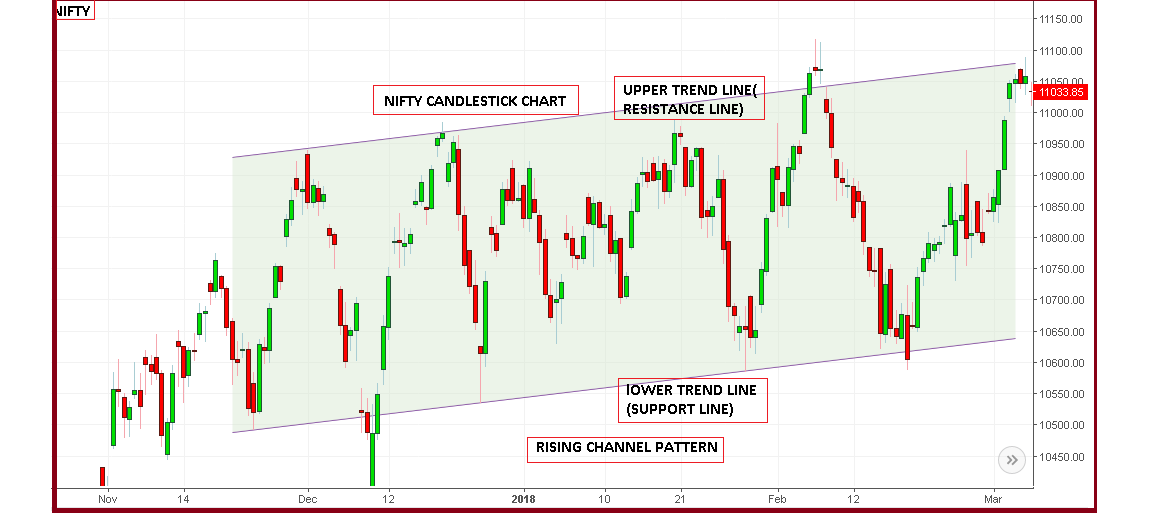

The upper trend line connects the swing highs in price, while the lower trend line connects the swing lows. The upper line of Channel represents the resistance line while the lower one acts as a support line.

Formation of the Channel PatternFigure out a high and a low in the past. This will be the starting point of the channel.

Find another subsequent high, as well as, a subsequent low.

Connect the two highs to draw a line which is called as ‘Upper Trend Line’ and connect the two lows to draw another line called ‘Lower Trend Line’.

If the above two connected trend lines so obtained are near parallel, a channel is formed.

Thus, there are at least two contact points at the Upper trend line and at least two contact points at the lower trend line.

More contact points increase the effectiveness and reliability of the channel.

Channels can form on all time frames and can last as short as an hour, or last for months on end.

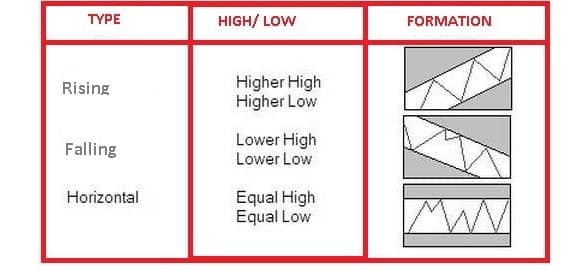

Types of ChannelsHere are three different types of channels, and each should be closely studied, they all point specifically to price being in trend.

Up trending Channels or Rising Channel- also known as "Ascending Channels"

Down trending Channels or Falling Channel- also knowns as "Descending Channels"

Horizontal Channels or Flat Channel - defined by two horizontal lines.

A rising channel is the price action contained between upward sloping parallel lines. Higher highs and higher lows characterize this price pattern. Technical analysts construct a rising channel by drawing a lower trend line that connects the swing lows, and an upper channel line that joins the swing highs as shown here.

Support and Resistance: Traders could open a long position when a stock's price reaches the rising channel’s lower trend line and exit the trade when price nears the upper channel line. A stop-loss order should be placed slightly below the lower trend line to prevent losses if the security’s price abruptly reverses. Traders who use this strategy should ensure there is enough distance between the pattern’s parallel lines to set an adequate risk/reward ratio.

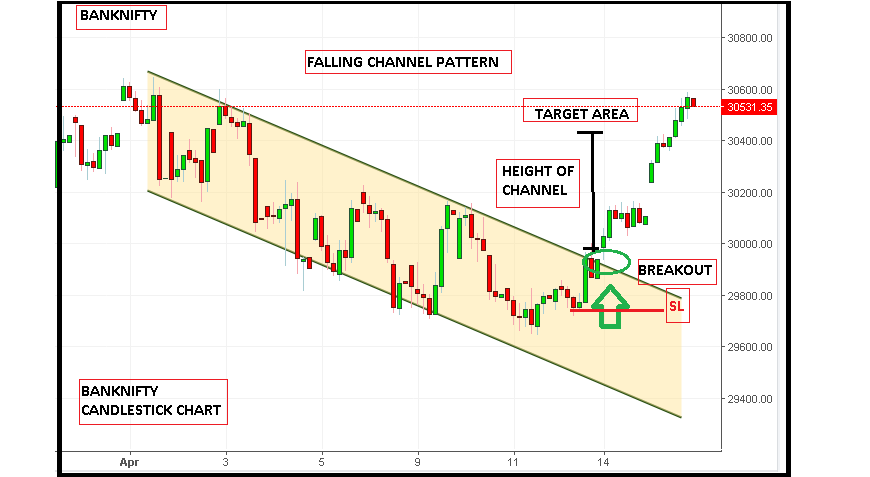

Trading on a breakout from Falling ChannelThe falling channel would normally have lower highs, and, lower lows.

Breakouts: Traders could buy a stock when its price breaks above the upper channel line of a falling channel. It is prudent to use other technical indicators to confirm the breakout. For example, traders could require that a significant increase in volume accompanies the breakout and that there is no overhead resistance on higher timeframe charts.

Volume can also add further insight while trading these patterns. Volume is invaluable when confirming any of the two-channel pattern breaks out on upside or downside. If volume isn’t present alongside patterns breakouts, then the resulting trading signal isn’t as reliable. It is observed that false or fake breakout of the pattern is witnessed in the absence of higher volume during the breakout process.

ConclusionChannel patterns are a commonly used technical analysis tool and majorly a choice of breakout traders.

One of the important criteria to bear in mind is there should be at least 4 points of reaction within the channel.

A channel is an area between two parallel trend lines, upper trend line (resistance line) and the lower trend line (support line).

A channel can be used as an entry pattern for the continuation of an established trend, as part of a trend following strategy.

(The author is Head - Technical & Derivative Research, Narnolia Financial Advisors)Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.