There are more useful and regular patterns of three candlesticks which have been identified as a very important for price action trading and trend reversals namely Three White Soldiers Pattern, Morning Star Pattern, Three Black Crows Pattern and Abandoned Baby Pattern. Here, the trading signal is generated based on three day’s trading action.

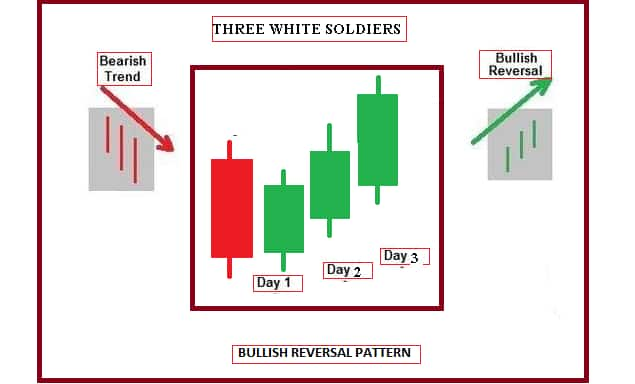

Three White Soldiers PatternDefinitionA three white soldiers pattern occurs in the candlestick chart of a financial instrument when a strong green candle manages to closes above high of the prior candle, consecutively for two candles, forming strong three white candles. This pattern usually occurs during a down trend and is thought to signal the beginning of a bullish trend in the stock, commodity or currency.

• The market is in an existing downtrend.

• Three consecutive long white body candlesticks are observed.

• Each white candlestick opens within the body of the previous day

• The green body is formed on the second & third day has managed to close above high of the body of the prior day.

ValidationThe Three White Soldiers pattern can appear after an extended downtrend or a period of consolidation. On the first day, the market opens lower in the direction of the existing downtrend. The next or second candlestick in the pattern is another bullish or long white candlestick, having a body slightly larger than the first candlestick. This second candlestick also needs to have little to no shadow and closing should be above high of prior candle. The last or third candlestick is another bullish candlestick that needs to be equal or greater length of a body than the second candlestick and closing should be above second body’s high.

When all three candlesticks appear as per validation, this chart pattern can be used to confirm the end of down trend and start of a new uptrend.

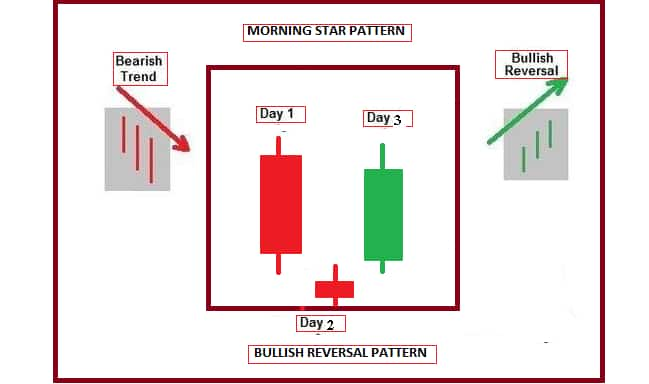

Morning Star PatternDefinitionThis is a triple candlestick pattern indicating a bottom out and trend reversal to uptrend. It is composed of a dark candlestick followed by a short candlestick, which opens lower to form a star.

• The market is in an existing down trend.

• A black body candlestick is observed on the first day.

• A short candlestick on the second day opens with gap down.

• The white body is formed on the third day, and it has managed to close inside or above first day’s black candle.

ValidationA downtrend is in progress and the formation of a black candlestick on the first day confirms the ongoing of the downward trend. The appearance of the short candlestick with a bearish gap on the following day indicates that bears are still active and prices are getting pushed downside. However, the narrow price movement on the second day indicates indecision and creates a doubt in bear’s mind about existing down trend and its strength. The third day is a white body candlestick where price closes well into the first day’s black body.

This pattern indicates reversal in trend, however strong move comes once price closes above first day’s black body’s high. Similar to Morning Star Pattern is Evening Star Pattern that indicates change in market from bullish to bearish.

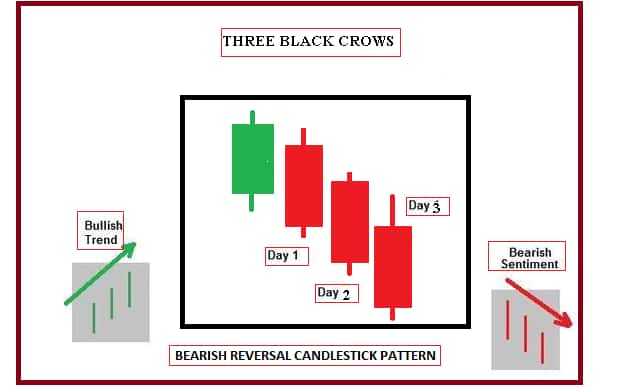

Three Black Crows PatternDefinitionThree black crows indicate a topping out pattern in the financial market. It is characterized by three red candlesticks moving downwards; however the opening of each day is slightly higher than previous close and prices progressively close at lower levels. This pattern usually occurs during an uptrend and is thought to signal the beginning of a bearish trend in the stock, commodity or currency.

• The market is in an existing uptrend.

• Three consecutive long black body candlesticks are observed.

• Each black candlestick opens within the body of the previous day

• The black body is formed on the second & third day has managed to close below low of the prior day.

ValidationEach of the three candlesticks in the Three Black Crows pattern should be relatively long bearish candlesticks with each candlestick closing at or near the low price for the day. This brings a sense of fear among the bulls who now consider closing their long positions causing prices to head lower. The confirmation level is defined as the third candles close. Prices should cross below this level for a sell signal to be generated.

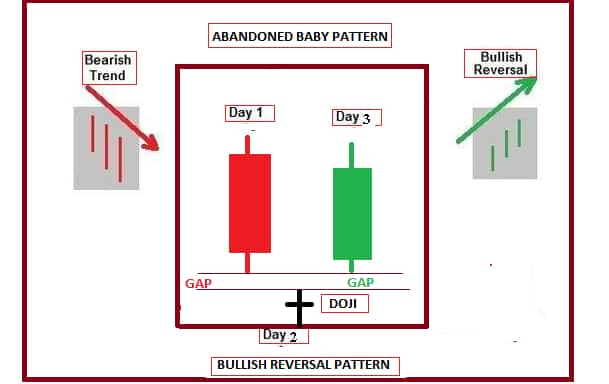

Abandoned Baby PatternDefinitionThe abandoned baby is a rare, but reliable, candlestick pattern that is useful in alerting traders to a possible trend change to the upside. The abandoned baby candlestick formation is a three bar reversal pattern that is similar to the morning and evening star formations and is a very reliable reversal signal when it occurs after a sharp drop; it is also called as “Sute Go” in Japanese.

• The market is in an existing down trend.

• A black body candlestick is observed on the first day.

• A doji candlestick on the second day opens with gap down

• Bearish gap occurrence between first candle’s lower shadow and second candle’s upper shadow and this gap is not filled.

• The white body is formed on the third day, and it has managed to close inside or above first day’s black candle.

• However bullish gap is formed in 2nd candle’s upper shadow and third body’s lower shadow.

ValidationThe third day’s closing must reach the midpoint between the first day’s opening and the second day’s lowest body level. Two gaps, bearish and bullish on either side of doji signify sudden change in trading psychology and indicate trend reversal to uptrend.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.